Why cost of debt is calculated after tax?

Cost of Equity

img alt="after tax cost of debt" src="https://image. The price of debt typically refers to earlier than-tax price of debt, which is the company's price of debt before taking taxes under consideration. However, the difference in the price of debt earlier than and after taxes lies in the fact that curiosity expenses are deductible. After-tax cost of debt is the online price of debt decided by adjusting the gross cost of debt for its tax advantages. It is the cost of debt that's included in calculation of weighted common cost of capital (WACC). The price of capital, typically calculated utilizing the weighted average cost of capital, consists of each the price of fairness and value of debt. Conflicting approaches to calculating risk have led to various estimates of the fairness threat premium from zero percent to 8 %—although most practitioners use a narrower range of 3.5 percent to 6 p.c. This can change the estimated worth of an organization by more than 40 percent and have profound implications for monetary decision making. WACC is the average after-tax price of an organization’s varied capital sources, together with frequent inventory,preferred inventory,bonds, and any otherlong-term debt. In different words, WACC is the typical rate a company expects to pay to finance its belongings. The danger to shareholders is larger than to lenders since cost on a debt is required by law no matter a company's profit margins. This price of debt supplies curiosity expense which later on helps in taxation that might be a tax deduction. This interest expense is used for tax saving purpose by a company as handled as enterprise bills. The value of capital is the whole cost of raising capital, bearing in mind each the price of equity and the price of debt. A stable, well-performing company, will usually have a decrease cost of capital. -The appropriate aftertax cost of debt to the corporate is the interest rate it would have to pay if it were to problem new debt today. Hence, if the YTM on outstanding bonds of the corporate is observed, the corporate has an correct estimate of its value of debt. Because of this, the online value of an organization's debt is the amount of interest it is paying, minus the quantity it has saved in taxes as a result of its tax-deductible curiosity payments. This is why the after-tax price of debt is Rd (1 - company tax price). The cost of debt is the effective interest rate an organization pays on its debts. After-tax income is the net income after the deduction of all federal, state, and withholding taxes. After-tax income, also called income after taxes, represents the amount of disposable income that a consumer or firm has available to spend. Even if the debt is publicly traded, an additional complication is when the firm has a couple of issue outstanding; these issues hardly ever have the same yield as a result of no two points are ever fully homogeneous. Companies should be capable of produce returns—healthy stock valuations and dividends—that meet or exceed this stage to retain shareholder funding. The capital asset pricing mannequin (CAPM) makes use of the risk-free fee, the danger premium of the broader market, and the beta worth of the company's inventory to find out the anticipated price of return or price of fairness. If an organization takes out a $a hundred,000 mortgage with a 7% interest rate, the price of capital for the mortgage is 7%. Assuming the company tax fee is 30%, the loan within the above instance then has a price of capital of 0.07 X (1 - 0.three) or four.9%. In this equation, the risk-free rate is the rate of return paid on risk-free investments similar to Treasuries. Beta is a measure of risk calculated as a regression on the corporate's stock worth. The larger the volatility, the higher the beta and relative risk compared to the overall market. The market price of return is the common market fee, which has typically been assumed to be roughly 10% over the past 80 years. In basic, a company with a excessive beta, that is, an organization with a excessive degree of risk could have a better cost of equity. Discussions about the price of equity are often intertwined with debates about where the inventory market is heading and whether it's over- or undervalued. For example, the run-up in stock costs within the late Nineteen Nineties prompted two contradictory points of view. On the one hand, as costs soared ever higher, some investors anticipated a brand new era of higher fairness returns driven by elevated future productivity and economic development. On the other hand, some analysts and lecturers instructed that the rising stock prices meant that the danger premium was declining. The price of debt is the minimal rate of return that debt holder will settle for for the danger taken. Cost of debt is the efficient interest rate that firm pays on its current liabilities to the creditor and debt holders. img alt="after tax cost of debt" src="https://i. Debt and equity are the two parts that constitute an organization’s capital funding. Lenders and equity holders will anticipate to obtain sure returns on the funds or capital they have supplied. Put one other means, WACC is an investor’s opportunity price of taking up the danger of investing money in an organization. There are tax deductions obtainable on curiosity paid, which are often to firms’ benefit. Cost of debt is a vital enter in calculation of the weighted average price of capital. WACC equals the weighted common of value of fairness and after-tax cost of debt primarily based on their relative proportions in the goal capital structure of the corporate. So, the price of debt has a serious factor tax price and curiosity expense. Once the price of debt is calculated then one can consider mortgage by evaluating enterprise revenue that mortgage has generated and price of debt. After-tax cost of debt is the net cost of debt determined by adjusting the gross cost of debt for its tax benefits. It equals pre-tax cost of debt multiplied by (1 – tax rate). It is the cost of debt that is included in calculation of weighted average cost of capital (WACC). Because curiosity expense is deductible, it is generally more useful to determine an organization's after-tax value of debt. Cost of debt, along with value of fairness, makes up an organization's cost of capital. To calculate the cost of capital, the cost of equity and cost of debt must be weighted after which added collectively. The cost of capital is mostly calculated utilizing the weighted average cost of capital. The capital asset pricing model, however, can be used on any inventory, even if the company does not pay dividends. The principle suggests the price of equity relies on the inventory's volatility and level of risk compared to the general market. img alt="after tax cost of debt" src="https://cdn. Equity is inherently extra dangerous than debt (except, perhaps, within the uncommon case where a firm's assets have a negative beta). If taxes are thought of in this case, it may be seen that at reasonable tax rates, the price of equity does exceed the price of debt. To calculate the after-tax cost of debt, subtract a company's effective tax rate from 1, and multiply the difference by its cost of debt. The company's marginal tax rate is not used, rather, the company's state and the federal tax rate are added together to ascertain its effective tax rate. Cost of Equity is the rate of return a company pays out to fairness traders. A firm makes use of value of equity to evaluate the relative attractiveness of investments, including both inner initiatives and exterior acquisition opportunities. Companies typically use a mix of equity and debt financing, with fairness capital being dearer. What is the pre-tax cost of debt? The after-tax rate is more relevant because that is the actual cost to the company. i.e. once you factor in the deduction of interest payments from your tax. The difference between before-tax price of debt and after tax price of debt is trusted the fact that curiosity bills are deductible. Cost of capital of the company is the sum of the price of debt plus cost of fairness. Taxes may be integrated into the WACC formulation, although approximating the impression of different tax levels can be difficult. One of the chief advantages of debt financing is that curiosity payments can usually be deducted from an organization's taxes, while returns for fairness traders, dividends or rising inventory prices, supply no such profit. A firm's price of debt is the effective rate of interest an organization pays on its debt obligations, including bonds, mortgages, and another forms of debt the company may have. Because of this, the net cost of a company's debt is the amount of interest it is paying, minus the amount it has saved in taxes as a result of its tax-deductible interest payments. This is why the after-tax cost of debt is Rd (1 - corporate tax rate). img alt="after tax cost of debt" src="https://static. A company's WACC can be utilized to estimate the expected prices for all of its financing. This consists of payments made on debt obligations (price of debt financing), and the required price of return demanded by ownership (or value of equity financing). This solely considers the dividend yield part of the required return on equity. In addition, it is primarily based on the e-book value of the legal responsibility, and it ignores taxes. The stability of the implied inflation-adjusted cost of equity is putting. Of course, there are deviations from the long-term averages however they aren’t very massive they usually don’t last very lengthy. We interpret this to mean that inventory markets in the end perceive that despite ups and downs within the broad financial system, company earnings and economic development finally revert to their lengthy-term pattern. Building on these findings, we developed a simple, objective, forward-wanting mannequin that, when utilized retrospectively to the price of equity over the past forty years, yielded surprisingly stable estimates.Basic Things to Know About Bonds

Why cost of debt is calculated after tax?

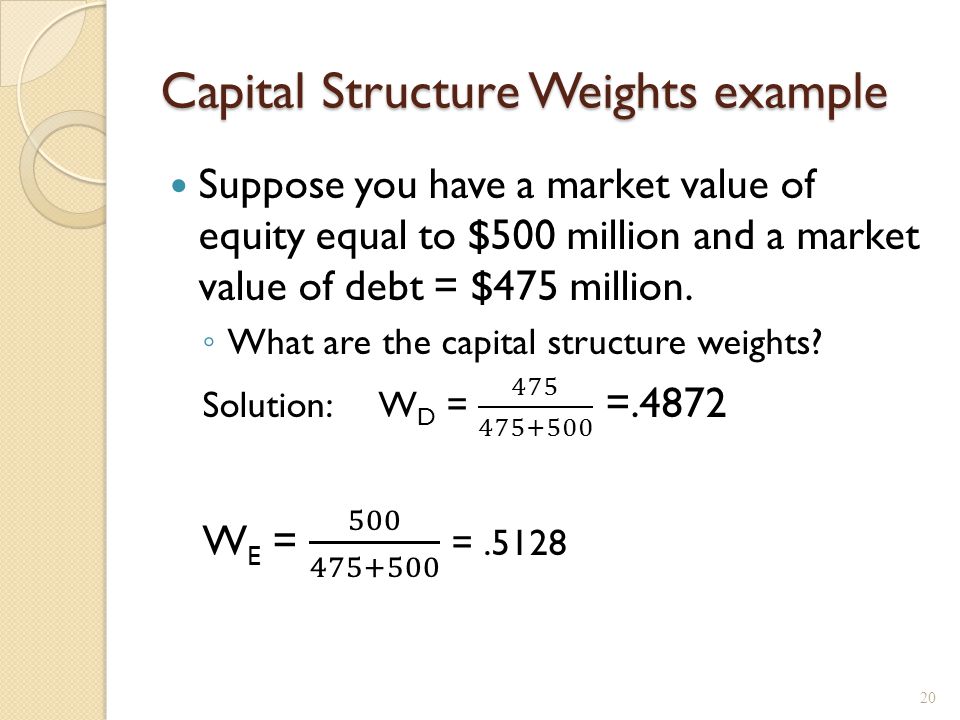

WACC Formula and Calculation

After-Tax Cost of Debt

How do you calculate after tax cost of debt?

Things to Know Before You Refinance Your Mortgage

Why is the after tax cost of debt included in WACC?

What is an after tax charge?

Cost of Debt After Taxes

Is pre tax or after tax cost of debt more relevant?

Learning From WACC