$ 0.007 6.70%

DMarket (DMT) Rank 3596

DMarket is a marketplace based on blockchain and smart contracts to enable one-click sale, exchange or evaluation of every virtual item between all games on any platform. DMarket tokens will be the only platform currency supplying item prices for every trade, exchange, fee and smart contract.

DMarket wants to create a whole new economic segment. Any kind of collaboration between gamers and games developers on DMarket platform will be regulated by market demand. Therefore, gamers have their own interest in the looting rare items, as well as game developers in creating and maintaining of unique, relevant, and tradable gaming content. Users (players as well as developers) will be able to leverage their own achievements and time spent, either for better gaming experience or for monetary purposes.

DMarket API will be supported by any popular gaming engine (Unreal Engine, Cryengine, Unity 3D, etc.). DMarket API will be available for any games, whether old games (from the 1990s) or new ones. This is caused by the existence of a big community which is still playing old-fashioned games, and have been collecting enormous amount of digital items, which can be converted into real value.

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000DMT |

| Market share | 0% | Total Supply | 0.00000000DMT |

| Proof type | Open | $ 0.0065 | |

| Low | $ 0.0065 | High | $ 0.0070 |

Market trend

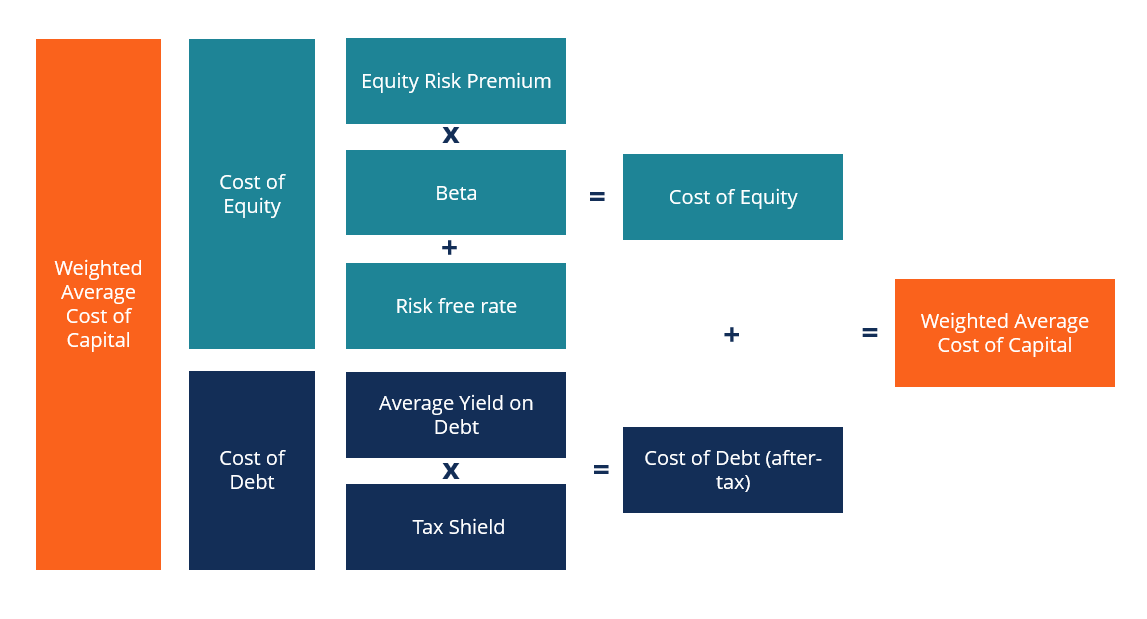

A company's market value of equity can be thought of as the total value of the company decided by investors. The market value of equity can shift significantly throughout a trading day, particularly if there are significant news items like earnings. Large companies tend to be more stable in terms of market value of equity owing to the number and diversity of investors they have. Small, thinly-traded companies can easily see double digit shifts in the market value of equity because of a relatively small number of transactions pushing the stock up or down.

The implicit assumption is that increases in industry concentration lead to increases in price. (The effect of any particular change in concentration could depend on the level of concentration.) A typical starting assumption is that the post-merger share of the merged firm equals the sum of the pre-merger shares of the merging firms. This of course may not be so as, for example, when entry is easy. In such a case, the use of pre-merger market shares in this way may be inappropriate. But let's suppose that we are in an industry where post-merger the share of the merged firm is well predicted by the sum of the pre-merger shares of the merging firms, so that the use of pre-merger market shares is sensible.

The Difference Between Market Value of Equity, Enterprise Value and Book Value

The company tries to introduce those products in the market which can add value to the customer. Market leaders often unveil products which can redefine the customer experience in terms of product quality, longevity, ease of operating that product etc.

In response, McDonald's has altered its marketing strategy to target the millennial generation by advertising fresher, healthier menu options and upscale coffee products such as espressos. According to QSR magazine's 2017 QRS 50, McDonald's is the largest fast-food chain in the U.S. ranked by sales. Targeted advertising and aggressive pricing have enabled McDonald's to capture 17 percent of the fast-food market share in the U.S. as of 2015. Geographic segmentation relies on the notion that groups of consumers in a particular geographic area may have specific product or service needs.

A monopolist of all of the products in a market would raise price profitability above current levels by, say 5%, for some time, say two years, on the assumption that the prices of all the products excluded from the market remain unchanged. These strike me as details that again, if they matter, would cause me to pause about the usefulness of the proxy of market shares and to delve more deeply into the underlying economics as described in the previous section. For example, exclusive territories can provide incentives for firms to engage in the provision of services by giving them the ability to raise price as a result of the elimination of competition. Therefore, the product characteristics (including service) are not being held constant when one compares the price with and without the alleged bad act. The analyst concludes this because the analyst observes a lower price in the absence of the alleged bad act and, therefore, incorrectly reasons that the bad act created additional market power.

Market Order Versus Limit Order

Market value of equity is the same as market capitalization and both are calculated by multiplying the total shares outstanding by the current price per share. Market value of equity represents how much investors think a company is worth today. Investors looking to calculate market value of equity can find the total number of shares outstanding by looking to the equity section of a company's balance sheet. A real-time quote shows actual security prices at that moment in time without a time delay and is imperative in fast markets and high-frequency trades. It’s a different story for stocks with low floats and/or very little average daily volume.

Notice that this type of feedback effect can also arise in one-sided markets, when a firm sells complementary products. The price increase in one product will adversely affect sales of the other, and that effect will temper the profitability of a price increase in the initial product.

It asks what is the critical amount of demand that has to be lost in response to a price rise before the price rise is unprofitable. That is a question about how big the demand elasticity has to be to make a price increase unprofitable. Critical loss can help one describe this critical demand elasticity, but it is not a new analytic tool and has been misused.

Use 'market' in a Sentence

Each level has a profile that can help investors gain insights into the behavior of the company. Small caps are generally young companies in the growth stage of development.

- For example, one could ask whether after the merger prices could be profitably increased above current levels(12) by a significant amount (e.g., 5%) for a significant time (e.g., 2 years).

- Its best use is likely to provide a safe harbor when industry concentration and shares of merging firms are low.

- We can contrast price in that industry to an industry with only one (or a few firms) and ask whether the price in the latter case is above the competitive price, C.

- In 2017, their combined economic output (US$32.6 trillion) was greater than either the European Union ($20.9 trillion) or the United States ($19.4 trillion).

- Together, these two countries are home to 40% of the world's labor force and population.

What is the difference between market research and user research?

To simplify, assume that there are no surrounding competing retail stores that are not in malls. We start out by recognizing that a mall owner puts together a portfolio of stores that complement each other and whose existence he coordinates by lowing the rent of one type of store to stimulate demand (and elevate rent) at another. Suppose that the mall owner charges each store a rent based on its retail sales. Following an approach similar to the Guidelines, we ask which nearby malls must a hypothetical monopolist control in order for it to be profitable for the merged firm to raise the "price" by, say 5%.

Such econometric studies can also shed light on the appropriate market definition. (See, Carlton (2003) and the similar views of Coleman and Scheffman (2003)).

radio button at the top of the screen to configure market codes for distribution to the properties in your cluster. Select the Property radio button to customize centrally distributed market codes for individual properties. Use market codes setup to manage and track the source of property business, and analyze industry statistics and trends.

Why is market research so valuable?

They ran a survey asking key questions to determine who their users were and what problems they were trying to solve with Smallpdf. How you ask this question, and what you want to know, will vary depending on your business model (e.g., business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing). An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ.

Again, these market codes will be linked to a Market Group. In addition, monthly revenue budgets can be entered for each of the market codes. If successful, the rapid growth can also lead to the fifth characteristic which is the higher-than-average return for investors. That's because many of these countries focus on an export-driven strategy. They don't have the demand at home, so they produce lower-cost consumer goods and commodities for developed markets.

Product A is a demand substitute for Product B if a price increase in B causes consumers to substitute to A. Product A is a supply substitute for Product B, if a price increase in B causes firms that produce A to shift their capacity to the production of B. In a merger case, one uses market shares to calculate industry concentration so as to determine the level of industry concentration and the change in industry concentration as a result of the merger.

They are Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Qatar, Peru, Philippines, Poland, Russia, South Africa, South Korea, Taiwan, Thailand, Turkey, and United Arab Emirates. This index tracks the market capitalization of every company listed on the countries' stock markets. It is this quality that makes emerging markets attractive to investors. They must have little debt, a growing labor market, and a government that isn't corrupt.

The presence of these customers constrains the price that these other steel customers can pay for steel. If there is no fixed price contract, then the capacity is attributable to Firm 1. The price to long term customers will be set in the marketplace where the price reflects competition amongst many other steel producers. In this situation, one is in the uncomfortable position of realizing how arbitrary market definition can be in Section 2 cases and how this arbitrariness can lead to errors. Perhaps the best one can say is that one might look at "similar" firms and throw out the antitrust case if there are enough of them-but that is a cop out unless one can define what "similar" means.