Will I go into debt if I use forex leverage and make a poor commerce?

Will I go into debt if I use forex leverage and make a poor commerce?

Businesses that require giant capital expenditures (CapEx), such as utility and manufacturing firms, may have to safe extra loans than other corporations. It's a good suggestion to measure a agency's leverage ratios against previous efficiency and with companies working in the same trade to raised perceive the information. Fedex has a D/E ratio of 1.78, so there's trigger for concern the place UPS is worried. However, most analysts contemplate that UPS earns sufficient cash to cover its debts.

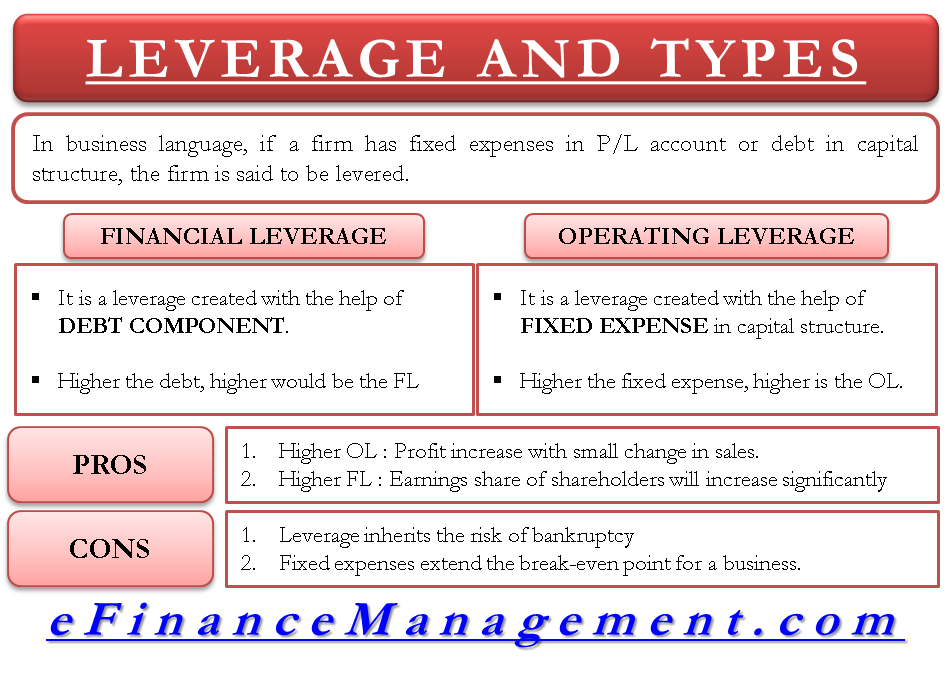

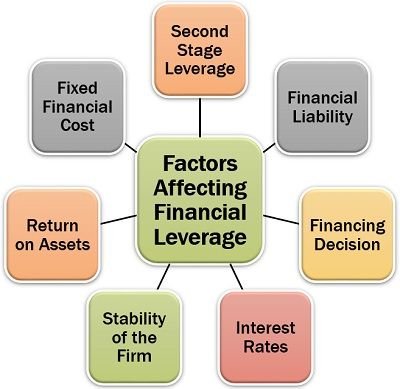

img alt="what is financial leverage" src="https://1. You will not owe any money, what you make on leverage is yours, which is the point. Think of it like getting a mortgage, that is leverage, if your house rises 50% in value and you use the equity to pay off a greater portion of your mortgage, you actually cleared some of your debt. The markets are no different. However, if an organization is financially over-leveraged a decrease in return on equity could occur. Financial over-leveraging means incurring an enormous debt by borrowing funds at a lower price of interest and utilizing the excess funds in high risk investments. If the risk of the investment outweighs the anticipated return, the worth of an organization’s fairness could decrease as stockholders believe it to be too dangerous. Thedebt-to-capital ratiois a measurement of an organization's financial leverage. Financial Leverage. Financial leverage is the ratio of equity and financial debt of a company. It is an important element of a firm's financial policy. Because earning on borrowing is higher than interest payable on debt, the company's total earnings will increase, ultimately boosting the earnings of stockholders. However, in finance the overall follow is to borrow cash to buy an asset with a better return than the interest on the debt. Instead of spending cash it doesn’t have, a company actually creates value. Typically, a D/E ratio higher than 2.0 indicates a risky state of affairs for an investor; however, this yardstick can vary by trade. Assets financed by debt cannot be written down because the bank's bondholders and depositors are owed these funds. A leverage ratio is any certainly one of a number of financial measurements that take a look at how a lot capital comes within the type of debt (loans) or assesses the power of an organization to satisfy its monetary obligations. Companies can merge both monetary leverage and working leverage, a mixture business consultants name mixed leverage. Financial leverage calibrates whole firm monetary risks while operating leverage measures business operating risk. It will be the case that the lowered return on fairness due to negative leverage is still acceptable to the investor, even with the increased risk of default. Thus, if there isn't any other different for financing the transaction, the investor should still go forward and use leverage to amass the property. At a perfect degree of financial leverage, an organization’s return on fairness will increase as a result of the use of leverage increases inventory volatility, increasing its level of threat which in flip increases returns. As the proportion of debt to property increases, so too does the quantity of economic leverage. Financial leverage is favorable when the uses to which debt may be put generate returns larger than the interest expense related to the debt. Many corporations use monetary leverage quite than acquiring more fairness capital, which might scale back the earnings per share of existing shareholders. Through stability sheet evaluation, buyers can examine the debt and equity on the books of varied firms and might invest in corporations that put leverage to work on behalf of their companies. Statistics corresponding to return on equity, debt to equity and return on capital employed help buyers decide how companies deploy capital and the way a lot of that capital corporations have borrowed. Using borrowed capital to finance property investments could be a very helpful strategy for investors pursuing double-digit returns, so long as such use of funds will enhance the investor’s return on equity (optimistic leverage). Such a technique might assist increase a beneath 10% unleveraged return to a double-digit return on fairness. However, if the uncertainty with respect to the property’s future net working income is excessive, then the investor is suggested to keep away from using leverage or restrict its use to very low levels, so as to restrict the risk of adverse leverage. In any case, no ultimate choice with respect to the use of borrowed funds must be made without estimating the anticipated leveraged return of the property by way of a detailed evaluation of its expected money flows. Negative leverage doesn't necessarily mean that borrowed funds should not be used to finance a specific actual property investment. The impression of leverage is measured by subtracting the economic profitability ratio from the return on equity ratio after deducting corporate tax. Because stockholders' return on equity of capital is normally higher than financial return ratio, leverage plays an necessary position in helping to achieve buyers' expectations regarding return on equity. For this cause, financial leverage is measured primarily based on how extra debt affects the earnings per share of frequent stockholders. However, it is adverse if the company's earnings are lower than the cost of securing the funds. Debt financing is an important supply of capital to help the restricted investment of stockholders. Active investors use a number of completely different leverage ratios to get a broad sense of how sustainable a firm’s borrowing practices are. In isolation, every of these fundamental calculations provides a somewhat restricted view of the corporate’s financial power. But when used collectively, a extra complete image emerges—one which helps weed out wholesome firms from those that are dangerously in debt. The dangers of unfavorable leverage do not come solely from a doubtlessly high mortgage rate. They come also from potential reductions in the Net Operating Income (NOI) and value of the property over its holding interval. Investors use leverage to considerably enhance the returns that may be provided on an investment. They lever their investments by utilizing varied devices that embody options, futures and margin accounts. In other phrases, as a substitute of issuing stock to raise capital, firms can use debt financing to invest in enterprise operations in an try to extend shareholder worth. Due to monetary leverage’s effect on solvency, an organization that borrows an excessive amount of money would possibly face bankruptcy throughout a business downturn, whereas a less-levered firm might keep away from bankruptcy because of larger liquidity. There is a well-liked prejudice against leverage rooted in the remark of people that borrow a lot of money for private consumption – for instance, heavy use of bank cards. img alt="what is financial leverage" src="https://image. The time period unfavorable leverage refers back to the situation in which using the borrowed funds reduces the general return on the investor’s fairness capital relative to the unleveraged return. The unleveraged return is the return and more specifically the inner rate of return (IRR) that a property funding would obtain with out the usage of borrowed funds. The primary cause of negative leverage is the high cost of the loan relative to the money move and the return generated by the property. Notice that the periodic value of a loan is a function of the rate of interest, its length and the loan amount. Financial Leverage Definition Financial leverage is the use of debt to buy more assets. Leverage is employed to increase the return on equity. However, an excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt. Significant reduction of NOI could drive the investor to make use of his/her own funds to pay a portion or the entire debt service. Such circumstances might lead to unfavorable leverage, which is able to cut back the investor’s total return and will lead to losses. Leverage = total company debt/shareholder's equity. Count up the company's total shareholder equity (i.e., multiplying the number of outstanding company shares by the company's stock price.) Divide the total debt by total equity. The resulting figure is a company's financial leverage ratio. It is among the more meaningful debt ratios as a result of it focuses on the connection of debt liabilities as a part of an organization's whole capital base. This kind of leverage is essentially the most pervasive utilized by corporations and investors - it represents the usage of debt to place an organization in a more advantageous monetary position. The more debt an organization takes on, nevertheless, the extra leveraged that company turns into. That's primarily due to the higher curiosity payments owed to the lender by the borrowing business. Yet if the leverage results in a higher investment return, in comparison with the speed of curiosity a company is paying on a mortgage, the extent of leverage is reduced. If the alternative happens, and curiosity funds are higher than the return on investment, the corporate might possibly be put into a deadly threat state of affairs - and may even face bankruptcy. Leverage outcomes from utilizing borrowed capital as a funding supply when investing to broaden the agency's asset base and generate returns on threat capital. Leverage is an funding strategy of using borrowed cash—particularly, using various monetary devices or borrowed capital—to increase the potential return of an investment. Leverage can even refer to the amount of debt a agency uses to finance belongings. When one refers to a company, property or investment as "highly leveraged," it means that merchandise has more debt than fairness. This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be. Since interest is usually a fixed expense, leverage magnifies returns and EPS. This is good when operating income is rising, but it can be a problem when operating income is under pressure. When investments underperform, hedge fund managers don't incur losses. This is the reason that hedge funds are restricted to accredited traders and bigger financial establishments. The diploma of monetary leverage is helpful for modeling what may occur to the net earnings of a enterprise sooner or later, primarily based on changes in its operating revenue, rates of interest, and/or quantity of debt burden. In particular, when debt is added to a business, this introduces curiosity expense, which is a hard and fast value. Since interest price is a hard and fast cost, it increases the breakeven point at which a business begins to turn a profit. To compensate for this, three separate regulatory bodies, the FDIC, theFederal Reserve, and theComptroller of the Currency, review and prohibit the leverage ratios for American banks. This means they restrict how much money a financial institution can lend relative to how much capital the bank devotes to its personal belongings. The level of capital is necessary as a result of banks can "write down" the capital portion of their assets if complete asset values drop. In the worst case, during which the investor can not make the required debt payments, it may outcome within the loss of possession and the investor’s fairness capital that was utilized in combination with the borrowed funds to amass the property. An particularly important leverage downside exists with intrinsically more risky investments, corresponding to hedge funds. img alt="what is financial leverage" src="https://3. It is usually used to boost the returns on equity capital of an organization, particularly when the business is unable to extend its operating effectivity and returns on total investment. Because incomes on borrowing is higher than interest payable on debt, the company's complete earnings will improve, in the end boosting the earnings of stockholders. The financial leverage method is measured because the ratio of complete debt to total belongings. To correctly consider these statistics, you will need to keep in mind that leverage comes in a number of varieties, together with operating, monetary, and combined leverage. While carrying a modest quantity of debt is sort of common, extremely leveraged companies face critical dangers. Large debt payments eat away at income and, in severe cases, put the corporate in jeopardy of default. Leverage is neither inherently good nor bad. Leverage amplifies the good or bad effects of the income generation and productivity of the assets in which we invest. Analyze the potential changes in the costs of leverage of your investments, in particular an eventual increase in interest rates. Financing property funding acquisitions with borrowed funds could be very engaging because it reduces considerably the investor’s own capital contribution. However, funding most of or the whole buy worth (that was occurring a lot before the worldwide monetary disaster) with borrowed cash entails risks.Operating Leverage and Financial Leverage

Do you have to pay back leverage?

What is financial leverage and why is it important?

Financial leverage

Leverage

What is meant by financial leverage?

Starbucks' 6 Key Financial Ratios (SBUX)

Importance of Leverage

What is financial leverage ratio formula?

Is higher or lower financial leverage better?

Is leverage good or bad?

Example of Leverage