Understanding the Difference Between Revenue vs. Profit

Understanding the Difference Between Revenue vs. Profit

img alt="transaction income statement balance sheet account" src="https://i. This calculation exhibits traders and collectors the overall profitability of the company as well as how efficiently the corporate is at generating earnings from total revenues. Like an operating lease, the company only lists the rental expenses on its balance sheet, whereas the asset itself is listed on the steadiness sheet of the proudly owning enterprise. A stability sheetlists a company's property, liabilities, and shareholders' fairness for a period. The income statement and balance sheet of a company are linked through the net income for a period and the subsequent increase, or decrease, in equity that results. It is through the income and equity accounts that the balance sheet and income statement reflect the total financial picture of the entity. Income statement accounts are also referred to as short-term accounts or nominal accounts as a result of on the end of every accounting year their balances will be closed. This means that the balances in the income assertion accounts will be combined and the web quantity transferred to a balance sheet equity account. img alt="transaction income statement balance sheet account" src="https://i. The revenue quantity is the revenue an organization generates before any expenses are taken out. Revenue is the entire quantity of earnings generated by the sale of goods or services associated to the company's main operations. Profit, usually called web profitor the underside line, is the amount of revenue that remains after accounting for all bills, money owed, additional earnings streams and operating prices. The Income Statement totals the debits and credits to determine Net Income Before Taxes. It is called the Balance Sheet because it reports on Asset, Liability, and Equity accounts, and is meant to show that these three accounts balance according to the accounting equation: Assets = Liabilities + Owner's Equity. Also, of concern is a few off-stability sheet objects have the potential to become hidden liabilities. For example, collateralized debt obligations (CDO) can turn into toxic assets, assets that may abruptly turn out to be nearly completely illiquid, earlier than investors are conscious of the corporate's monetary publicity. The format of the income statement parts permits for dissecting the revenues, bills, operating earnings, and income of an entity. The revenue statement is certainly one of three crucial firm financial statements for investor analysis. In different words, the balance sheet shows the belongings and liabilities that outcome, in part, from the actions on the cash circulate assertion. The balance sheet and cash circulate assertion are two of the three monetary statements that companies issue to report their monetary performance. The monetary statements are utilized by buyers, market analysts, and creditors to evaluate a company's financial health and earnings potential. While the steadiness sheet exhibits what an organization owns and owes, the cash circulate statement data the cash activities for the period. “The three financial statements are the income statement, balance sheet, and statement of cash flows. The income statement is a statement that illustrates the profitability of the company. It begins with the revenue line and after subtracting various expenses arrives at net income. If the cost phrases permit credit to customers, then revenue creates a corresponding quantity of accounts receivable on the balance sheet. Or, if a sale is being made in change for another asset (which occurs in a barter transaction) then another asset on the balance sheet might enhance. Undoubtedly, Apple recorded cash flow exercise in addition to exercise from the revenue assertion, such as revenue and bills. Statement of owners equity is considered a link between the income statement and balance sheet. In the case of a sole proprietorship, the fairness account is the proprietor's capital account. As a result, the earnings statement accounts will begin the next accounting 12 months with zero balances. The single main difference between revenue (an income statement merchandise) and property (balance sheet objects) is that revenue is recorded over the course of a interval. For occasion, Wal-Mart's fourth-quarter revenue will mirror every thing it bought from Oct. 1 to Dec. 31. The earnings statement calculates thenet incomeof an organization by subtracting totalexpensesfrom totalincome. Balance sheets are all the time ready for a time limit and the term “as at …” is included within the title. The stability sheet communicates what the entity owns by way of assets, what it owes by way of liabilities, and the difference between those two which represents what the homeowners of the corporate are entitled to. The revenue statement is a abstract of the sources of revenues and bills that lead to a revenue or a loss for a specified accounting period. img alt="transaction income statement balance sheet account" src="http://thumb7. The accounting equation shows on a company's steadiness sheet whereby the entire of all the company's assets equals the sum of the corporate's liabilities and shareholders' equity. The accounting equation is taken into account to be the muse of the double-entry accounting system. The steadiness sheet above exhibits a snapshot of Apple's assets and liabilities for the quarter, but you'll notice it doesn't present the amount of money that was spent nor the profit or revenue generated for the quarter. The cash circulate statement (CFS) measures how well an organization manages and generates money to pay its debt obligations and fund operating bills. The cash move assertion is derived from the earnings statementby taking web earnings and deducting or adding the cash from the company's activities shown below. If Wal-Mart sells a prescription to a customer for $50, it may not receive the fee from the insurance firm until one month later. However, it'll report $50 in revenue and $50 as an asset (accounts receivable) on the steadiness sheet. It will also lower the worth of stock for the quantity it paid for the prescription it bought to the customer. Unlike the stability sheet, the income assertion calculates net revenue or loss over a range of time. For instance annual statements use revenues and expenses over a 12-month period, while quarterly statements focus on revenues and bills incurred throughout a 3-month interval. The revenue statement, additionally known as theprofit and loss assertion, is a report that reveals the income, expenses, and resulting earnings or losses of an organization during a particular time period. Off-stability sheet objects are an necessary concern for investors when assessing an organization's financial well being. Off-stability sheet items are sometimes troublesome to establish and monitor within a company's financial statements because they typically only appear within the accompanying notes. From an accounting standpoint, the corporate would recognize $50 in income on itsincome statementand $50 in accrued income as an asset on its balance sheet. When the corporate collects the $50, the cash account on the income statement increases, the accrued income account decreases, and the $50 on the earnings statement will remain unchanged. However, the balance sheet does not present the actual activity from the quarter. Instead, the steadiness sheet reveals the outcomes of what the corporate owns and owes as a result of that exercise. In double-entry bookkeeping, bills are recorded as a debit to an expense account (an revenue statement account) and a credit score to both an asset account or a liability account, that are stability sheet accounts. Typical business bills embrace salaries, utilities, depreciation of capital property, and curiosity expense for loans. A stability sheet exhibits what a company owns within the type of assets, what it owes in the form of liabilities, and the sum of money invested by shareholders listed beneath shareholders' fairness. The income statement is a press release that illustrates the profitability of the company. It begins with the revenue line and after subtracting numerous bills arrives at internet revenue. The stability sheet exhibits a snapshot of a corporation’s property, liabilities, and equity at one time limit and it demonstrates the accounting equation. Profits are additionally known as web revenue or the “bottom line” as a result of profits are reported at the backside of the revenue statement. Some analysts call these “accounting profits” as a result of they include non-cash accounting entries corresponding to depreciation and amortization. Off-steadiness sheet objects aren't inherently supposed to be misleading or misleading, although they are often mis-utilized by bad actors to be deceptive. For example, investment management companies are required to maintain purchasers' investments and assets off-balance sheet. For most companies, off-stability sheet items exist in relation to financing, enabling the company to maintain compliance with present financial covenants. (No revenue account or expense account is involved.) Another example of a transaction affecting two balance sheet accounts and no income statement account is a deposit for future services. The payer will debit the asset Prepaid Expenses and will credit the asset Cash. An extra of inflows over outflows is known as web revenue, and an excess of outflows over inflows is known as a internet loss. When speaking financial information to readers of the knowledge, commonplace codecs for financial statements have been established. The two most widely used statements are the Balance Sheet and Income Statement. Revenue is also known as the highest line as a result of it sits at the high of the earnings statement. Off-steadiness sheet objects are also used to share the risks and benefits of belongings and liabilities with different companies, as within the case of joint venture (JV) initiatives. Off-stability sheet (OBS) objects is a term for assets or liabilities that do not seem on a company's balance sheet. Typically that interval is one year but it may be a month or a quarter as properly. Income statements are all the time prepared for a time period and the term “for the period ended…” is included in the title. The revenue statement communicates the inflows and outflows of assets, where inflows are the revenues generated and outflows are the bills. The balance sheet reveals a snapshot of the assets and liabilities for the interval, but it does not present company's activity in the course of the period, such as income, bills, nor the amount of cash spent. If a company's cost terms are money solely, then revenue also creates a corresponding amount of money on the stability sheet. Unlike the income statement, the stability sheet doesn't account for the entire interval and quite is a snapshot of the company at a specific cut-off date similar to the tip of the quarter or 12 months. The balance sheet shows the company’s resources (assets) and funding for these assets (liabilities and stockholder’s equity). Another instance of a transaction affecting two steadiness sheet accounts and no earnings assertion account is a deposit for future companies. The payer will debit the asset Prepaid Expenses and can credit the asset Cash. The firm receiving the fee will debit Cash and will credit score a legal responsibility account such as Customer Deposits, Unearned Revenues or Deferred Revenues. Net Income is a key line merchandise, not only in the earnings statement, however in all three core financial statements. While it's arrived at via the revenue statement, the net revenue is also used in both the balance sheet and the cash move statement. Financial statements are written data that convey the enterprise actions and the monetary performance of a company. Financial statements embody the stability sheet, revenue assertion, and money move statement. If cash is used to pay down a company's debt, for instance, the debt legal responsibility account is decreased, and the cash asset account is reduced by the same quantity, maintaining the steadiness sheet even. Although not recorded on the steadiness sheet, they are nonetheless property and liabilities of the corporate. Off-steadiness sheet items are typically these not owned by or are a direct obligation of the corporate. For example, when loans are securitized and bought off as investments, the secured debt is usually kept off the financial institution's books. A few of the many income statement accounts used in a business include Sales, Sales Returns and Allowances, Service Revenues, Cost of Goods Sold, Salaries Expense, Wages Expense, Fringe Benefits Expense, Rent Expense, Utilities Expense, Advertising Expense, Automobile Expense, Depreciation Expense, Interest Expense, In different words, a company's cash move assertion measures the circulate of cash in and out of a business, whereas a company's stability sheet measures its property, liabilities, and owners' equity. In order to do that, we create a separate part that calculates the adjustments in net working capital. The purchase of a capital asset similar to a constructing or tools isn't an expense. For one, they seem on utterly different elements of an organization's monetary statements. Assets are listed on the steadiness sheet, and revenue is proven on an organization's income statement.What account does not affect the balance sheet or income statement?

Free Financial Statements Cheat Sheet

How is the income statement related to the balance sheet?

What is balance sheet income statement and cash flow?

What are the 3 financial statement?

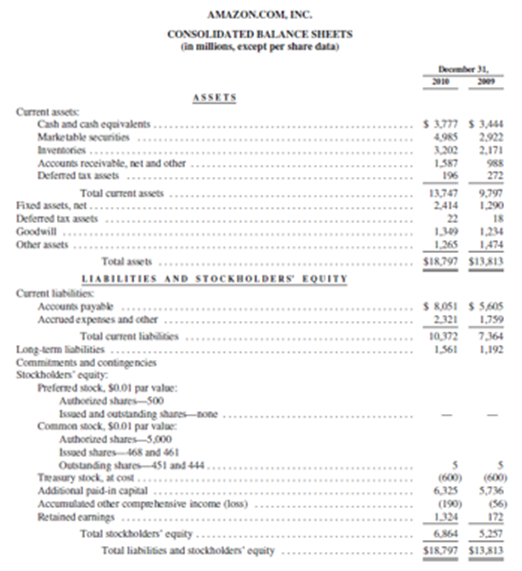

Our Balance Sheet

Will each transaction affect an income statement account and a balance sheet account?

Accounting: The Income Statement and Balance Sheet

What accounts go on the income statement?

Running a Trial Balance

![]()

Which financial statement is considered a link between the income statement and balance sheet?

ideas on “Accounting Relationship: Linking the Income Statement and Balance Sheet”