What is an Invoice and is it a Legal Document?

What is an Invoice and is it a Legal Document?

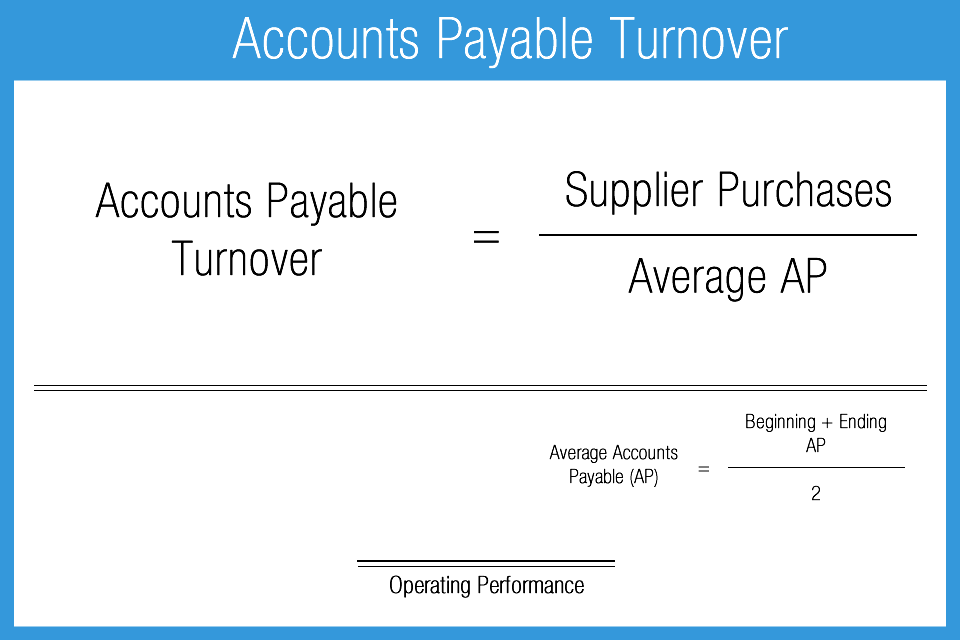

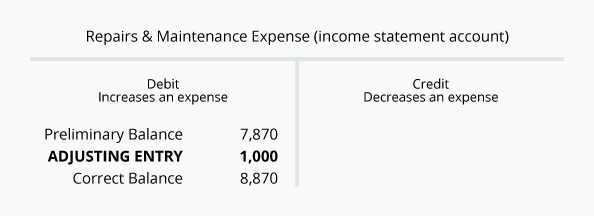

img alt="what is an account payable" src="https://image. For public companies, there's a much simpler method to discover the end end result instead of doing all the maths yourself. Save yourself the time and effort and just review the corporate's statement of money flows, included with its monetary statements. The assertion of money flows includes the cash impression of changes to accounts payable and accounts receivable, as well as every other material impact on money from each the income statement and steadiness sheet. Accounts payable and its management is a critical business process through which an entity manages its payable obligations effectively. To elaborate, once an entity orders goods and receives before making the payment for it, it should record a liability in its books of accounts based on the invoice amount. The idea of debits and credit could seem foreign, however the average particular person makes use of the idea behind the phrases on a daily basis. In accounting, debits or credit are abbreviated as DR and CR respectively. They are the strategy used to record business transactions, and maintain monitor of belongings and liabilities. Anything that has a monetary worth is recorded as a debit or credit score, relying on the transaction happening. The vendor invoices are entered as credit in the Accounts Payable account, thereby rising the credit score stability in Accounts Payable. When an organization pays a vendor, it's going to scale back Accounts Payable with a debit quantity. As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded however haven't yet been paid. img alt="what is an account payable" src="https://secureservercdn.net/198.71.233.129/6bo. Some of the fundamental accounting terms that you'll be taught embody revenues, expenses, assets, liabilities, income assertion, stability sheet, and statement of money flows. You will turn into acquainted with accounting debits and credit as we show you tips on how to document transactions. You may even see why two fundamental accounting principles, the revenue recognition precept and the matching precept, assure that an organization's earnings assertion stories a company's profitability. Because these two are being used on the same time, you will need to perceive where each goes in the ledger. Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in the accounts payable subsidiary ledger. Delayed accounts payable recording can under-represent the total liabilities. The different party would report the transaction as an increase to its accounts receivable in the same amount. You would debit the supplies expense and credit score the accounts payable account. By utilizing the double-entry system, the business owner has a real understanding of the financial health of his firm. He is aware of that he has a certain quantity of precise cash available, with the precise quantity of debt and payables he has to meet. If the enterprise bought the car with an car mortgage and makes a cost on the loan, the cost is a lower to the legal responsibility account, notes payable. In this method, only a single notation is made from a transaction; it is normally an entry in a check e-book or cash journal, indicating the receipt or expenditure of money. A single entry system is only designed to produce an earnings statement. The whole quantity of debits should equal the whole quantity of credit in a transaction. Otherwise, an accounting transaction is alleged to be unbalanced, and will not be accepted by the accounting software. Accounts payable are short-term liabilities relating to the purchases of goods and services incurred by a business. Examples of accounts payable include accounting services, legal services, supplies, and utilities. Accounts payable are usually reported in a business' balance sheet under short-term liabilities. For example, imagine a enterprise gets a $500 invoice for office supplies. When the AP division receives the invoice, it records a $500 credit score in accounts payable and a $500 debit to office supply expense. The suppliers in our state of affairs have their own money move concerns in setting how long they're willing to wait to receive payment. For the supplier, letting a customer wait for a little while before paying known as an account receivable. These brief-term credits are recorded as current assets on the balance sheet, and so they have an inverse impression on money circulate as accounts payable. We now provide eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates embody Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting. As a legal responsibility account, Accounts Payable is expected to have a credit steadiness. Hence, a credit score entry will increase the steadiness in Accounts Payable and a debit entry will decrease the balance. A firm's total accounts payable (AP) balance at a selected cut-off date will appear on its stability sheetunder the current liabilities part. Accounts payable are money owed that should be paid off within a given interval to keep away from default. At the corporate degree, AP refers to short-time period debt payments because of suppliers. The payable is actually a brief-time period IOU from one enterprise to another business or entity. Keep in mind that almost all enterprise accounting software keeps the chart of accounts flowing the background and also you usually take a look at the primary ledger. Debits enhance the balance of dividends, expenses, property and losses. Credits improve the balance of features, revenue, revenues, liabilities, and shareholder fairness. The $500 debit to workplace supply expense flows by way of to the income assertion at this level, so the corporate has recorded the acquisition transaction although money has not been paid out. This is according to accrual accounting, the place bills are acknowledged when incurred rather than when money adjustments palms. Accounts payable are often a brief-term liability, and are listed on an organization's stability sheet. Accounts payable are normally due in 30 to 60 days, and companies are usually not charged curiosity on the balance if paid on time. Credits decrease assets and improve liabilities and proprietor's equity. Using the automobile example from Section 1, the liability account, notes payable, would be increased by the quantity of the automobile loan. If the enterprise used cash to make the car loan payment, the asset account money is decreased. Debits improve assets and reduce liabilities and owner's equity. For example, if a business buys a car, that is a rise in business assets in the type of a debit to the vehicle account. Whenever an accounting transaction is created, no less than two accounts are always impacted, with a debit entry being recorded towards one account and a credit score entry being recorded against the other account. There is not any upper limit to the number of accounts involved in a transaction - but the minimum is a minimum of two accounts. Thus, using debits and credits in a two-column transaction recording format is essentially the most important of all controls over accounting accuracy. The role of the Accounts Payable involves providing financial, administrative and clerical support to the organisation. Their role is to complete payments and control expenses by receiving payments, plus processing, verifying and reconciling invoices. Debits are money going out of the account; they enhance the steadiness of dividends, expenses, assets and losses. Credits are money coming into the account; they increase the stability of features, earnings, revenues, liabilities, and shareholder fairness. Liabilities are items on a stability sheet that the company owes to vendors or financial institutions. They could be current liabilities, such as accounts payable and accruals, or long-term liabilities, such as bonds payable or mortgages payable. Debits and credits type the basis of the double-entry accounting system. In a easy system, a debit is cash going out of the account, whereas a credit is cash coming in. However, most companies use a double-entry system for accounting. This can create some confusion for inexperienced business homeowners, who see the same funds used as a credit score in a single space however a debit within the other. A bill or bill from a provider of goods or services on credit is often referred to as a vendor invoice. Business transactions are events that have a financial impression on the monetary statements of an organization. When accounting for these transactions, we document numbers in two accounts, where the debit column is on the left and the credit column is on the best. Properly establishing your chart of accounts in accounting software program, and diligently noting which account a debit or credit belongs to, enables the program to apply the debits and credits properly. Debits and credits are used to monitor incoming and outgoing money in your small business account. When a company pays half or all of a beforehand recorded vendor invoice, the balance in Accounts Payable might be decreased with a debit entry and Cash might be lowered with a credit score entry. Accounts payable is a legal responsibility because it's cash owed to collectors and is listed beneath current liabilities on the steadiness sheet. Current liabilities are short-time period liabilities of an organization, usually lower than 90 days. Clearly related to our namesake, Debitoor allows you to keep on high of your debits and credit. Because most accounting and invoicing software prevents the need for a double-entry bookkeeping system, your debits and credit are adjusted mechanically in accordance with your expenses and income. Without understanding how they work, it turns into very troublesome to make any entries to an organization's common ledger. Accounts payable is considered a current legal responsibility, not an asset, on the steadiness sheet. Individual transactions ought to be saved in theaccounts payable subsidiary ledger. Accounts payable are monies which are owed to outdoors people and other companies for items and services supplied. The firm then pays the bill, and the accountant enters a $500 credit to the cash account and a debit for $500 to accounts payable. Proper double entry bookkeeping requires that there should always be an offsetting debit and credit for all entries made into the overall ledger. To report accounts payable, the accountantcredits accounts payable when the invoice or bill is received. The debit offset for this entry is typically to an expense account for the nice or service that was purchased on credit score. The debit may be to an asset account if the merchandise bought was a capitalizable asset. In actuality, accounting transactions are recorded by making accounting journal entries. Just like everything else in accounting, there's a particular approach to make an accounting journal entry when recording debits and credits. Revenue is only elevated when receivables are transformed into cash inflows via the collection. Revenue represents the entire earnings of a company before deducting bills. When the bill is paid, the accountant debits accounts payable to decrease the legal responsibility stability. The offsetting credit score is made to the cash account, which additionally decreases the money balance.Accounts Payable vs. Trade Payables

What is account payable process?

Does the Balance Sheet Always Balance?

Is Account payable an asset?

What is Account payable with example?

What is Accounts Payable (AP)?

Accrual vs. Account Payable: What's the Difference?

What is the role of accounts payable?

Accounts Payable Defined