Long Term Debt to Total Asset Ratio

Long Term Debt to Total Asset Ratio

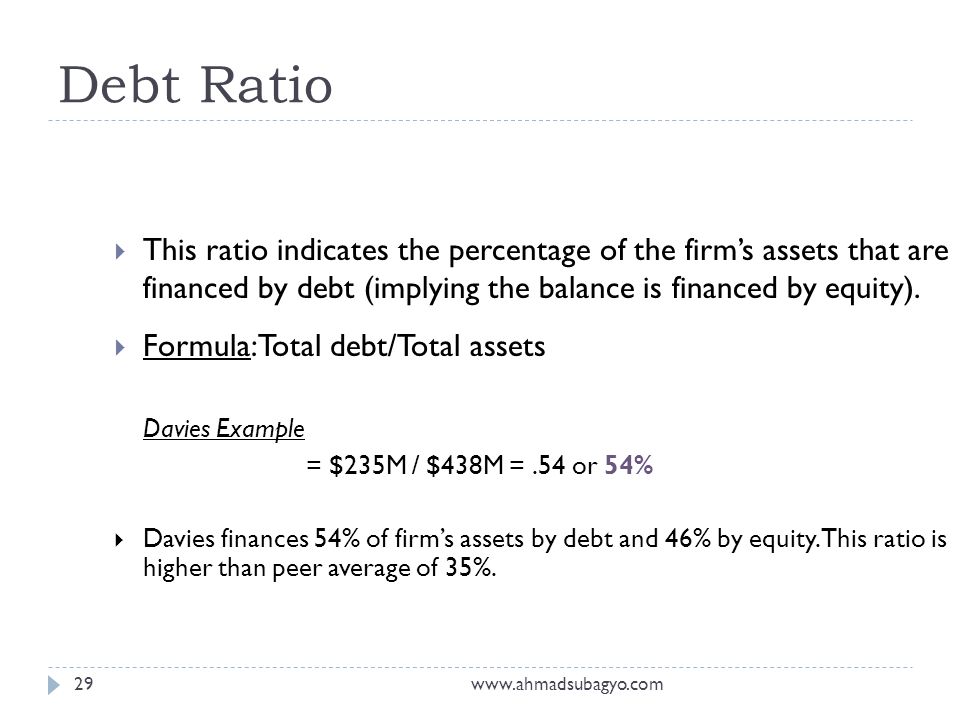

img alt="debt ratio" src="http://www. But not all excessive debt-to-fairness ratios signal poor business practices. In truth, debt can catalyze the growth of a company's operations and in the end generate further income for both the enterprise and its shareholders. Tim is on the lookout for further financing to assist grow the corporate, so he talks to his enterprise partners about financing choices. Tim’s total property are reported at $150,000 and his total liabilities are $50,000. For instance, the debt ratio for a business with $10,000,000 in belongings and $2,000,000 in liabilities could be 0.2. This means that 20 p.c of the company's property are financed via debt. Capitalization ratios are indicators that measure the proportion of debt in a company’s capital construction. A ratio greater than 1 shows that a substantial portion of debt is funded by assets. A high ratio also indicates that a company could also be placing itself at a danger of default on its loans if rates of interest have been to rise suddenly. A ratio below 1 translates to the fact that a higher portion of a company's assets is funded by fairness. Long Term Debt to Total Asset Ratio is the ratio that represents the financial position of the corporate and the company’s capability to fulfill all its monetary necessities. It exhibits the percentage of an organization’s assets that are financed with loans and other monetary obligations that final over a yr. This second classification of brief-time period debt is carved out of lengthy-term debt and is reclassified as a present liability referred to as current portion of lengthy-term debt (or a similar name). The remaining long-time period debt is used in the numerator of the lengthy-time period-debt-to-fairness ratio. img alt="debt ratio" src="https://cdn1. If the ratio is larger than 0.5, many of the firm's property are financed via debt. Companies with excessive debt/asset ratios are mentioned to be highly leveraged. The greater the ratio, the greater risk will be associated with the firm's operation. However, one monetary ratio by itself doesn't present sufficient details about the corporate. When contemplating debt, looking at the company’s money move is also necessary. These figures looked at together with the debt ratio, give a better insight into the company's capacity to pay its debts. While the entire debt to complete assets ratio consists of all money owed, the long-term debt to belongings ratio only takes under consideration lengthy-time period money owed. Both ratios, nonetheless, encompass all of a enterprise's assets, together with tangible property similar to tools and stock and intangible assets corresponding to accounts receivables. Because the entire debt to assets ratio includes extra of a company's liabilities, this quantity is almost always higher than a company's lengthy-time period debt to assets ratio. Total liabilities divided by total assets or the debt/asset ratio reveals the proportion of an organization's assets which are financed by way of debt. If the ratio is lower than 0.5, many of the firm's property are financed via equity. The debt-to-fairness ratio (D/E) is a monetary ratio indicating the relative proportion of shareholders' equity and debt used to finance an organization's belongings. Closely associated to leveraging, the ratio is also referred to as risk, gearing or leverage. To find the debt ratio for a corporation, simply divide the total debt by the total property. The debt ratio provides company leaders perception into the monetary strength of the corporate. This ratio is calculated by taking whole debt and dividing it by whole property. Total debt is the sum of all lengthy-term liabilities and is identified on the company's steadiness sheet. A debt-to-asset ratio is a monetary ratio used to evaluate an organization's leverage – particularly, how a lot debt the enterprise is carrying to finance its belongings. As this ratio is calculated yearly, lower in the ratio would denote that the corporate is fairing well, and is less dependant on debts for their business needs. A low level of danger is preferable, and is linked to a more impartial business that does not need to rely heavily on borrowed funds, and is subsequently extra financially stable. These businesses could have a low debt ratio (under .5 or 50%), indicating that most of their assets are totally owned (financed by way of the firm's own fairness, not debt). In the monetary industry (significantly banking), an analogous idea is fairness to total belongings (or fairness to threat-weighted property), in any other case often known as capital adequacy. If an organization has a high debt ratio (above .5 or 50%) then it's typically considered to be"highly leveraged" (which implies that most of its assets are financed via debt, not equity). The debt ratio takes under consideration each short-time period and long-term property by applying both in the calculation of the whole property in comparison with complete debt owed by the corporate. Another in style iteration of the ratio is the lengthy-time period-debt-to-fairness ratio which makes use of only lengthy-time period debt in the numerator as an alternative of complete debt or complete liabilities. Your debt-to-income ratio, or DTI, expresses in percentage form how much of your gross monthly income is spent on servicing liabilities, such as auto loans, credit cards, mortgage payments (including homeowners insurance, property taxes, mortgage insurance, and HOA fees), rent, credit lines, etc. In a basic sense, Total Debt / Equity is a measure of all of a company's future obligations on the balance sheet relative to equity. However, the ratio could be extra discerning as to what is truly a borrowing, versus other types of obligations that may exist on the steadiness sheet under the liabilities part. For instance, typically only the liabilities accounts which are really labelled as "debt" on the balance sheet are used in the numerator, as an alternative of the broader class of "whole liabilities". If there is a distinction, the shareholder equity will increase or decreases. img alt="debt ratio" src="https://image. Debt ratio evaluation, defined as an expression of the connection between a company’s complete debt andassets, is a measure of the ability to service the debt of an organization. It signifies what proportion of a company’s financing asset is from debt, making it a good way to examine a company’s long-termsolvency. The debt ratio is also known as the debt to asset ratio or the total debt to total assets ratio. Hence, the formula for the debt ratio is: total liabilities divided by total assets. The debt ratio indicates the percentage of the total asset amounts (as reported on the balance sheet) that is owed to creditors. A lower debt-to-asset ratio suggests a stronger monetary structure, simply as a better debt-to-asset ratio suggests higher risk. Generally, a ratio of zero.4 – forty p.c – or lower is taken into account an excellent debt ratio. A ratio above 0.6 is mostly thought-about to be a poor ratio, since there's a threat that the enterprise won't generate enough cash circulate to service its debt. You might struggle to borrow money if your ratio proportion starts creeping in the direction of 60 %. Based on the accounting equation, we will assume the totalequityis $a hundred,000. The fairness ratio highlights two important monetary concepts of a solvent and sustainable business. The first part shows how much of the total company assets are owned outright by the buyers. In different words, after all of the liabilities are paid off, the buyers will find yourself with the remaining assets. When a business finances its belongings and operations mainly by way of debt, collectors may deem the enterprise a credit danger and buyers shy away. The debt ratio is defined as the ratio of whole debt to whole assets, expressed as a decimal or proportion. It can be interpreted as the proportion of an organization’s assets which might be financed by debt. A excessive danger degree, with a high debt ratio, means that the enterprise has taken on a large amount of danger. Debt ratios differ broadly across industries, with capital-intensive businesses corresponding to utilities and pipelines having much greater debt ratios than other industries such as the expertise sector. For instance, if a company has complete property of $a hundred million and whole debt of $30 million, its debt ratio is 30% or 0.30. Is this firm in a better monetary situation than one with a debt ratio of forty%? The debt-to-fairness ratio might help buyers determine extremely leveraged companies which will pose risks, throughout tough patches. Investors can examine an organization's debt-to-equity ratio towards business averages and different comparable companies to gain a basic indication of an organization's fairness-liability relationship. The fairness ratio communicates the shareholder’s funds to whole belongings along with indicating the lengthy-time period or prospective solvency place of the business. Debt Ratio is a monetary ratio that indicates the percentage of a company's assets which are offered by way of debt. It is the ratio of complete debt (lengthy-time period liabilities) and total property (the sum of current belongings, fixed assets, and different belongings similar to 'goodwill'). Sometimes referred to easily as a debt ratio, it is calculated by dividing a company's whole debt by its whole belongings. Average ratios vary by business kind and whether or not a ratio is "good" or not depends on the context by which it is analyzed. The equity ratio refers to a monetary ratio indicative of the relative proportion of fairness applied to finance the property of an organization. This ratio fairness ratio is a variant of the debt-to-fairness-ratio and can also be, typically, referred as net worth to complete property ratio. In addition, high debt to belongings ratio could point out low borrowing capability of a agency, which in flip will lower the agency's monetary flexibility. Like all financial ratios, an organization's debt ratio must be in contrast with their business average or other competing firms. Generally, a ratio of 0.4 – 40 percent – or lower is considered a good debt ratio. A ratio above 0.6 is generally considered to be a poor ratio, since there's a risk that the business will not generate enough cash flow to service its debt.BUSINESS OPERATIONS

Debt Ratio Definition

BUSINESS PLAN

What is included in debt ratio?

What Does the Debt Ratio Tell You?

What is debt ratio formula?

The Most Crucial Financial Ratios For Penny Stocks

What is a good debt ratio?