$ 13.989 -12.68%

Tellor (TRB) Rank 1267

| Mkt.Cap | $ 39.59 M | Volume 24H | 68,604.00TRB |

| Market share | 0% | Total Supply | 0.00000000TRB |

| Proof type | N/A | Open | $ 16.02 |

| Low | $ 13.59 | High | $ 16.15 |

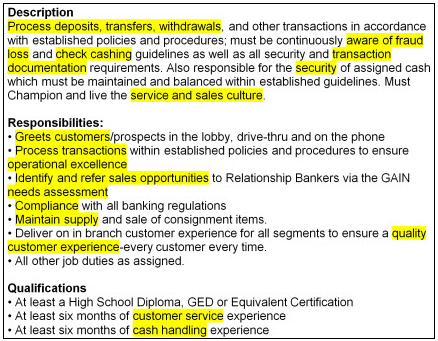

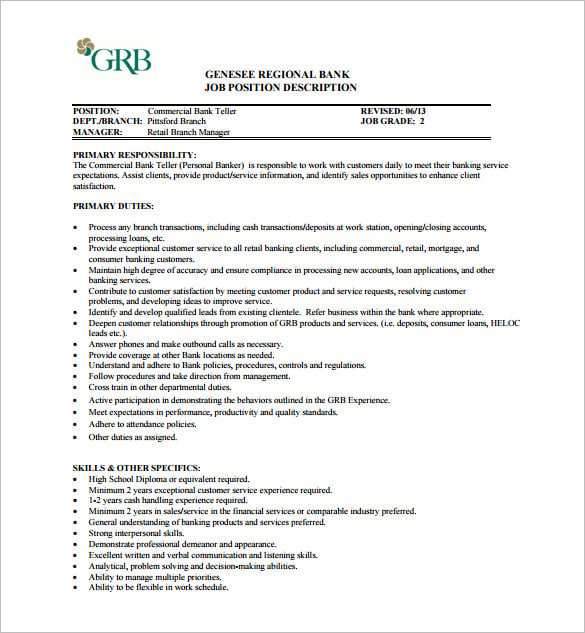

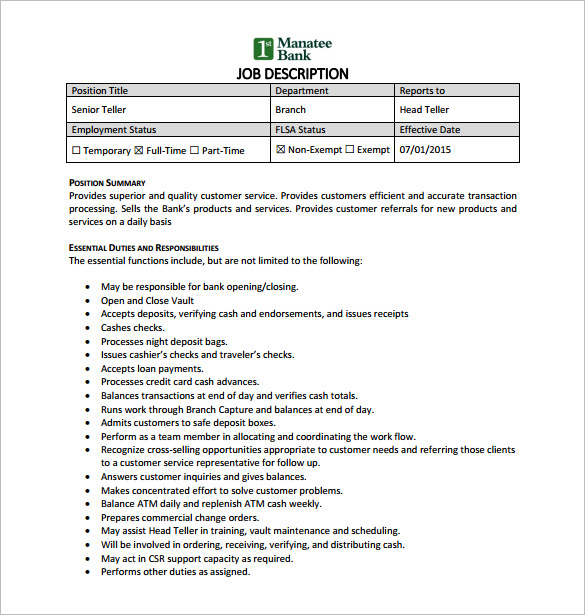

Bank Teller Assessment Test

Bank tellers must also be able to work with other members of the branch as part of a team. The rustling of money is music to most people's ears, the responsibility of handling it is something else altogether. But if you can deal with the pressure of managing one of the most important assets in our culture, then being a bank teller is a pretty sweet job. They must also learn the bank's security, audit and compliance procedures. As important as your skills are, remember that bank tellers constantly deal with the public.

What qualifications do I need to work in a bank?

Bank teller positions require a high school diploma or GED. A college degree isn't necessary to find work, but a 2-year associate or 4-year bachelor's degree in finance, business, or math might help one get hired or promoted.

If that sounds like something you can handle while being fast, accurate and friendly, you are probably a great fit for a job as a bank teller. In traditional banks operating hours are typically between 8 a.m. Banks are also opening branches in grocery stores and retail shops. These smaller branches often have extended hours, so bank tellers willing to work part-time and evening hours will have additional opportunities to be hired at those locations. The U.S. Bureau of Labor Statistics or BLS reported in May 2015 that the median salary for bank tellers was $26,410.

Popular Schools

Many banks will hire applicants who list a minimum of a high school diploma on their resumes, providing training to these employees upon being hired. Though, those with college degrees pertaining to finance or a related field may be more successful, along with those who are bilingual or multilingual. Bank tellers need strong math skills to count and handle large amounts of money. When a customer wants to withdraw money, tellers must determine whether the client's account balance meets the requirement for the transaction.

Now you have a basic understanding of the life of a bank teller. It can be a great stepping stone on the way to that dream job! That job might even be closer than you think as many tellers are able to train on the job and move their way up the ranks to a much higher paying position. If you are good with numbers and people, this is a great place to start. Here are some potential careers that working as a bank teller can lead you to.

More popular banks have more stressful positions, but will keep you busy and make your day pass quickly. Whichever you choose, here is a list of pros and cons when working in this profession.

JobTestPrep is here to help; read on for bank teller interview tips and other relevant information. Apply online if a form is available or send your resume to the bank. Keep in mind that if you send in a resume without a form they will most likely have an application for you to complete.

What is CSR teller?

CUSTOMER SERVICE REPRESENTATIVE - TELLER Handles outward clearing operations and performs end of day cash balancing. Responsible for cash handling and processing of cash/check deposits, withdrawals, check encashments, closing of accounts and signature verification through the Signature Verification System (SVS).

If you work as a cashier for six months you’ll have experience with customer service and handling money and you might be able to leverage this into a bank teller position. Ensure that you're committed to being a bank teller. In many cases bank tellers must do a lot of work and have a great deal of responsibility, but do not get paid much. [1] If you enjoy working with the general public and want to meet new people, this could be the right job for you. Maybe you want to pursue a career in banking and this is a way to get your foot in the door.

Bank Teller Training

- The money you make is not closely enough to compensate you for the stress.

- Many bank teller interviews also include situational (role play) exercises and behavioral questions.

- They do work like money with drawl, deposits, money transfers, wire transfers,cheque encashing, saving bonds, resolving customer issues also some times.

- Kokemuller has additional professional experience in marketing, retail and small business.

- Being knowledgeable will help you accomplish many tasks.

Advancement Experienced tellers can advance within their bank. They can become head tellers or move to other supervisory positions. Some tellers can advance to other occupations, such as loan officer. Based on a survey of 300 respondents who cancelled the service because they had found a job.

Your Resume, Made Easy.

What qualities make a good bank teller?

Bank Teller Job Duties 1) Receiving the working cash for the day and counting it before the shift begins. 2) Accepting deposits of both checks and cash and validating deposit slips. 3) Processing cash withdrawals. 4) Verifying customers, admitting them to their safety deposit boxes and opening and closing vaults.

Anyone considering this job must be able to give customers bad news and stick to the rules when they try to pressure you to make an exception. Customers often don’t understand banking policies and procedures. No matter how many times you try to explain it to them, they are only hearing that they can’t get what they want and believe the bank is out to get them. Tellers need strong speaking, writing and listening skills. They must understand and answer customer questions regarding interest rates, service charges and account histories.

Know what type of accounts and services they offer. Learn the basics of their personal, small business, savings and student accounts services, and delve into info about loans, credit lines and wealth management options. Read the site's “About Us” section and look up any recent news about the bank to find out about the direction and philosophies of the company. Doing your research shows that you're committed to the job, organized, prepared and savvy. Remember that before your bank teller interview, you will be required to take theBank Teller Assessment Test.

Emphasize math skills and illustrate your knowledge of specialized funds, like savings bonds, money orders and traveler's checks. If you don't know much about these things, do your research beforehand so you don't get taken off-guard. Cite specific examples where possible, such as stories about successfully defusing an angry customer at your past job.

What are the benefits of bank?

A bank teller (often abbreviated to simply teller) is an employee of a bank who deals directly with customers. In some places, this employee is known as a cashier or customer representative. Most teller jobs require experience with handling cash and a high school diploma.

Also hurting job growth is the rise in online and mobile banking, which allow customers to handle their own transactions with fewer visits to the teller window. Despite slow overall job growth, tellers entering the field should be able to find work because the occupation has high turnover, and that will create new openings. On-the-job-training, typically one month long, is usually led by a veteran teller. The experienced teller demonstrates how to promote financial products and services as well as how to use the bank’s software.

The position of bank teller is considered entry level. That means there is only one way to go, and that’s up. Most banks require tellers to have a minimum of a high school diploma. Some banks or some specialized teller positions may require previous teller or cashier experience.

And when customers do visit the bank, it’s often for technical support or assistance with a service or problem they can’t manage for themselves. According to the United States Bureau of Labor Statistics, the annual average salary of most tellers is $23,610. This is an average, and salaries may vary widely from bank to bank and from one part of the country to another. For example, in California, bank tellers earn an average salary of between $26,000 and $34,000.

Salary for related jobs

Banks look for tellers who display excellent interpersonal skills and easily put on a friendly face to the public. Bank tellers are solely responsible for most of the money transactions between the bank and their customers.

Classes in these programs explain bank operations, banking regulations, ethics and teller duties. The curriculum is designed to strengthen the student's math and customer service skills.

But if not, try harder next time and just remember, every bank is a different fit for each person. There are plenty of bank teller jobs out there. Try to keep building customer service experience and keep searching for bank teller openings.