What Is a Good Liquidity Ratio?

Liquidity Ratios Introduction

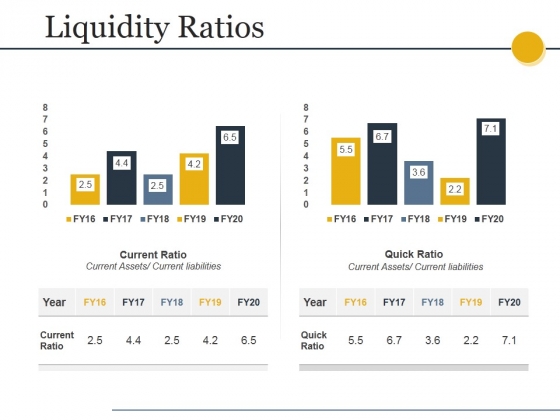

Potential collectors use this ratio in figuring out whether or to not make quick-time period loans. The present ratio can also give a sense of the effectivity of an organization's working cycle or its capability to show its product into cash. The second step in liquidity analysis is to calculate the company's quick ratio or acid check. The fast ratio is a more stringent take a look at of liquidity than the present ratio. It appears at how nicely the company can meet its quick-term debt obligations without having to sell any of its inventory to take action.

What Is an Example of a Liquidity Ratio?

The fast ratio is ameasure of a company's ability to satisfy its quick-time period obligations utilizing its most liquid property (near cash or quick assets). Quick property include those present belongings that presumably may be shortly transformed to money at near their guide values. Quick ratio is viewed as an indication of an organization's financial power or weakness; it gives information about a company’s quick time period liquidity. The ratio tells collectors how a lot of the corporate's quick term debt may be met by promoting all the company's liquid belongings at very short discover. Current ratio is stability-sheet financial efficiency measure of company liquidity.

What Is a Good Liquidity Ratio?

What is the liquidity ratio formula?

It is calculated by dividing the current assets by the current liabilities. It is also called working capital ratio. A ratio greater than 1 shows that the company expects to receive more cash inflows from liquidation of current assets than it expects to pay on account of current liabilities in next 12 months.

Liquidity ratios show a company’s current assets in relation to current liabilities. The data used to calculate liquidity ratios comes from a company’s steadiness sheet. It makes use of an identical formula however does not include stock in its calculation.

If an organization’s present ratio is on this range, then it typically indicates good quick-term monetary strength. If present liabilities exceed current property (the current ratio is beneath 1), then the company might have problems assembly its short-time period obligations (present liabilities). It signifies a company's capability to fulfill its short-time period liabilities with its brief-term belongings. A current ratio larger than or equal to at least one signifies that current assets should have the ability to satisfy near-time period obligations. In this article, we will consider some generally used liquidity ratios used within the monetary analysis of an organization.

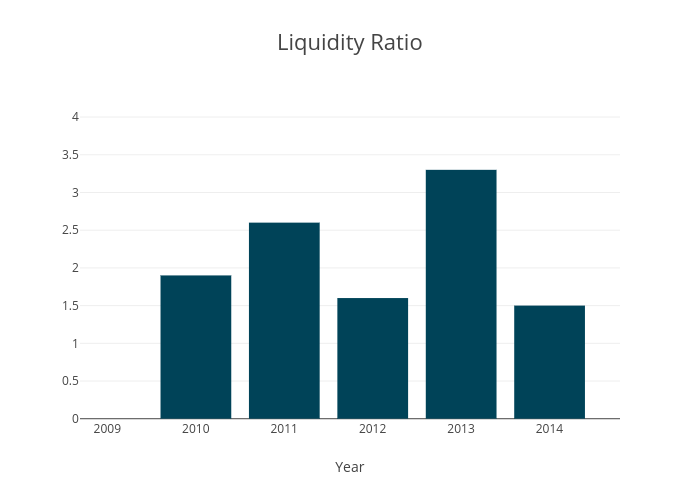

img alt="liquidity ratio" src="https://3. A company should have more whole property than whole liabilities to be solvent and more current assets than present liabilities to be liquid. Although solvency does not relate directly to liquidity, liquidity ratios current a preliminary expectation relating to an organization's solvency. This ratio reveals whether the agency can cowl its brief-term money owed; it is an indication of a agency’s market liquidity and ability to meet creditor’s calls for. For a healthy business, a present ratio will usually fall between 1.5 and three. If the current ratio is just too excessive, the corporate could also be inefficiently using its present belongings or its quick-term financing facilities. The worth of inventory is also thought of related asset for calculations of liquidity ratios by some analysts. The present ratio, also called the working capital ratio, measures the business’ ability to pay off its brief-term debt obligations with its current assets. Liquidity ratios greater than 1 indicate that the company is in good financial health and it is less likely fall into financial difficulties. Most common examples of liquidity ratios include current ratio, acid test ratio (also known as quick ratio), cash ratio and working capital ratio. img alt="liquidity ratio" src="http://cdn. Leverage ratios focus more on lengthy-term debt, while liquidity ratios cope with quick-term debt. The three major leverage ratios embody the debt, debt-to-equity and interest-protection ratios. Current ratio indicates a company's capability to meet short-time period debt obligations. The idea of money cycle can be necessary for better understanding of liquidity ratios. A firm’s money is usually tied up in the completed goods, the raw materials, and trade debtors. It isn't until the inventory is offered, gross sales invoices raised, and the debtors’ make funds that the company receives money. The money tied up within the money cycle is known as working capital, and liquidity ratios attempt to measure the balance between current belongings and present liabilities. If the value of a current ratio is taken into account excessive, then the company will not be effectively using its present property, specifically money, or its brief-time period financing options. A high current ratio is usually a sign of problems in managing working capital (what is leftover of current assets after deducting present liabilities). While a low present ratio could point out an issue in assembly present obligations, it is not indicative of a major problem. If an organization has good long-time period income streams, it might be able to borrow against these prospects to meet present obligations. A stability sheet is offered for instance for calculating an organization's financial position by measuring its liquidity, which is the ability to pay its current debt with its present property. Cash ratio(also calledcash asset ratio)isthe ratio of a company's cash and money equal belongings to its whole liabilities. The cash ratio determines the flexibility of an organization to right away pay for his or her current liabilities with liquid assets. Higher-leverage ratios show a company is in a better position to fulfill its debt obligations than a lower ratio. In contrast to liquidity ratios, solvency ratios measure an organization's capacity to satisfy its complete monetary obligations. Solvency pertains to a company's overall capability to pay debt obligations and continue enterprise operations, while liquidity focuses extra on present financial accounts. The quick-run represents a time interval of 12 months and the long-run means a time interval of greater than 1 year. Liquidity is related to the quick-run whereas solvency is relevant in the lengthy-run. Almost all liquidity ratios measure relationships between present property and current liabilities. A company can improve its liquidity ratios by raising the worth of its current assets, decreasing current liabilities by paying off debt, or negotiating delayed payments to creditors. The current ratio is a financial ratio that measures whether or not or not a agency has sufficient resources to pay its money owed over the subsequent 12 months. Liquidity ratios are an essential class of monetary metrics used to determine a debtor's capacity to repay present debt obligations without elevating external capital. Liquidity ratios are financial ratios which measure a company’s capacity to pay off its quick-term monetary obligations i.e. current liabilities utilizing its present assets. Most frequent liquidity ratios are current ratio, quick ratio, cash ratio and cash conversion cycle. A excessive present ratio, fast ratio and money ratio and a low money conversion cycle shows good liquidity position. A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. A current ratio below 1 means that the company doesn't have enough liquid assets to cover its short-term liabilities. The debt ratio shows the connection between a company’s money owed and its belongings. If a company experiences a debt ratio higher than one, the corporate has extra debt than property on its steadiness sheet. Thecurrent ratiois a popular metric used throughout the business to evaluate an organization's quick-termliquidity with respect to its obtainable property and pending liabilities. In different words, it reflects a company's capacity to generate sufficient cash to repay all its debts as soon as they become due. It's used globally as a approach to measure the overallfinancial health of a company. There are three common types of liquidity ratio: the current ratio, the quick ratio and the operating cash flow ratio. The current ratio is used to determine an organisation or individual's ability to pay their short and long-term debts. It compares their total assets (both liquid and fixed) to their total debt. It is calculated by dividing the present belongings by the current liabilities. A ratio higher than 1 exhibits that the company expects to receive more cash inflows from liquidation of current belongings than it expects to pay on account of present liabilities in subsequent 12 months. The balance sheets usually show present belongings and current liabilities separately from non-current assets and non-present liabilities. In analyzing a company’s financial position, we are concerned with two timelines, the quick-run and the long-run. Along with other monetary ratios, the current ratio is used to attempt to consider the general financial condition of a company or different organization. Financial ratios could also be utilized by managers within a agency, by present and potential shareholders (house owners) of a agency, and by a firm’s creditors. Financial analysts use financial ratios to check the strengths and weaknesses in varied firms. Ratios may be expressed as a decimal worth, such as zero.10, or given as an equivalent p.c worth, similar to 10%. Cash ratio is a refinement of fast ratio and signifies the extent to which readily available funds can pay off current liabilities. Potential creditors use this ratio as a measure of a company's liquidity and the way simply it could service debt and canopy quick-term liabilities. Most common examples of liquidity ratios embody present ratio, acid check ratio (also known as quick ratio), cash ratio and dealing capital ratio. Some analysts think about solely the cash and money equivalents as related belongings as a result of they're most probably for use to fulfill brief time period liabilities in an emergency. Some analysts contemplate the debtors and trade receivables as related property along with cash and money equivalents. Some kinds of companies usually operate with a current ratio of less than one. For example, when stock turns over more quickly than accounts payable turns into due, the current ratio shall be less than one. Liquidity ratios gauge an organization's capability to pay off its short-time period debt obligations and convert its property to cash. It is essential that a company has the flexibility to convert its quick-time period belongings into cash so it can meet its quick-time period debt obligations. A healthy liquidity ratio can also be essential when the corporate desires to buy further property. The solvency ratio contains monetary obligations in each the long and quick time period, whereas liquidity ratios focus more on a company's short-term debt obligations and current assets. The current ratio indicates an organization's capability to fulfill brief-time period debt obligations. The present ratio measures whether or not a firm has enough assets to pay its money owed over the subsequent 12 months.Quick Ratio

What are the four liquidity ratios?

Liquidity ratios: What is it?

What is a good liquidity ratio?

Quick ratio

Current Ratio

What are the types of liquidity ratios?