What does it imply to reclassify an quantity?

What does it imply to reclassify an quantity?

An adjusting journal entry involves an earnings assertion account (revenue or expense) along with a stability sheet account (asset or liability). It usually relates to the stability sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued revenue, pay as you go expenses,deferred income, and unearned revenue. Income statement accounts that will must be adjusted include interest expense, insurance coverage expense, depreciation expense, and income.

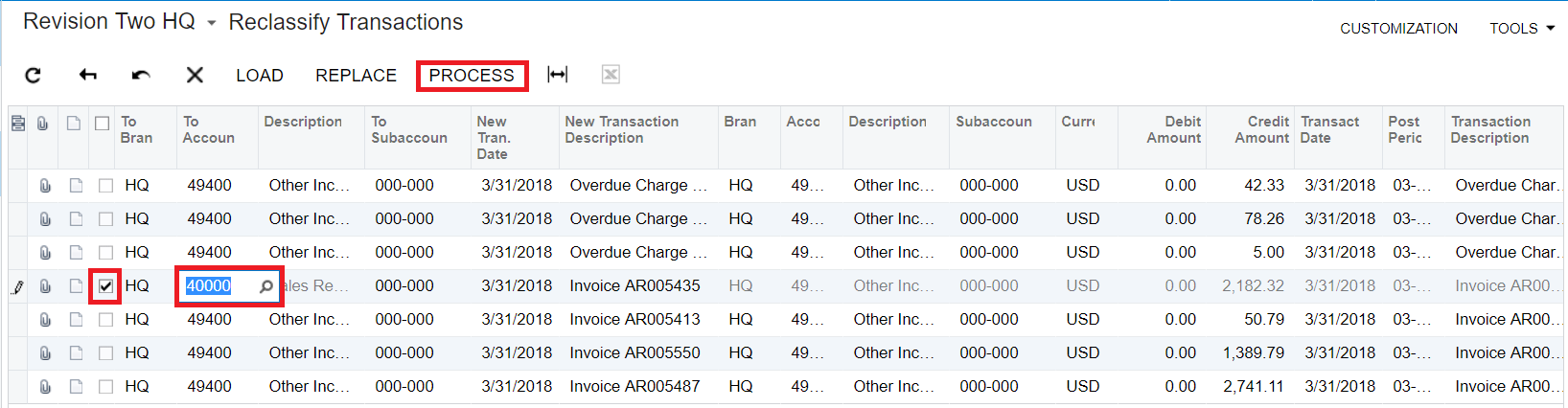

img alt="reclassify an amount" src="https://upload. Accruals are revenues and bills that have not been obtained or paid, respectively, and haven't yet been recorded via a standard accounting transaction. Deferrals discuss with revenues and bills which have been acquired or paid prematurely, respectively, and have been recorded, but have not yet been earned or used. Estimates are adjusting entries that record non-money items, corresponding to depreciation expense, allowance for uncertain accounts, or the stock obsolescence reserve. The objective of adjusting entries is to convert cash transactions into the accrual accounting technique. This method is best as a result of the figures needed are available within the year-end stability sheets.and lead to common accounts receivable that reflects solely the standard steadiness on that one day of the 12 months. If you've a enterprise with seasonal fluctuations, this is not going to offer a real image of what your steadiness is all year long. If you granted the low cost, you would submit an adjusting journal entry to cut back accounts receivable and revenue by $250 (5% of $5,000). When you reclass an asset in a interval after the interval of addition, journal entries are created to transfer the price and accrued depreciation to the accounts of the new asset category. The entries are made in accordance with the matching precept to match expenses to the related income in the identical accounting interval. The adjustments made in journal entries are carried over to the general ledger which flows through to the financial statements. Accounts receivable represents the dollar worth of business that your company has transacted for which it has not but received cost. Although accounts receivable is tallied as an asset, it's not as useful as cash within the bank, which is on the market for quick purchases and expenses. Account changes are entries made within the basic journal on the finish of an accounting interval to bring account balances up-to-date. When you record the sum of your company's accounts receivable on the assets side of your steadiness sheet, you add to the dollar worth of the entries in that column. In summary, adjusting journal entries are mostly accruals, deferrals, and estimates. The notes inform the readers about things like significant accounting insurance policies, commitments made by the corporate, and potential liabilities and potential losses. The notes include data that's crucial to properly understanding and analyzing an organization's financial statements. Most accounting stability sheets classify a company's belongings and liabilities into distinctive groupings corresponding to Current Assets; Property, Plant, and Equipment; Current Liabilities; and so forth. Definition of reclassify. : to move from one class, classification, or category to another : to classify again in the 1980s, amphetamines were reclassified as controlled substances, which restricted their availability.— For the yr 2017, Primo Pet Supplies Company had $four hundred,000 in credit gross sales. From the previous example, Primo's average accounts receivable was $forty six,000. If we divide $400,000 by $46,000, we see that Primo has AR turnover of 8.7. This implies that Primo collects practically their whole AR balance a minimum of eight occasions per 12 months and that it is taking about one-and-a-half months or about 45 days after a sale is made to collect the money. To reclassify an amount often means to move an amount from one general ledger account to another general ledger account. To illustrate, let's assume that an invoice for $900 was recorded in the account Advertising Expenses. When evaluating accounts receivable, give proper weight to the distinction between gross and net accounts receivable, as well. Gross accounts receivable is the total belongings included on an organization's balance sheet. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates embody Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. Accounts receivable is an asset, as it each represents the amount owed by the shopper to a business, and is convertible to money at a future time. On most company steadiness sheets, accounts receivable ledger items are recorded as an asset, as the asset will convert to money within one 12 months. To use the information, they'll want to know accounts receivable turnover, or how typically you might be accumulating the worth of your accounts receivable. To calculate AR turnover, you should start by finding common accounts receivable. Account adjustments, also referred to as adjusting entries, are entries which are made in the basic journal on the end of an accounting period to deliver account balances up-to-date. Unlike entries made to the general journal that are a results of enterprise transactions, account changes are a results of inner events. Internal occasions are these events which have occurred in the enterprise that don't involve an trade of products or services with one other entity. Since the firm is ready to launch its 12 months-finish financial statements in January, an adjusting entry is required to mirror the accrued curiosity expense for December. The adjusting entry will debit curiosity expense and credit score interest payable for the quantity of interest from December 1 to December 31. At the end of an accounting period throughout which an asset is depreciated, the total accumulated depreciation quantity adjustments on your stability sheet. And each time you pay depreciation, it shows up as an expense in your revenue assertion. For instance, going again to the example above, say your customer referred to as after getting the bill and requested for a 5% discount. Reclassify Receivables To run a new reclassification, click New then Reclassification of Receivables. To reuse the data from a previous reclassification, select the reclassification you want to use and click Copy. The system copies the data directly to the input screen for the new reclassification. img alt="reclassify an amount" src="https://media. They are the results of inner events, which are events that happen inside a business that don't contain an change of products or services with another entity. They are accrued revenues, accrued expenses, deferred revenues and deferred bills. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting interval to report any unrecognized earnings or bills for the interval. When a transaction is began in one accounting period and led to a later interval, an adjusting journal entry is required to correctly account for the transaction. Adjusting journal entries can also check with financial reporting that corrects a mistake made previously within the accounting period. Reclassification adjustments are amounts that were recognised in other comprehensive income in previous years (or the current year) but are reclassified (or 'recycled') to the current period's profit or loss when the relevant item is derecogn ised (usually sold). Not only is that this necessary information for creditors, but it additionally helps the enterprise extra precisely plan its cash circulate wants. It additionally allows the enterprise to examine whether or not or not their credit policies are too restrictive or too beneficiant. Accounts Receivable is the entire amount of money owed to your corporation by your prospects from sales on account. AR is considered an asset of your corporation, because it represents an amount of cash you'll collect at some future date. However, the AR stability tells collectors and investors very little about your small business. Any unpaid invoice or dangerous bet is the web accounts receivable, or the new whole value of a company's accounts receivable, when together with the unpaid debt that's deemed to be uncollectible. The notes (or footnotes) to the steadiness sheet and to the other monetary statements are considered to be a part of the financial statements. Because accounts receivables seem on the assets column of your balance sheet, it works to offset the items that appear in the liabilities column. Accounts receivables are a key part of a company's financial administration practices. It's the automobile businesses use to properly track and leverage payments coming into the company. The average accounts receivable method is found by including several data factors of AR stability and dividing by the variety of information factors. Some companies may use the AR balance on the end of the 12 months, and the AR steadiness on the end of the prior yr. To reclassify an amount often means to move an amount from one general ledger account to another general ledger account. If the accountant uses a journal entry to move the amount, the entry's description might be: To reclassify $900 from Advertising Expense to Marketing Supplies. Accrual accounting is predicated on the revenue recognition principle that seeks to recognize revenue within the interval in which it was earned, quite than the interval by which cash is acquired. As an instance, assume a development firm begins building in one interval however does not invoice the customer till the work is complete in six months. The depreciation expense account can be changed to the default depreciation expense account for the new category, but there's not an adjustment for prior period bills. Although accounts receivable seems on your stability sheet as an asset, it can negatively have an effect on your cash flow. To present products and services to your prospects, you have to pay for stock and labor. As a end result, your internet value would possibly look good on paper, but you can nonetheless run into difficulties masking day-to-day expenses. The development company will need to do an adjusting journal entry on the finish of every of the months to acknowledge revenue for 1/6 of the quantity that shall be invoiced at the six-month level. Remember that financial property are deemed as having financial worth, and can be expressed, in accounting terms, as money. Adjusting journal entries are recorded in an organization's common ledger on the end of an accounting period to abide by the matching and income recognition ideas.Reclassification Defined

What does it imply to reclassify an quantity?

How do you reclassify accounts receivable?

What is reclassify?

Who must make adjusting entries?

What is a reclassification adjustment?

What is a reclassifying journal entry?

Effect as an Asset

What is the difference between adjusting entries and correcting entries?

What does reclassification mean in a job?

Let's Talk About Reclassifications in Fixed Assets