What are the major types of costs?

True Cost

Examples of fixed costs are lease, insurance coverage, and loan payments. Some others are property taxes, depreciation on gear, and non-consumption services such as for Internet usage. Certain fastened costs can quickly change based mostly on enterprise activity.

Once we have those two pieces of knowledge, we can use them to determine the approximate price for any stage of manufacturing. In order to use the high-low methodology, you'll have to mix the fastened and variable prices of production within your company to give you a complete price.

For example, in a manufacturing operation, the cost of direct materials and labor corresponds to production ranges. As more models are produced, extra materials, labor hours and machine hours are needed and vice versa. Similarly, variable prices in a service enterprise will fluctuate depending on provides and equipment needed, required journey bills and labor costs of assist personnel. A merchandiser might expertise variable prices that embrace sales commissions, stock management and delivery bills. The prices related to a product, product line, equipment, store, geographic sales region, or subsidiary, encompass both variable costs and stuck costs.

What are the major types of costs?

There are three major types of costs direct (labor, materials, equipment, other); project overhead; and general and administrative (G&A) overhead.

When prices are easily observable and quantifiable, value standards are often developed. Also often known as engineered standards, they're developed for every physical enter at each step of the manufacturing course of. At that point an engineered value per unit of production can be determined. By documenting variable costs and pretty allocating fastened costs to different departments, a price accounting system can provide administration with the accountability and price controls it wants to improve operations.

Cost Behavior Analysis Template

In most real-world cases, it should be attainable to obtain more data so the variable and stuck prices could be determined directly. Thus, the high-low methodology should solely be used when it isn't potential to acquire precise billing data.

The accountant can analyze these numbers using information from the month-to-month bills and the exercise level. He does not need to contact anyone exterior of the corporate to find out the mounted bills or the variable rate per unit. The high-low method is one sort of price-quantity evaluation used in accounting.

img alt="what is cost behavior" src="http://community. Mixed prices share traits with fixed and variable prices. For instance, suppose the monthly utility bill accommodates flat price limits for fuel, water and electricity consumption and additional costs for exceeding those limits. During instances of low exercise ranges, during which the business does not exceed flat fee ranges, the prices are fixed. Conversely, throughout occasions of excessive production or gross sales levels, consumption increases beyond the flat rate stage and complete prices differ. Fixed costs happen regardless of the business's production levels or gross sales quantity. To determine each price parts of the total value, an analyst or accountant can use a way generally known as the excessive-low method. A CBA could also be used to check completed or potential courses of actions, or to estimate (or consider) the worth towards the price of a choice, venture, or coverage. The high-low technique is used to calculate the variable and stuck price of a product or entity with combined prices. It considers the whole dollars of the mixed prices on the highest quantity of activity and the total dollars of the blended costs at the lowest volume of activity. Another benefit of this method is that it only requires two units of numbers to calculate the fastened and variable costs. The accountant reviews the monetary transactions for the account over several months to obtain the whole cost quantity. She critiques department data to determine the exercise ranges for those self same months. CBA helps predict whether or not the advantages of a policy outweigh its costs (and by how a lot), relative to other alternate options. This allows the ranking of other insurance policies by way of a cost–profit ratio. Generally, correct value–benefit analysis identifies selections which increase welfare from a utilitarian perspective. Assuming an correct CBA, changing the established order by implementing the choice with the lowest price–profit ratio can improve Pareto effectivity. You will notice that the excessive-low method will only provide you with an estimate of what complete prices could be at any given quantity of manufacturing. These estimates are helpful to administration when making ready budgets for upcoming months. In value accounting, the excessive-low methodology is a way of attempting to separate out fastened and variable prices given a restricted quantity of information. The high-low technique entails taking the best level of activity and the lowest level of activity and comparing the whole costs at every stage. Activity ranges within the enterprise will change the variable value totals. img alt="what is cost behavior" src="https://o. After gathering data from these two locations, the accountant has all the knowledge she must perform the analysis. One benefit of the excessive-low methodology is the lack of formality required. The complete amount of mounted costs is assumed to be the same at each factors of activity. The change in the complete prices is thus the variable price fee times the change in the variety of models of exercise. One very quick means of estimating the fee per unit produced is to use the excessive-low methodology of value-volume analysis. The excessive-low methodology takes the distinction between the highest and lowest gross sales portions and the total of fixed and variable costs related to each to get an approximate value per unit of manufacturing. Another drawback of the excessive-low method is the variety of steps essential to carry out this analysis. Cost behavior analysis refers to management's attempt to understand how operating costs change in relation to a change in an organization's level of activity. These costs may include direct materials, direct labor, and overhead costs that are incurred from developing a product. Cost behavior is an indicator of how a cost will change in total when there is a change in some activity. The total amount of a variable cost will also decrease in proportion to the decrease in an activity. Fixed costs. The total amount of a fixed cost will not change when an activity increases or decreases. A similar strategy is used in the environmental analysis of total economic value. Costs are typically most thoroughly represented in value–benefit analyses due to comparatively-ample market knowledge. The guideline of evaluating advantages is to list all events affected by an intervention and add the positive or unfavorable worth (normally monetary) that they ascribe to its effect on their welfare. Cost–benefit evaluation is commonly utilized by organizations to appraise the desirability of a given coverage. It is an evaluation of the expected stability of advantages and costs, including an account of any alternatives and the established order. There are four basic cost behavior patterns: fixed, variable, mixed (semivariable), and step which graphically would appear as below. The relevant range is the range of production or sales volume over which the assumptions about cost behavior are valid. Often, we describe them as time-related costs. It is commonly utilized in commercial transactions, business or policy decisions (particularly public coverage), and venture investments. The high-low technique is mostly not most well-liked as it can yield an incorrect understanding of the information if there are modifications in variable or mounted cost rates over time or if a tiered pricing system is employed. This lesson describes how it's used and explains the method for shortly computing an estimated price per unit. Total value (TC) in the easiest phrases is all the prices incurred in producing something or partaking in an activity. In economics, complete value is made up of variable prices + fixed costs. CBA attempts to measure the constructive or negative consequences of a project.

Cost operate assumptions

Chapter 5: Cost Behavior and Cost-Volume-Profit Analysis

How is cost behavior calculated?

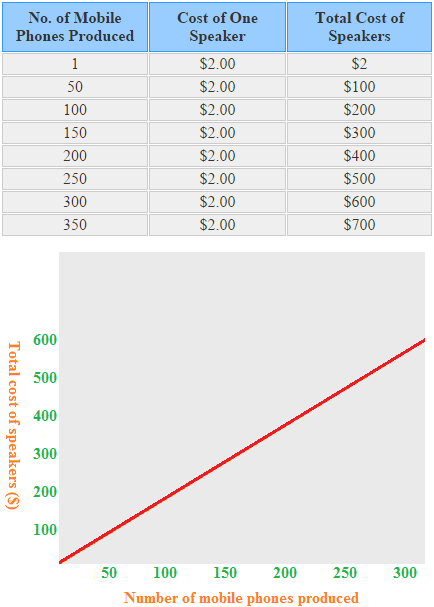

Examples of Cost Behavior

What are the different types of cost behavior?

What is cost behavior analysis?

High-Low cost conduct instance