How to Calculate a Single Deduction From Take-Home Pay?

How to Calculate a Single Deduction From Take-Home Pay?

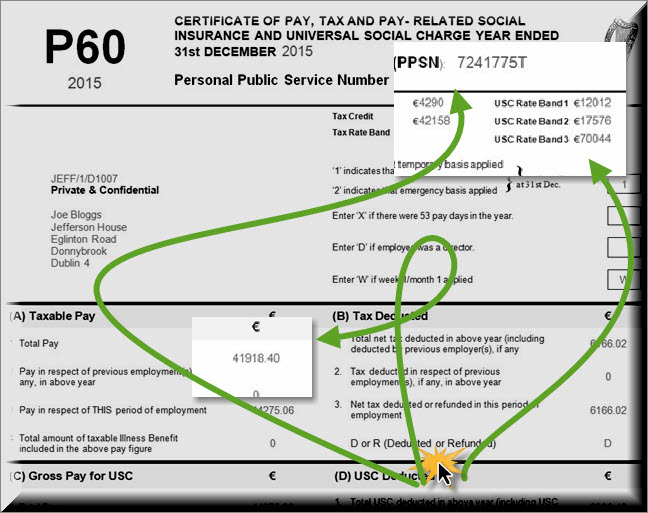

img alt="what is gross pay" src="https://images. Arriving on the complete net of tax determine requires subtracting the entire revenue taxes paid all year long from the gross revenue obtained. If an entity receives a refund at tax time, this could be a type of reimbursement for taxes already withheld. In basic, individuals and companies usually search to take advantage of as many tax deductions and credit as attainable to scale back the entire taxes paid and increase their annual internet of tax worth. Taxable Pay Taxable pay is Gross Pay minus any tax-free elements e.g. pension 18. Total Deductions Details total of all Deductions 19. Net Pay Details Net Pay (take-home pay). This is the difference between total Pay and Allowance minus total of Deductions. Return have to be filed January 5 - February 28, 2018 at taking part places of work to qualify. Type of federal return filed is predicated on your personal tax scenario and IRS rules. Additional fees apply for Earned Income Credit and certain other further forms, for state and native returns, and if you select different services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Deduct Social Security tax at 6.2 p.c of wages as much as $113,000 for the yr, as of 2013. You might get hold of federal employment tax charges from IRS Circular E, the Employer’s Tax Guide. If applicable, use your state and native tax company’s pointers for state and native revenue tax withholding. Not all of an employee's gross pay is subject to federal income tax. Your gross income is the whole revenue quantity that you should report to the IRS. The resulting quantity is used as the idea for determining your earnings tax, and then you definitely subtract all of your allowable tax deductions to give you your adjusted gross earnings, commonly called the AGI. Net pay is the amount of pay remaining for issuance to an employee after deductions have been taken from the individual's gross pay. This is the amount paid to each employee on payday. Type of federal return filed relies on taxpayer's personal situation and IRS guidelines/regulations. Additional charges apply with Earned Income Credit and you file any other returns such as metropolis or local earnings tax returns, or if you choose different services and products such as Refund Transfer. Available at taking part U.S. places. Valid for 2017 personal earnings tax return solely. The amount of your gross pay. If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay. Additional terms and restrictions apply; See Free In-individual Audit Support for full particulars. After subtracting above-the-line tax deductions, the result's adjusted gross earnings (AGI). An individual’s gross income is used by lenders or landlords to find out whether or not said individual is a worthy borrower or renter. Additional training or testing may be required in CA, OR, and different states. This course just isn't open to any individuals who are both currently employed by or seeking employment with any professional tax preparation firm or organization other than H&R Block. The student will be required to return all course materials, which will not be refundable. Nonresident aliens are subject to U.S. federal earnings tax solely on revenue from a U.S. enterprise and sure income from United States sources. Source of revenue is decided based mostly on the kind of revenue. The supply of compensation revenue is the place where the providers giving rise to the income had been performed. The supply of sure income, such as dividends and curiosity, is based on location of the residence of the payor. The supply of income from property relies on the situation where the property is used. By regulation, you have to take federal revenue tax, Social Security tax, Medicare tax, and applicable state and local taxes out of your workers’ paychecks. To withhold federal revenue tax, apply the Internal Revenue Service tax desk that goes with the worker’s submitting standing, wages after allowances and pay interval. As of 2013, withhold Medicare tax at 1.45 percent of all taxable wages; a further zero.9 % goes for workers whose income exceeds $200,000 for the yr. Gross annual income is the amount of cash an individual earns in a single yr earlier than taxes and includes income from all sources. At the top of the 12 months when entities file their tax returns, sure deductions or credit might help to reduce the taxes they owe. When filing federal and state income taxes, gross earnings is the starting point earlier than subtracting deductions to find out the amount of tax owed. Individual gross income is a part of an income tax return and—after certain deductions and exemptions—turns into adjusted gross revenue after which taxable revenue. Taxable gross is your earnings before deductions of any sort. This would come with your wages, tips, salary, unemployment compensation and truthful market value for any bartered items or services. You should subtract the amount of withholding allowances and different deductions to find the taxable earnings. Compute the value of a withholding allowance by dividing the present amount of 1 personal exemption by the annual variety of pay durations. img alt="what is gross pay" src="https://netsalarycalculator. Additional skills may be required. There is not any tuition fee for the H&R Block Income Tax Course; nonetheless, you could be required to purchase course materials, which may be non-refundable. Basic Definition Gross salary is the term used to describe all of the money you've made while working at your job, figured before any deductions are taken for state and federal taxes, Social Security and health insurance. If you work more than one job, you'll have a gross salary amount for each one. This is the precise quantity you need to pay taxes on and is the amount some creditors, such because the Department of Housing and Urban Development, use to determine your mortgage eligibility. All withholdings and deductions are calculated from the gross pay. The first step is to determine the Federal Income Tax necessities, which are based mostly on the person’s W4. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. To calculate an employee's gross pay, start by identifying the amount owed each pay period. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed. Salary employees divide the annual salary by the number of pay periods each year. This number is the gross pay. Gross revenue for a person—also known as gross pay when it's on a paycheck—is the individual’s whole pay from his or her employer before taxes or other deductions. This includes earnings from all sources and isn't restricted to revenue acquired in money; it also contains property or companies received. Discount is off course supplies in state where relevant. Discount must be used on initial buy only. CTEC# 1040-QE-2127 ©2019 HRB Tax Group, Inc. img alt="what is gross pay" src="https://prod-qna-question-images. Only out there for returns not ready by H&R Block. All tax situations are completely different and not everyone gets a refund. Fees apply in case you have us file an amended return. The IRS permits taxpayers to amend returns from the earlier three tax years to assert further refunds to which they're entitled. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and doesn't embody legal representation. Gross pay is the amount of money your employees receive before any taxes and deductions are taken out. Net pay is the amount of money your employees take home after all deductions have been taken out.What is a net pay?

How do I calculate gross pay for an hourly employee?

How do u calculate gross pay?

How to Calculate Gross Pay to Net Pay

How do I figure out my take home pay?

Fall in love with fashionable payroll

Net Pay

Is taxable pay gross pay?

How does gross pay and internet pay have an effect on my taxes as an employer?

What does gross pay mean?

How do you calculate gross pay?