How to Calculate Interest Rates on Bank Loans?

How to Calculate Interest Rates on Bank Loans?

The Formula for Effective Annual Interest Rate Is

The extra usually compounding occurs, the upper the effective rate of interest. The Effective Interest Rate Calculator is used to calculate the effective annual rate of interest based mostly on the nominal annual interest rate and the variety of compounding periods per yr. A bank certificates of deposit, a savings account, or a mortgage offer may be marketed with its nominal interest rate as well as its efficient annual interest rate. The nominal interest rate doesn't take reflect the results of compounding curiosity and even the fees that include these monetary products.

APR vs APY: Why Your Bank Hopes You Can't Tell the Difference

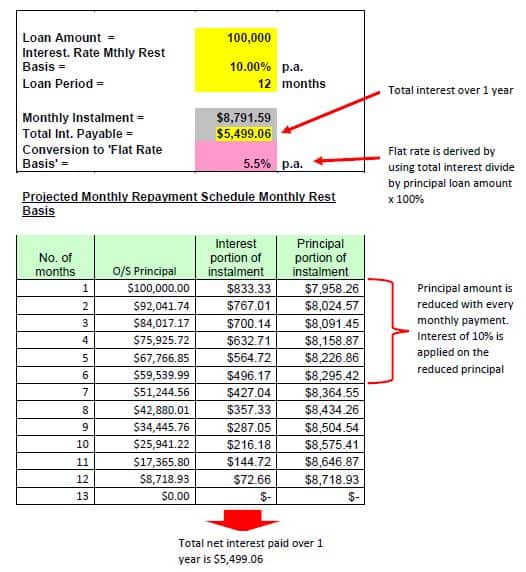

img alt="effective interest rate" src="https://i. It additionally reveals the true proportion fee owed in curiosity on a mortgage, a bank card, or any other debt. When analyzing a mortgage or an funding, it can be difficult to get a transparent image of the mortgage's true cost or the funding's true yield. There are several totally different terms used to describe the rate of interest or yield on a loan, together with annual proportion yield, annual share fee, effective fee, nominal fee, and more. Up until July 1, 2016, the utmost efficient interest rate which could be used for Swiss personal loans was 15 p.c. An addition to the Swiss Consumer Credit Act which took impact at that time stipulates that maximum efficient annual rates of interest shall be adjusted to match the general curiosity surroundings on an annual foundation. A assertion that the "rate of interest is 10%" means that curiosity is 10% per year, compounded yearly. In this case, the nominal annual rate of interest is 10%, and the effective annual interest rate is also 10%. However, if compounding is more frequent than as soon as per 12 months, then the effective rate of interest might be greater than 10%. Of these, the effective interest rate is perhaps probably the most useful, giving a comparatively complete picture of the true price of borrowing. To calculate the effective interest rate on a loan, you will need to understand the loan's said terms and carry out a simple calculation. In the case of Swiss private loans, you need to use the mortgage calculator to simply find the efficient annual rate of interest, mortgage value (monthly reimbursement), mortgage amount or time period of a loan based on its different elements. img alt="effective interest rate" src="https://www. The reason they do this is similar – efficient fee in deposit looks extra attractive than the nominal one. Though the efficient fee will increase because the number of compounding interval increases, there is a limit to this. The effective interest rate is the rate of interest on a loan or financial product restated from the nominal interest rate as an interest rate with annual compound curiosity payable in arrears. It is used to match the annual curiosity between loans with different compounding phrases (daily, month-to-month, quarterly, semi-yearly, annually, or other). It can also be known as effective annual rate of interest, annual equal fee (AER) or simply efficient fee. In Switzerland, the efficient annual interest rate is the standard cost indicator for personal loans, leasing, and credit cards. img alt="effective interest rate" src="https://cdn. The effective annual rates of interest of Swiss personal loans which fall beneath the Swiss Consumer Credit Act must be calculated using the internal fee of return methodology. In this case, the efficient annual interest rate for the borrower is similar to the interior fee of return for the lender, with the borrowers expense matching the lenders profit. We aim to discover a single annual fee with one compounding per yr that may give us the identical future value of $1 as the nominal interest rate quoted by the bank over the multiple compounding intervals. The effective annual rate of interest is the same as 1 plus the nominal interest rate in % divided by the variety of compounding persiods per 12 months n, to the facility of n, minus 1. Investment B has a better stated nominal rate of interest, however the effective annual rate of interest is lower than the effective fee for investment A. img alt="effective interest rate" src="http://img. This is as a result of Investment B compounds fewer instances over the course of the year. The effective annual rate of interest is the actual return paid on savings or the true value of a mortgage as it takes into account the results of compounding and any charges charged. The efficient annual rate of interest is the real return on a savings account or any interest-paying investment when the results of compounding over time are taken into consideration. But within the mortgage contract will proceed to be the figure of 18%. However, the brand new regulation requires banks to specify in the loan settlement to the efficient annual rate of interest. However, the borrower will see this determine after the approval and signing of the contract. In accountancy the term effective rate of interest is used to explain the speed used to calculate interest expense or revenue underneath the efficient curiosity method. Effective annual rates of interest include attainable hidden prices as a result of they're calculated primarily based on the actual excellent debt and account for amortization payments. Because of this, efficient annual rates of interest are better suited to evaluating the price of loans than nominal rates of interest. If a loan has extra costs above the nominal interest or if its interest compounding intervals are shorter than one year, the efficient annual interest rate is greater than the nominal annual interest rate. If there are no further costs or intra-12 months curiosity compounding intervals, the effective annual rate of interest will match the nominal annual rate of interest. You can use the effective vs. nominal annual interest rate calculator to substantiate this. Nominal curiosity can solely exceed effective annual curiosity when the term is longer than 1 year. In European Union member countries, the interior rate of return (IRR) method is more generally used. They present a uniform standards for the comparison of loan offers by potential debtors. where "ia" is the effective annual rate of interest, "r" is the nominal annual rate of interest, and "m" is the variety of compounding intervals per 12 months. Calculate the efficient annual interest rate equivalent to a nominal interest rate of (text8,seventy five%) p.a. Determine the efficient annual interest rate of each of the nominal charges listed above. This just isn't the same because the effective annual rate, and is often said as an APR fee. That's why efficient annual interest rate is a crucial financial idea to understand. You can examine varied provides accurately provided that you realize the effective annual rates of interest of each. On the other hand, when the banks are paying interest on deposit, they usually advertise the effective annual price. For calculating the repeatedly compounding efficient annual interest rate, we elevate the number “e” to the ability of the interest rate. It is a basic rule that as the number of compounding intervals improve, the effective annual interest rate additionally rises. For occasion, quarterly compounding offers the next return compared to the semi-annual compounding, while monthly compounding provides more return than the quarterly. Similarly, every day compounding produces a better return than monthly. For instance, for a mortgage at a acknowledged rate of interest of 30%, compounded monthly, the efficient annual interest rate could be 34.48%. Banks will sometimes promote the said rate of interest of 30% quite than the efficient interest rate of 34.48%. Meanwhile, this specific loan becomes much less favorable should you hold the money for a shorter time frame. For instance, if you borrow $1,000 from a bank for one hundred twenty days and the interest rate remains at 6%, the effective annual rate of interest is far larger. Cash loans which fall underneath the Swiss Consumer Credit Act must be repaid in identical installments. The decrease the efficient annual interest rate, the extra inexpensive the corresponding mortgage is. In Switzerland, effective annual rates of interest are most commonly used in relation to shopper loans.What Does the Effective Annual Interest Rate Tell You?

Effective interest rate

Related wikiHows

AccountingTools