$ 0.001 -0.97%

Bitshares (BTS) Rank 2852

BitShares (BTS) is a brand of open-source software based on the as blockchain technology as used by Bitcoin. Unlike bitcoins, which do not produce any income for their owners, BitShare can be used to launch Decentralized Autonomous Companies (DACs) which issue shares, produce profits and distribute profits to shareholders. As such, BitShares is about making profitable companies that people want to own shares in, thus creating return for the shareholders. The first DAC launched by this proces was called BitSharesX, a decentralized asset exchange based in Hong Kong. BitShares was originally launched under the name of ProtoShares (PTS); it was later renamed to BitShares (BTS) and "reloaded" in November 2014 by merging several products into BitShares (BTS).

Features

Working together, this community has designed and developed the BitShares platform to include numerous innovative features which are not found elsewhere within the smart contract industry

- Price-Stable Cryptocurrencies

SmartCoins provide the freedom of cryptocurrency with the stability of the dollar - Decentralized Asset Exchange

A fast and fluid trading platform - Industrial Performance and Scalability

Over 100,000 transactions per second - Recurring & Scheduled Payments

Flexible withdrawal permissions - Referral Rewards Program

Network growth through adoption rewards - Dynamic Account Permissions

Management for the corporate environment - User-Issued Assets

Regulation-compatible cryptoasset issuance - Stakeholder-Approved Project Funding

A self-sustaining funding model - Transferable Named Accounts

Easy and secure transactions - Delegated Proof-of-Stake Consensus

A robust and flexible consensus protocol

Technology

The BitShares platform itself is run and maintained by the BitShares community–an open consortium of individuals and organizations committed to providing universal access to the power of smart contracts.

| Mkt.Cap | $ 3.22 M | Volume 24H | 69.71 MBTS |

| Market share | 0% | Total Supply | 2.15 BBTS |

| Proof type | PoS | Open | $ 0.0011 |

| Low | $ 0.0011 | High | $ 0.0011 |

BitShares Documentation — BitShares Documentation documentation

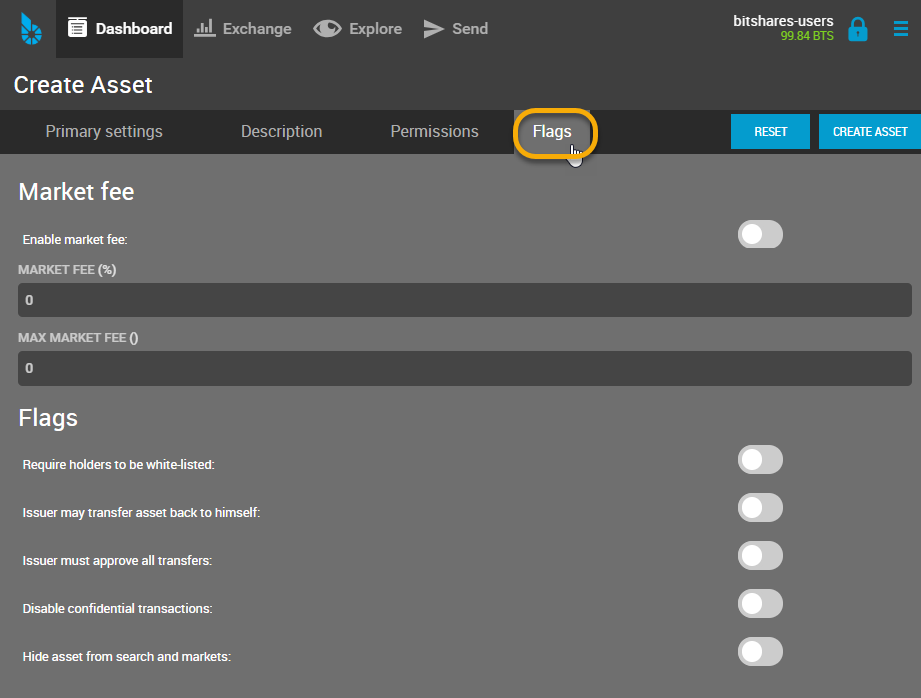

The issuer can decide on the token name, description, initial distribution, trading fees and more. Trading and investing in digital assets is highly speculative and comes with many risks. The analysis / stats on CoinCheckup.com are for informational purposes and should not be considered investment advice.

Accessing restricted API's

The genesis account can technically perform any action that any other account can perform. This means it is possible to send funds to the genesis account or specify the genesis account as an escrow agent.

Your lists

Collateralizing the asset by BTS means the exchange rate will be automatically set to the settlement price. A transfer-restricted asset allows the holders of the asset to trade it in the markets but not transfer it from person to person.

This method provides a very high degree of trust and accountability, which creates an untold number of applications whereby elected delegates can perform tasks to aid stakeholders. On the BitShares blockchain, people never need to deal with addresses or public keys but can instead use account names.

Standard financial institutions have to use illiquid assets to fulfill obligations to depositors, while the virtual resource quietly uses personal tokens for this purpose and does not remain in loss. If taxpayers stop paying on loans in a timely manner, it will be problematic for a financial institution to pay interest on deposits in a timely manner, while investors will not face BitShares. BitShares has its own reserve pool to which it collects the transaction fees. The funds from this pool can be spent on the improvement of the network and its maintenance.

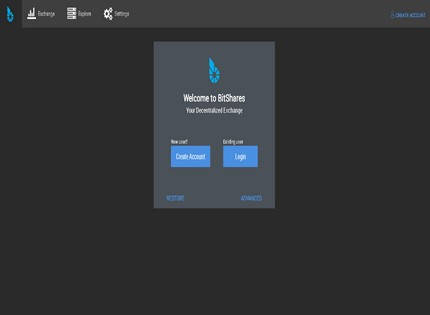

Potential investors in BTS can purchase it on the BitShares Asset Exchangeby trading another cryptocurrency for it, or directly from exchanges such as ZB.COM, Binance, Huobi, Poloniex and Gate.io. BTS coins are also different – distinguishable by being less of a currency than a security that can be used as collateral, but cannot be mined. Tokens can be created on the BitShares network and converted to BTS, which is then convertible to BitAssets, which in turn are tied to real-world markets. Larimer himself describes BitShares as “many things to different people”. Like many other blockchain-based platforms, BitShares offers a referral program with rewards.

bitshares.org BitShares Websitemore_vert

This release includes new features, optimizations, and bug fixes but does not include any changes to the consensus protocol. Daniel Larimer(BM) is a software programmer and cryptocurrency serial entrepreneur.

- Whoever creates the asset will specify the name, distribution, description, and any customization requirements, such as if only those on a specific whitelist can hold tokens.

- This means it is possible to send funds to the genesis account or specify the genesis account as an escrow agent.

- If you want information which is not available from an API, it might be available from the database; it is fairly simple to write API methods to expose database methods.

- BitShares the company also provides loans, mostly in USD (BitUSD), the secured asset in BTS.

Without this feature, many exchanges would be unable to issue their assets on the BitShares blockchain. One unique feature of the BitShares platform is “user-issued assets.” These are custom tokens that users can register on the platform as well as hold and trade within a set of restrictions. Whoever creates the asset will specify the name, distribution, description, and any customization requirements, such as if only those on a specific whitelist can hold tokens.

Financial institutions issue loans (debts) under the guarantee of no less valuable collateral. Earn banking institutions on interest paid on loans and attracting investment from investors. BitShares the company also provides loans, mostly in USD (BitUSD), the secured asset in BTS. Who needs another currency can choose BitOil, BitSilver, BitGold, etc.

bitshares / bitshares-core

People don’t care how technology works they just want the same level of convenience that they are accustomed to on other platforms. Those exchanging BitUSD for Bitshares, and vica versa, on the platform’s own distributed exchange. Holders of BitUSD are able to redeem the tokens for the Bitshares held in collateral.

The purpose of the fee pool is to provide a convenience to users that would like to use an asset without concerning themselves with the details of acquiring BTS. Anyone may fund the fee pool, but only the issuer may specify the exchange rate.

About BitShares

The other users then vote to decide if the proposal gets approved. This model allows the platform to be self-sustaining and rely less on external funding. Bitshares (BTS), formerly known as ProtoShares, is a peer-to-peer distributed ledger and network that can issue collateralized market-pegged smart coins known as bitAssets. For instance, it can issue crypto-based assets, denominated by “bitAsset”, that track real-world markets like the USD, such as the bitUSD. Each smart coin has at least 100% of its value backed by the BitShares’ native currency, the BTS, which can be converted at any time at an exchange rate set by a trustworthy price feed.

Our doxygen documentation contains the most up-to-date information about API's for the witness node and thewallet. If you want information which is not available from an API, it might be available from the database; it is fairly simple to write API methods to expose database methods. BitShares Core is the BitShares blockchain implementation and command-line interface.

They are the result of BitShares designing permissions based on people as opposed to cryptography. This makes it possible for accounts to be controlled via weighted combinations of private keys and other accounts. The hierarchical structure involved was designed to mimic real-life permissions and allow for simpler multiuser control of funds. It is this multiuser control that dramatically enhances security and can almost completely eliminate risks of hacking-related thefts.

BitShares is an investment currency with its own digital currency, BTS. With BitShares, users can trade and invest in an essentially unlimited list of assets while taking advantage of the blockchain’s security. BitShares has the features you expect from a traditional trading platform, but with the added advantages of cryptocurrency and blockchain technologies, such as decentralization. An issuer who offers both USD and EUR deposits may need to restrict direct trading between their USD and EUR assets to avoid being subject to foreign currency exchange regulations. Some cryptocurrency exchanges allow trading between fiat and cryptocurrencies, but not between two fiat currencies.

What is Universal Protocol? An Alliance to Connect Digital Assets

SmartCoins are cryptocurrencies with a value pegged to another asset, like gold or the U.S. dollar. BTS, the core currency of BitShares, always backs 100 percent or more of the value of SmartCoins. Users can also convert SmartCoins to BTS at any moment with the exchange rate from the price feed. SmartCoins are almost always guaranteed to have a value that is at least their face value, with the exception of the most extreme conditions in the market.