What Is a Pro Forma Operating Budget?

What Is a Pro Forma Operating Budget?

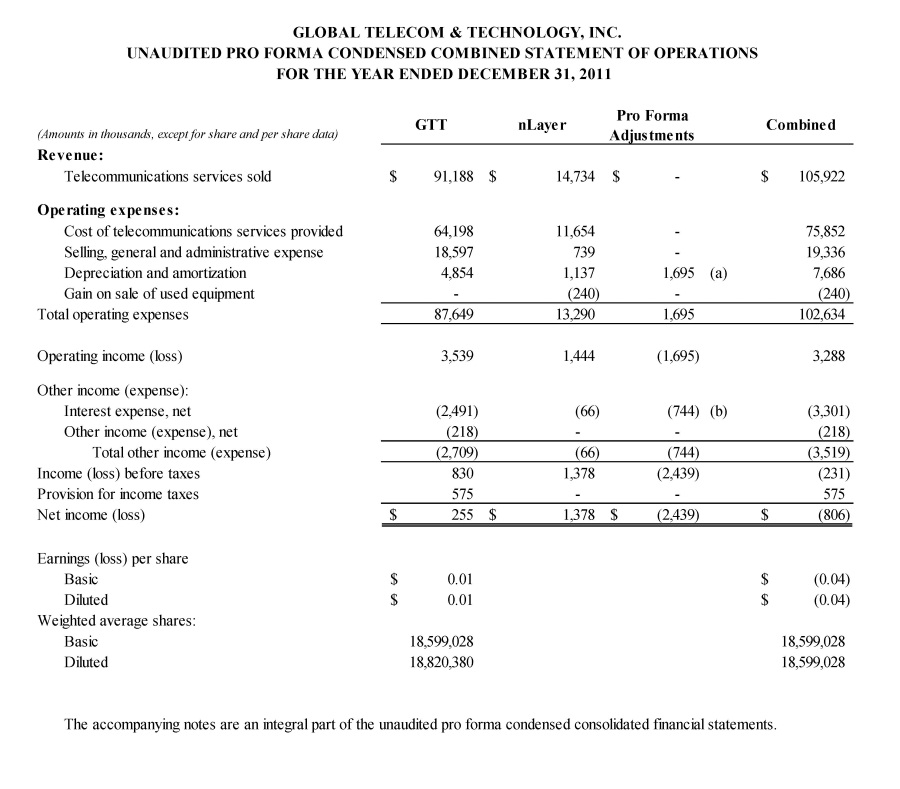

img alt="pro forma financial statements" src="https://i. Pro forma statements for every plan provide essential details about future expectations, together with gross sales and earnings forecasts, money flows, steadiness sheets, proposed capitalization, and revenue statements. This is a projection of an organization's 12 months-to-date results, to that are added expected outcomes for the remainder of the year, to reach at a set of full-yr professional forma monetary statements. This approach is helpful for projecting anticipated results each internally to administration, and externally to buyers and collectors. Preparing a pro forma income statement together with providing the assumptions and supporting the valuations needs to be a basic assignment for your corporation. The crucial half is that you want pro forma income assertion report back to present the monetary results. Most particularly, the SEC has discovered that pro forma statements, which aren't required to comply with Generally Accepted Accounting Principles (GAAP), may give a false impression of the corporate's actual financial status. For this purpose, SEC requires that each one pro forma statements be accompanied with forms that do conform to GAAP, the corporate required to pick out those variations of formal statements most intently resembling the professional forma. The objective of pro forma financial statements is to facilitate comparisons of historic information and projections of future performance. In these circumstances customers of monetary statements want to gauge a brand new or proposed business entity on a basis comparable to the predecessor business in order to perceive the impact of the change on money circulate, income, and financial place. Pro forma changes to accounting rules and accounting estimates reformat the statements of the brand new entity and the acquired business to conform with these of the predecessor. If so, they might problem professional forma financial statements that embody the corrections they imagine are necessary to offer a greater view of the enterprise. The Securities and Exchange Commission takes a dim view of this sort of adjusted reporting, and has issued rules about it in their Regulation G. A firm's claims that certain expenses are non-recurring should also be taken with care. 1 Marks: 1 In developing the pro forma income statement we follow four important steps: 1) compute other expenses, 2) determine a production schedule, 3) establish a sales projection, 4) determine profit by completing the actual pro forma statement. What is the correct order for these four steps? Choose one answer. They base on certain monetary planning options which your agency is most probably going to face within the near future.The professional forma report is a proof that your enterprise is generating income. The point is that it is going to rank the approximate figures of your group. Certain companies incur litigation expenses very frequently as a result of inherent nature of the enterprise, similar to medical practices. If these expenses recur yearly and the corporate excludes them on the pro forma statements, the company's management could also be misleading its traders. Other non-recurring objects that companies have a tendency to use in adjusting GAAP earnings for pro forma statements are restructuring costs. In 2014, Best Buy reported $159 million of expenses associated with restructuring its enterprise, and the corporate did not expect to incur such charges sooner or later. A firm prepares professional forma monetary statements when it expects to expertise or has simply experienced important financial changes. The pro forma financial statements present the impression of those adjustments on the corporate's monetary position as depicted in the revenue assertion, balance sheet, and the cash-flow statement. For instance, management may prepare pro forma statements to gauge the consequences of a potential merger or joint venture. These models forecast the anticipated result of the proposed transaction, with emphasis positioned on estimated net revenues, cash flows, and taxes. Managers are then able to make business choices primarily based on the potential benefits and costs. Pro forma statements are an integral a part of enterprise planning and management. Managers use them within the determination-making process when setting up an annual budget, creating long-vary plans, and choosing amongst capital expenditures. img alt="pro forma financial statements" src="https://d2vlcm61l7u1fs. A company could also be looking for funding, and needs to indicate buyers how the corporate's outcomes will change if they invest a sure sum of money in the enterprise. This approach may result in several completely different sets of pro forma financial statements, every designed for a different funding quantity. Additionally, with a pro forma assertion, a startup or agency can decide on the amount of money for advertising, analysis, and growth. It additionally helps traders to evaluation the corporate's strategy, plan and operating earnings. An effective business plan has to include at least three important "pro forma" statements (pro forma in this context means projected). They're based on the three main accounting statements: The profit or loss, also called income, statement shows sales, cost of sales, operating expenses, interest and taxes. Notes to the professional forma statements explain the adjustments mirrored in the statements. Simulating competing plans could be quite helpful in evaluating the monetary results of the completely different alternate options into account. Based on different units of assumptions, these plans propose numerous scenarios of gross sales, manufacturing prices, profitability, and viability. By altering its accounting practices, a enterprise would possibly significantly have an effect on the presentation of its monetary position and the results of its operations. The change also may distort the earnings development reported in the income statements for earlier years. Some examples of modifications in accounting principles might embody valuation of stock through a first-in, first-out (FIFO) methodology or a final-in, first-out method (LIFO), or recording of depreciation via a straight-line method or an accelerated methodology. img alt="pro forma financial statements" src="https://cdn. Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. On its pro forma earnings statement, Best Buy added back this restructuring charge to its web earnings. With the passage of the Sarbanes-Oxley Act of 2002, modifying accounting and disclosure statements, the SEC has begun issuing new requirements related to professional forma statements. Pro forma, a Latin term meaning "as a matter of form," is applied to the process of presenting financial projections for a specific time period in a standardized format. Businesses use pro forma statements for decision-making in planning and control, and for external reporting to owners, investors, and creditors. A properly-corrected earnings report offers investors with a greater information of economic consequences. Management dialogue and analysis or MD&A is an built-in a part of a company's annual monetary statements. Pro forma is a Latin term that means “for the sake of form” or “as a matter of form.” In the world of accounting and investing, pro forma refers to a method by which firms calculate financial results using certain projections or presumptions, as pro forma financial statements. For an organization that decided to amass a part of a new enterprise or eliminate part of its existing enterprise, a meaningful pro forma assertion ought to adjust the historical figures to reveal how the acquired part would have fared had it been a company. Pro forma statements also needs to set forth standard financial statements of the acquiring company, and pro forma monetary statements of the business to be acquired. It additionally would possibly prepare professional forma statements to gauge the consequences of refinancing debt by way of issuance of most well-liked stock, widespread inventory, or other debt. When a company changes an accounting methodology, it uses professional forma monetary statements to report the cumulative impact of the change for the period during which the change occurred. Pro forma, a Latin term meaning "as a matter of kind," is utilized to the process of presenting financial projections for a specific time period in a standardized format. Businesses use pro forma statements for choice-making in planning and management, and for exterior reporting to house owners, investors, and creditors. Pro forma statements can be used as the premise of comparison and analysis to offer management, funding analysts, and credit officers with a really feel for the actual nature of a business's monetary structure under varied circumstances. A professional forma earnings statement is often a financial assertion that uses the professional forma calculation method, usually designed to attract potential investors' focus to specific figures when a company points an earnings announcement. Companies may also design these professional forma statements to assess the potential earnings value of a proposed business change, corresponding to an acquisition or a merger. The function of the MD&A is to offer a story rationalization, through the eyes of management, of how an entity has carried out in the past, its monetary situation, and its future prospects. In so doing, the MD&A attempt to offer traders with complete, truthful, and balanced data to assist them determine whether or not to speculate or proceed to invest in an entity. In managerial accounting, accountants design financial statements ready in the pro forma technique ahead of a deliberate transaction such as an acquisition, merger, change in capital structure, or new capital investment. Investors ought to be conscious that an organization’s professional forma financial statements could hold figures or calculations that are not in compliance with typically accepted accounting rules (GAAP). Sometimes, pro forma figures differ vastly from these generated inside a GAAP framework, as pro forma outcomes will make adjustments to GAAP numbers to focus on important features of the corporate's operating performance. The differences between historical and pro forma statements is the data. In a pro forma statement, the firm is using a projection based off of past results, the data in a pro forma is not actual, but rather forecasted. This is the difference forecasted data vs actual data among the two statements.

THE SEC FORMAT

Financial Modeling

What does proforma mean in business?

Pro Forma Statements

What are the 4 steps in developing a pro forma income statement?

What is the purpose of pro forma statements?

What is the difference between historical and pro forma financial statements?

What is a pro forma template?

The Power of Passive Income

Pro Forma Statements for Changes in Entity and for Business Combinations

What should be included in a pro forma?