How to Calculate Gross Margin?

How to Calculate Gross Margin?

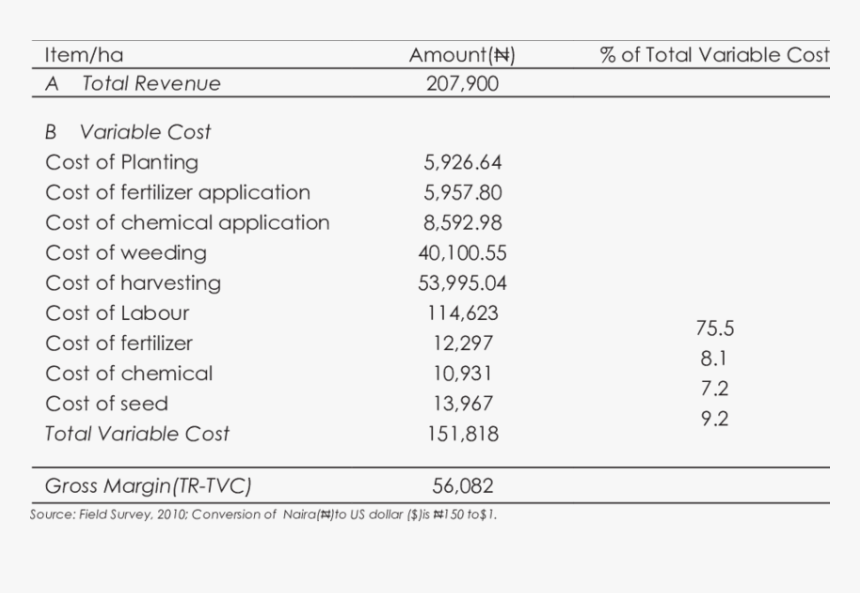

img alt="what is gross margin" src="https://i. The reality is that there are three frequent measures of the profit margin, but just one is equivalent to the return on sales. Return on gross sales is the same thing because the operating profit margin, however it's totally different from the gross revenue margin or net profit margin. Business owners ought to perceive these variations after they're benchmarking their revenue margins against other corporations or past performance. The value of gross revenue margin varies from firm and trade. Companies use gross margin to measure how their manufacturing costs relate to their revenues. The second level of profitability is operating revenue, which is calculated by deducting working bills from gross revenue. Gross profit appears at profitability after direct expenses, and working profit looks at profitability after working expenses. Investors can assess if an organization's management is producing sufficient revenue from its gross sales and whether or not working prices and overhead prices are being contained. For instance, a company can have rising revenue, but if its working prices are growing at a quicker price than revenue, its web revenue margin will shrink. Ideally, traders need to see a track record of expanding margins that means that net profit margin is rising over time. Gross margin is the difference between income and price of goods sold (COGS) divided by revenue. Gross Margin is often used interchangeably with Gross Profit, however the terms are totally different. When talking about a monetary amount, it's technically right to use the term Gross Profit; when referring to a proportion or ratio, it's appropriate to use Gross Margin. In different phrases, Gross Margin is a share worth, while Gross Profit is a financial worth. In addition, value of products offered does not embody indirect prices that can't be attributed to the production of a specific product, like promoting and transport costs. You may be asking yourself, “what is a good profit margin?” A good margin will vary considerably by industry, but as a general rule of thumb, a 10% net profit margin is considered average, a 20% margin is considered high (or “good”), and a 5% margin is low. While gross margin focuses solely on the connection between income and COGS, the net revenue margin takes all of a enterprise's expenses under consideration. When calculating net revenue margins, companies subtract their COGS, in addition to ancillary expenses similar to product distribution, sales rep wages, miscellaneous operating bills, and taxes. Calculating the gross revenue margin requires calculating gross revenue. According to the IRS, gross profit is the same as total receipts or sales minus the worth of returned goods and the price of goods offered. Gross profit margin is the same as gross revenue divided by total gross sales and is often expressed as a proportion. Gross profit margins can be used to measure firm efficiency or to check two companies of various market capitalizations. In addition to the above, a company can have a lower gross revenue in comparison with another similar firm, but still have a higher profit margin. This signifies that for each sales greenback the company takes in, it earns 50 cents of profit. The first degree of profitability is gross profit, which is sales minus the cost of items sold. Sales are the primary line merchandise on the income assertion, and the cost of items sold (COGS) is generally listed slightly below it. For example, if Company A has $a hundred,000 in sales and a COGS of $60,000, it means the gross revenue is $40,000, or $a hundred,000 minus $60,000. For instance, if an organization's gross margin is falling, it could attempt to slash labor prices or supply cheaper suppliers of materials. Alternatively, it may decide to increase costs, as a income growing measure. img alt="what is gross margin" src="https://i. Record both gross and internet revenue in your small business revenue statement. Your revenue statement reveals your revenue, followed by your price of goods offered, and your gross revenue. Gross margin is a company's net sales revenue minus its cost of goods sold (COGS). In other words, it is the sales revenue a company retains after incurring the direct costs associated with producing the goods it sells, and the services it provides. Similarly, it implies that the higher the COGS, the lower the gross profit margin. If the COGS exceeds whole sales, a company could have a negative gross revenue, meaning it's shedding cash over time and likewise has a adverse gross profit margin. Gross revenue margin is the gross revenue divided by whole income and is the proportion of revenue retained as profit after accounting for the cost of items. Gross revenue marginis the proportion of money left over from revenues after accounting for the cost of items sold (COGS). COGS are uncooked supplies and expenses related immediately with the creation of the corporate's primary product, not including overhead prices corresponding to rent, utilities, freight, or payroll. A company's value of products offered, or COGS, is one of the major components that influences gross profit margin. The cost of goods bought for a certain product is the direct prices associated with its manufacturing, together with the supplies and labor needed to provide the product. COGS does not include oblique costs that can not be attributed to the production of a particular product, like advertising and shipping costs. The larger a enterprise' COGS, the lower its gross profit margin shall be. If the COGS exceeds total sales, the corporate will have unfavorable gross profit, meaning it is shedding money over time, and it'll even have a adverse gross revenue margin. This information will cover formulas and examples, and even present an Excel template you should use to calculate the numbers by yourself. For example, a small company may only have sales of $50,000, but when its cost of goods bought is $25,000, it has a gross revenue margin of 50% and $25,000 of gross profit. A giant firm might have $1,000,000 of gross sales and $900,000 in prices, which amounts to a gross revenue margin of 10% and $one hundred,000 of gross profit. Cost of products (COGS) sold is among the key parts that influences the gross profit of a company. Hence, a rise in the price of items bought can decrease the gross revenue. Since the gross revenue comes after the discount of variable prices from the whole income, increases within the variable costs can lower the margin for gross profit. Gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue. In other words, Gross Margin is a percentage value, while Gross Profit is a monetary value. For example, if a company has a gross profit of $500,000 and $1,000,000 in total gross sales, its gross profit margin is half or 50%. This implies that, for every sales dollar the corporate takes in, it earns 50 cents of revenue. Calculating gross profit margin requires calculating gross revenue. For example, if an organization has a gross profit of $500,000 and $1,000,000 of total gross sales, its gross profit margin is 1/2 or 50 percent. Net profit margin is the percentage of revenue left after all expenses have been deducted from sales. The measurement reveals the amount of profit that a business can extract from its total sales. The net sales part of the equation is gross sales minus all sales deductions, such as sales allowances. Divide gross revenue by sales for the gross profit margin, which is 40%, or $40,000 divided by $100,000. The gross profit margin ratio, also called gross margin, is the ratio of gross margin expressed as a percentage of sales. Gross margin, alone, indicates how a lot profit an organization makes after paying off its Cost of Goods Sold. It is a measure of the efficiency of a company utilizing its raw supplies and labor through the production process. Gross margin is the difference between revenues and the cost of goods sold, which leaves a residual margin that is used to pay for selling and administrative expenses. Net margin is the residual earnings left after all expenses have been deducted from revenues. The subsequent part shows your operating, curiosity, and tax expenses. Gross profit is your business’s revenue minus the cost of goods bought. Your value of products bought (COGS) is how a lot cash you spend directly making your merchandise. But, your business’s different bills are not included in your COGS. Gross revenue is your organization’s profit earlier than subtracting expenses. The gross profit margin ratio analysis is an indicator of a company's financial health. A higher gross profit margin indicates that a company can make a reasonable profit on sales, as long as it keeps overhead costs in control. Investors tend to pay more for a company with higher gross profit.How Do Gross Profit and EBITDA Differ?

What is a good profit margin?

Related Terms

What does gross margin tell you?

Does gross revenue embody labor and overhead?

What is difference between gross profit and gross margin?

How do you explain net profit margin?

Gross Margin Definition

What is the difference between gross margin and net margin?

The Difference Between Gross Margin and Net Margin

Is high gross margin good?