$ 0.055 0.00%

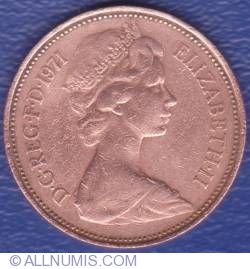

MonetaryUnit (MUE) Rank 2842

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000MUE |

| Market share | 0% | Total Supply | 0.00000000MUE |

| Proof type | PoW | Open | $ 0.06 |

| Low | $ 0.05 | High | $ 0.06 |

Understanding Medically Unlikely Edits

We know that a person could buy more with $1.00 in 1965 than they could today. The monetary unit assumption does not provide for differences in the value of a dollar due to the passage of time. The monetary unit assumption states that a company must record its business transactions in dollars or some other unit of currency. Companies use the dollar since it is stable in value and available everywhere.

Why money is important in our life?

Money is important because it means less financial worries. Money is important because it enables you to give back to your community, to pick the charities and causes you believe in and support them. Money is important because having money means that life is not a constant effort at keeping your head above the water.

Currency Trading

Like the stock exchange, money can be made (or lost) on trading by investors and speculators in the foreign exchange market. Currencies can be traded at spot and foreign exchange options markets. The spot market represents current exchange rates, whereas options are derivatives of exchange rates. A movable or adjustable peg system is a system of fixed exchange rates, but with a provision for the revaluation (usually devaluation) of a currency. For example, between 1994 and 2005, the Chinese yuan renminbi (RMB) was pegged to the United States dollar at RMB 8.2768 to $1.

Another 66 countries either use the U.S. dollar or peg their currencies directly to the dollar. The value of any currency fluctuates constantly in relation to other currencies.

the standard unit of value of the currency of a country, as the dollar in the U.S. and the franc in France. Using the monetary unit assumption, a company records its business transactions in dollars or some other unit of currency. It cannot account for an item that does not have a quantifiable value such as loyal customers, excellent customer service, or a superior management team. The monetary unit assumption does not take into account the impact of inflation, or the rise in prices and the corresponding decrease in the purchasing power of money.

Those fluctuations create the market for currency trading. The foreign exchange market where these trades are conducted is one of the world's largest markets in sheer volume.

What does stand for in money?

The four most relevant types of money are commodity money, fiat money, fiduciary money, and commercial bank money.

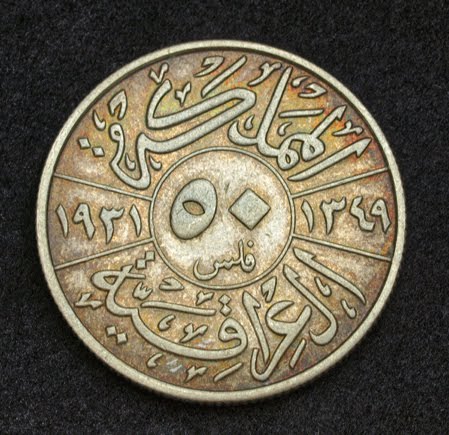

What is one tenth of a penny called?

A mill of this kind is a coin, worth one-tenth of a penny.

It also provides a consistent method of comparing the results of one company with those of another. The first type (indicator value “1”)is a quantity of service limit that applies just to services on a single claim line. So for example, it may limit the number of services reported on a service line to 4 units.

In effect, the U.S. dollar was once again fully backed by gold. As Mike described in his book, Guide to Investing in Gold and Silver, before the Federal Reserve was created, each U.S. Treasury note (paper dollar) was fully backed by gold or silver. When the Federal Reserve Act was passed in 1913, the amount of gold backing each dollar was reduced to just 40% of the face value of existing currency. In effect, this allowed the U.S. government to increase the amount of currency it could create and spend by 60%, enabling deficit spending for World War I and the accompanying increase of the currency supply.

Fiduciary money depends for its value on the confidence that it will be generally accepted as a medium of exchange. Unlike fiat money, it is not declared legal tender by the government, which means people are not required by law to accept it as a means of payment. Instead, the issuer of fiduciary money promises to exchange it back for a commodity or fiat money if requested by the bearer. As long as people are confident that this promise will not be broken, they can use fiduciary money just like regular fiat or commodity money.

If a currency is free-floating, its exchange rate is allowed to vary against that of other currencies and is determined by the market forces of supply and demand. Exchange rates for such currencies are likely to change almost constantly as quoted on financial markets, mainly by banks, around the world.

How Money is Made: Lesson for Kids

That is, bills are pieces of paper rather than coins made of gold, silver, or bronze. The concept of using paper as a currency may have been developed in China as early as 1000 BC, but the acceptance of a piece of paper in return for something of real value took a long time to catch on. Modern currencies are issued on paper in various denominations, with fractional issues in the form of coins. Many countries accept the U.S. dollar for payment, while others peg their currency value directly to the U.S. dollar.

- Unlike commodity money, fiat money is not backed by any physical commodity.

- Fiat currencies only have value because the governments who print them say they do.

- In 1933, gold coins were taken back, and the gold standard was changed, setting the price of a troy ounce to $35.

- It builds on scarce natural resources that act as a medium of exchange, store of value, and unit of account.

Akram, Q. Farooq; Brunvatne, Kari-Mette; Lokshall, Raymond (2003). Uncovered interest rate parity (UIRP) states that an appreciation or depreciation of one currency against another currency might be neutralized by a change in the interest rate differential.

After an intermediate period, imports will be forced down and exports to rise, thus stabilizing the trade balance and bring the currency towards equilibrium. In the retail currency exchange market, different buying and selling rates will be quoted by money dealers. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell that currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way.

Most modern economies are based on a fiat money system. Like purchasing power parity, the balance of payments model focuses largely on tradeable goods and services, ignoring the increasing role of global capital flows. In other words, money is not only chasing goods and services, but to a larger extent, financial assets such as stocks and bonds.

What do the different MUE Adjudication Indicators (MAI) for service lines and service dates mean on the Medically Unlikely Edits (MUE)?

The USD (United States Dollar) is the official currency of the United States of America. The United States dollar, or U.S. dollar, is made up of 100 cents. It is represented by the symbol $ or US$ to differentiate it from other dollar-based currencies. Commodity money is the simplest and, most likely, the oldest type of money.

How many euros is a dollar?

The euro to U.S. dollar conversion tells you how many dollars the euro can buy according to its exchange rate. It compares the euro's value to the dollar's value. The euro was worth $1.11 on August 16, 2019. It meant that one euro could buy 11 cents more in goods and services than one dollar could.

This reserve requirement can be held in the bank vaults as cash, or on deposit with the Federal Reserve Bank. When a person or business wants to take a loan from the bank to buy something, the bank uses the deposits from all of its clients in order to make that loan. Long-term savers are paid interest in exchange for letting the bank use their deposits to make these loans, but money in checking accounts can also be used (which is why some accounts charge no fees if you have a certain minimum balance). However, practically the smallest unit of economic value in monetary terms, will be the smallest unit which value exceeds the transactions costs (the costs of registering or fabricating this unit). Theoretically, through inflation and introduction of new currencies, any monetary unit of value could be endlesly divisible.

As a result, currencies become over-valued or under-valued, leading to excessive trade deficits or surpluses. Paper money came into existence first by banks similar to what today we would call “certificates of deposit”, or CDs. As proof that you deposited some amount of money at a bank, the bank would give you a piece of paper engraved with the bank’s information and the amount you deposited.

Fiat currencies only have value because the governments who print them say they do. Of course, there’s an underlying demand for fiat currency because governments require citizens and companies to pay taxes to them in their official currency. In reality, all currencies in the world today are fiat. If you use MonetaryUnit to buy the things you want, you will save money. No technical knowledge necessary, just find the item you want and pay for it.

the standard unit of CURRENCY that forms the basis of a country's domestic MONEY SUPPLY, e.g. the pound (UK), or dollar (USA). The monetary units of countries are related to each other for international trade and investment purposes through their EXCHANGE RATE values. Thus the real exchange rate is the exchange rate times the relative prices of a market basket of goods in the two countries. This is the exchange rate (expressed as dollars per euro) times the relative price of the two currencies in terms of their ability to purchase units of the market basket (euros per goods unit divided by dollars per goods unit).

Fractional reserve banking describes a process where commercial banks give out loans worth more than the value of the actual currency they hold. At this point just note that in essence, commercial bank money is debt generated by commercial banks that can be exchanged for “real” money or to buy goods and services. Increased demand for a currency can be due to either an increased transaction demand for money or an increased speculative demand for money.

Emerging markets

All trades are in large volumes, with a standard minimum lot of $100,00. Most currency traders are professionals investing for themselves or for institutional clients including banks and large corporations. Commercial bank money can be described as claims against financial institutions that can be used to purchase goods or services. It represents the portion of a currency that is made of debt generated by commercial banks. More specifically, commercial bank money is created through what we call fractional reserve banking.

How is money created?

The smallest unit of the value of a trade is, as mentioned in another answer, the smallest unit of a currency, i.e., cent, penny, paise or whatever. By contrast, the value perceived by a consumer, also known as utility, is conceived as a continuous quantity and represented by a number, such as .