$ 50.133 1.71%

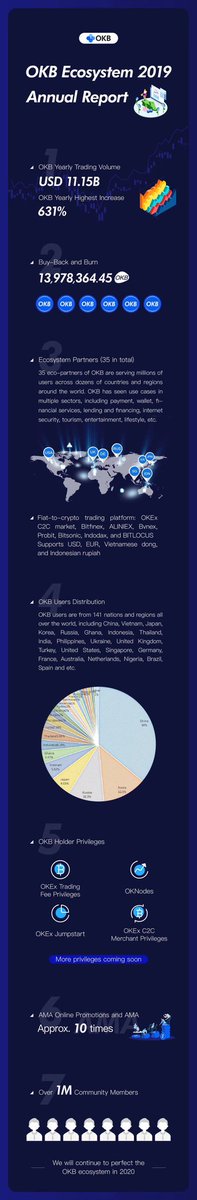

Okex (OKB) Rank 4409

| Mkt.Cap | $ 0.00000000 | Volume 24H | 46,442.00OKB |

| Market share | 0% | Total Supply | 1000 MOKB |

| Proof type | N/A | Open | $ 49.29 |

| Low | $ 49.04 | High | $ 50.50 |

How to transfer Ethereum from OKEx to Bitbank? – CoinCheckup HowTo Guides

This API can retrieve the latest 1,440 entries of data. Charts are returned in groups based on requested granularity.

Batch cancel open orders; a maximum of 10 orders can be canceled at a time. Only one of order_id or client_oid parameters should be passed per request.

ParametersParameters TypesRequiredDescriptionwithdraw_idStringNoWithdrawal IDTransfer currency only, return all withdrawal record of this trading pair. Retrieve market data summary of all contracts of an underlying index for options trading. The 200 entries of market depth data of the order book that return for the first time after subscription will be pushed. Then for every 100 milliseconds, we will snapshot and push entries that have been changed during this time.

Error Code

This is used to set the leverage level for assets in the futures account. When placing an order, the system will deploy the leverage level you set accordingly. Retrieve information from all tokens in the futures account. You are recommended to get the information one token at a time to improve performance.

The bill refers to all the records that results in changing the balance of an account. This API can retrieve data in the last Three months. Spot and margin trading shares the same market data, please visit the spot trading section of the document for details.

This function can help users verify the accuracy of depth data. The maximum buying price and the minimum selling price of the contract.

Retrieve the latest price snapshot, best bid/ask price, and trading volume in the last 24 hours for all trading pairs. This provides snapshots of market data and is publicly accessible without account authentication.

If size is larger than '200', only 200 results will be returned. ParameterTypeRequiredDescriptionunderlyingStringYesThe underlying index that the contract is based upon, e.g. BTC-USD.order_idStringNoEither client_oid or order_id must be present.

Get Deposit History of a Currency

1.OKEx uses cursor pagination for all REST requests which return arrays. Cursor pagination allows for fetching results before and after the current page of results and is well suited for realtime data. Endpoints like /trades, /fills, /orders, return the latest items by default.

Retrieve market data, account info, order operations, order inquires, and bills of perpetual swap trading. Get the recent 300 transactions of all contracts. The entire book will be returned in one request. The parameters for highest price, lowest price and trading volume are all computed based on the data in the last 24 hours.

The rules stated above apply to all positions, whether it is opening or closing. If a long position is to be opened or short position to be closed, the price limit will apply when the price of limit order is higher than the ceiling price. If a short position is to be opened or long position to be closed, the price limit will apply when the price of the limit order is lower than the floor price. Otherwise, the order would be matched and executed as expected.

Requests to public endpoints do not require any authentication. REST API provides access to account management, market data, and trading. ParametersParameters TypesDescriptionwithdraw_idStringWithdrawal ID2.Request withdrawal record for all tokens.

Public- Depth400

- This does not guarantee orders are canceled successfully.

- This endpoint provides snapshots of market data and is publicly accessible without account authentication.

- The processing time for getting futures account information of all tokens can be long.

To retrieve more results subsequent requests should specify which direction to paginate based on the data previously returned. ParametersParameters TypesRequiredDescriptionleverageStringNoleverage5.Request parameter added “depth” for futures and perpetual swap depth API.

ParametersTypeRequiredDescriptioninstrument_idStringYesContract ID, e.g. (default 100)Contract name will be verified. If the name differs from database, error code will be triggered. [Functionality Optimization] The request and return parameters of spot and margin trading, futures, and perpetual swap will include user ID “client_oid” parameter.

BTC-USD C. If this parameter is provided, only data for corresponding instrument is returned. Orders in the middle of being filled cannot be modified; only unfilled orders can be modified. If the order cannot be modified because it has already been filled or canceled, the reason will be returned with the error message. If the order cannot be canceled because it has already been filled or canceled, the reason will be returned with the error message. The HTTP Request will respond when an order is either rejected (insufficient funds, invalid parameters, etc) or received (accepted by the matching engine).

Both parameters will be ignored if either one of start or end are not provided. The last 300 records of data will be returned if the time range is not specified in the request. Get loan history of the margin trading account of a specific token. before and after cursor arguments should not be confused with before and after in chronological time. Most paginated requests return the latest information (newest) as the first page sorted by newest (in chronological time) first.

Without this system, participant with a small amount of funds using high leverage can trigger considerable price volatility. However, the mark price must be constructed carefully to maintain a vibrant futures market. For the sake of better risk management, we cannot disclose the full details of how the mark price is set.

Get loan history of the margin trading account. This includes endpoints for retrieving market data, account information, order management, and bills details of your margin trading account. The last 200 records of data will be returned if the time range is not specified in the request. For batch order cancellation, only one of order_id or client_oid parameters should be passed per request. OKEx uses cursor pagination for REST requests that return arrays.

Dear valued customer, To provide a better trading experience and enhance the liquidity in the market of spot, futures…

Each swap contract has a notional value of $100 Bitcoin (BTC) equivalent. To provide a better trading experience and enhance the liquidity in the market of spot, futures, and perpetual swap trading, we are launching a global market maker program.

Maximum 2,880 recent strings of chart data can be retrieved. The maximum data set is 200 candles for a single request.

For "all open interests/all account info" futures and perpetual swap account endpoints, if no position/token is held then no response will be returned. For "single open interests/single account info" endpoints, if no position/token is held then the response will return with default value. The state of unfilled orders may change during the time of endpoint request and response, depending on the market condition. When using client_oid for batch order cancellation, up to 10 orders can be canceled per trading pair.

For batch order cancellation, only one of order_ids or client_oids parameters should be passed per request. ParameterTypeDescriptionorder_infoStringThe result list of the orders in the batch. Orders in the middle of being filled cannot be canceled; only unfilled orders can be canceled. BTC-USD-SWAP,BTC-USDT-SWAPThe Contract ID will be verified. if the ID differs from that in the database, an error code will be returned.

The response will contain a OK-BEFORE header which will return the cursor id to use in your next request for the page before the current one. The page before is a newer page and not one that happened before in chronological time. The information returned by the perpetual contract position interface adds an unrealized profit and loss field.