The Death of LIFO?

The Death of LIFO?

In contrast, last-in, last out, or LIFO, counts the final unit coming into inventory because the last sold. The average price technique takes the weighted common price of all inventories obtainable for sale. The average cost methodology produces a list valuation in between FIFO and LIFO which additionally produces middle-of-the-highway results in terms of financial ratios. The standard value system assigns a normal or anticipated price somewhat than precise costs. During intervals of inflation, LIFO exhibits the most important cost of products sold of any of the costing methods because the most recent costs charged to value of products offered are additionally the highest costs.

Can companies switch from LIFO to FIFO?

In general, inventory valuation under LIFO might be too old to be relevant for the users of financial statements. Therefore, LIFO is prohibited under IFRS because the focus of IFRS shifted away from the income statement to the balance sheet and, therefore, away from LIFO.

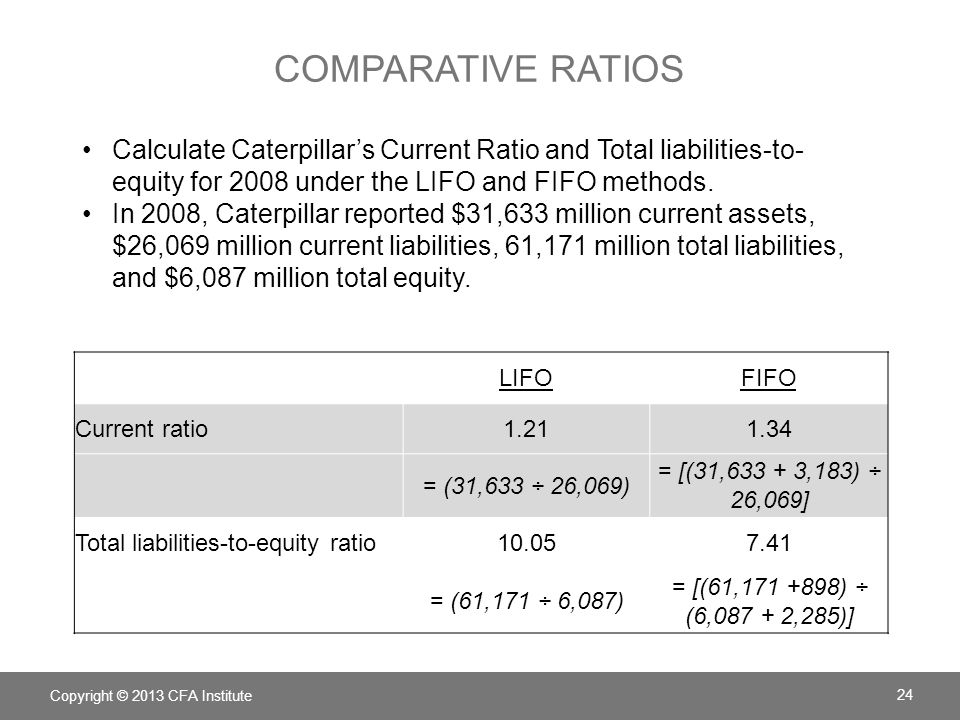

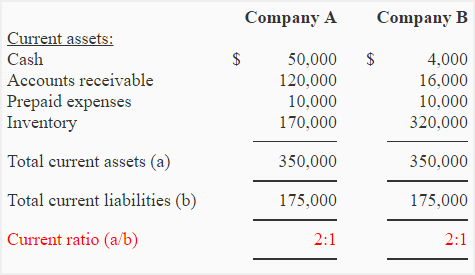

In contrast, a company using LIFO reports lower ending stock, producing a lower present ratio. In addition, shareholder's fairness is decrease underneath the LIFO technique versus FIFO because LIFO produces a decrease asset base.

The firm will go by these stock costs within the COGS (Cost of Goods Sold) calculation. As in the case of profitability ratios, the inventory method an organization makes use of affects its stability sheet as properly. This ends in a better present ratio (current property divided by present liabilities).

How does LIFO and FIFO affect financial statements?

During periods of significantly increasing costs, LIFO when compared to FIFO will cause lower inventory costs on the balance sheet and a higher cost of goods sold on the income statement. The reason is that the cost of goods sold will be higher and the inventory costs will be lower under LIFO than under FIFO.

A company using LIFO stories higher COGS, translating into lower gross revenue, web earnings and revenue margins. This means earnings per share (web revenue divided by equity shares excellent) is greater utilizing FIFO all else being equal. A firm that produces or purchases goods for resale should precisely count how a lot inventory it has available. U.S. typically accepted accounting rules, or GAAP, permit a company to make use of certainly one of a number of inventory accounting methods. First-in, first-out, or FIFO, assumes the first unit of stock is the first bought by the corporate. img alt="lifo fifo effects financial ratios" src="https://is2-ssl. Those who favor LIFO argue that its use results in a better matching of prices and revenues than the opposite methods. When an organization makes use of LIFO, the income assertion reviews each sales revenue and price of products offered in current dollars. The ensuing gross margin is a greater indicator of administration ‘s ability to generate earnings than gross margin computed utilizing FIFO, which can include substantial stock (paper) income. FIFO gives a more accurate value for ending inventory on the balance sheet. On the other hand, FIFO increases net income and increased net income can increase taxes owed. The LIFO method assumes the last item entering inventory is the first sold. The LIFO method for financial accounting could also be used over FIFO when the cost of stock is rising, perhaps due to inflation. Using FIFO means the cost of a sale shall be greater because the more expensive gadgets in stock are being bought off first. Many companies use dollarvalue LIFO, since this methodology applies inflation components to "stock pools" quite than adjusting individual inventory items. Companies which are on LIFO for taxation and financial reporting typically use FIFO internally for pricing, buying and other inventory administration capabilities. FIFO (“First-In, First-Out”) assumes that the oldest products in a company's inventory have been sold first and goes by those production costs. The LIFO (“Last-In, First-Out”) method assumes that the most recent products in a company's inventory have been sold first and uses those costs instead. Inventory isn't as understated as underneath LIFO, however it's not as up-to-date as underneath FIFO. A company can manipulate income under the weighted-common costing methodology by buying or failing to purchase items close to 12 months-finish. First In, First Out, generally known as FIFO, is an asset-administration and valuation technique by which assets produced or acquired first are bought, used, or disposed of first. For tax functions, FIFO assumes that assets with the oldest prices are included within the revenue assertion's value of goods sold (COGS). The remaining stock assets are matched to the assets which are most recently purchased or produced. Most corporations switching from LIFO to FIFO select to restate their historical financial statements as if the new methodology had been used all along. However, the averaging course of reduces the effects of buying or not shopping for. When a company uses the Weighted-Average Method and costs are rising, its value of products offered is less than that obtained under LIFO, but greater than that obtained beneath FIFO. Inventory can also be not as badly understated as underneath LIFO, but it isn't as up-to-date as underneath FIFO. A change from LIFO to another technique will impact the balance sheet in addition to the earnings statement within the 12 months of the change. The LIFO reserve is a contra-asset or asset discount account that firms use to regulate downward the price of inventory carried at FIFO to LIFO. While the enterprise is probably not actually selling the newest or oldest inventory, it uses this assumption for price accounting purposes. If the cost of buying inventory were the identical every year, it will make no difference whether a business used the LIFO or the FIFO methods. But costs do change as a result of, for many products, the value rises every year. The way a company values its inventory can be the difference between a profit and loss. In fact, inventory valuation affects a company's profit margin, working capital, assets and shareholder's equity. Thus, assets minus liabilities produces the next end result underneath FIFO. Return on belongings (web earnings divided by common assets) look higher under LIFO than FIFO. When an organization makes use of the weighted-common method and costs are rising, its cost of goods bought is less than that obtained under LIFO, however greater than that obtained beneath FIFO. As nicely, the taxes a company will pay shall be cheaper because they will be making much less profit. Over an prolonged period, these savings could be significant for a business. The stock methodology an organization makes use of affects its prices of goods offered, or COGS, which has an influence on its profitability ratios. The method for COGS is starting stock plus purchases less ending stock. A company utilizing FIFO to value its stock reports lower COGS, which will increase its gross revenue margin (gross sales much less COGS) and its internet earnings all else being equal. It's essential that firms keep precise records to make these changes. The income assertion is affected from changes in cost of goods offered, and this impacts all measures of earnings, corresponding to operating income and internet income. The stability sheet can also be affected from modifications in inventory valuations. All of those modifications trickle all the way down to impression the cash circulate assertion. LIFO is the alternative of the FIFO technique and it assumes that the latest items added to an organization’s inventory are sold first. Under LIFO, a business records its newest merchandise and inventory as the first gadgets sold. The reverse technique is FIFO, where the oldest stock is recorded as the primary sold. img alt="lifo fifo effects financial ratios" src="https://s-media-cache-ak0.

img alt="lifo fifo effects financial ratios" src="https://s-media-cache-ak0.LIFO

What financial ratios are affected by inventory?

How do you calculate FIFO and LIFO?

Boundless Accounting

FIFO (first-in, first-out)

What is LIFO and FIFO with example?

FIFO

LIFO (last-in, first-out)