$ 0.001 0.00%

Rate3 (RTE) Rank 4328

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000RTE |

| Market share | 0% | Total Supply | 1000 MRTE |

| Proof type | N/A | Open | $ 0.0005 |

| Low | $ 0.0005 | High | $ 0.0005 |

Understanding Why Interest Rates Change

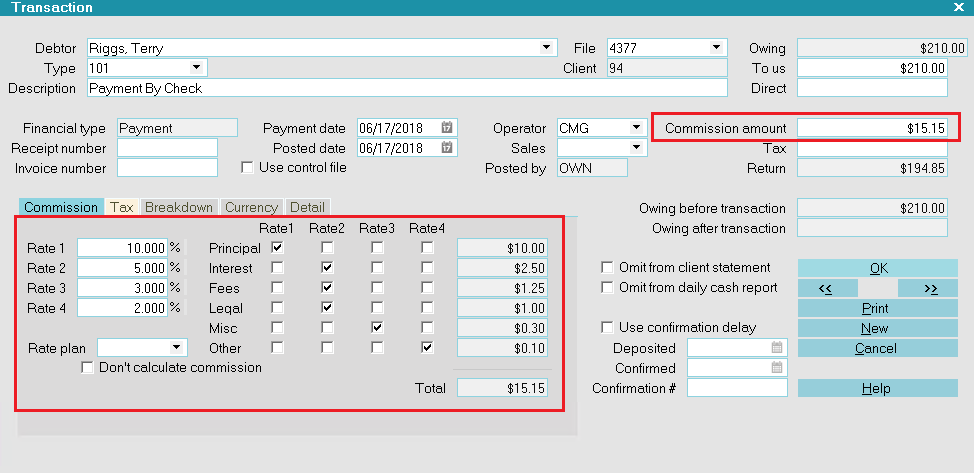

A variable interest rate is an interest rate that moves up and down with the rest of the market or along with an index. The obvious advantage of a variable interest rate is that if the underlying interest rate or index declines, the borrower’s interest payments also fall. Conversely, if the underlying index rises, interest payments increase. Unlike variable interest rates, fixed interest rates do not fluctuate over its term. The International Fisher Effect states the movement of the exchange rate of two currencies is proportional to the difference in their nominal interest rates.

How do you write simple interest?

Yes, it is right l think money is everything in life. without money we can't be survive .money is everything .you just think if you go market you want to buy something and you have no enough money than what you do.

The underlying benchmark interest rate or index for a variable interest rate depends on the type of loan or security but is frequently linked to the LIBOR or the federal funds rate. Series I bond is a non-marketable, interest-bearing U.S. government savings bond that earns a combined fixed interest and variable inflation rate (adjusted semiannually). A term deposit is a type of financial account where money is locked up for some period of time in return for above average interest payments on those amounts. The Fisher Effect is an economic theory created by Irving Fisher that describes the relationship between inflation and both real and nominal interest rates.

These markets regulate the prices by which investors are purchasing one currency with another, with the hopes of making more money when that nation's money gains strength. In travel, the exchange rate is defined by how much money, or the amount of a foreign currency, that you can buy with one US dollar. The exchange rate defines how many pesos, euros, or baht you can get for one US dollar (or what the equivalent of one dollar will buy in another country). In the United States, the fed funds rate is that guiding rate. It's what banks charge each other for overnight loans.

What do u mean by variable?

According to Bankrate.com, the average national average interest rate is 3.87% with . 43 points. The national average for a 15-year fixed mortgage loan was 4.35%, but a survey of 50 of the top 200 lenders by Informa Research Services, Inc. "Secondly; mortgage rates vary based upon 'cost.

Learn About the Top Exchange Rates Pegged to the U.S. Dollar

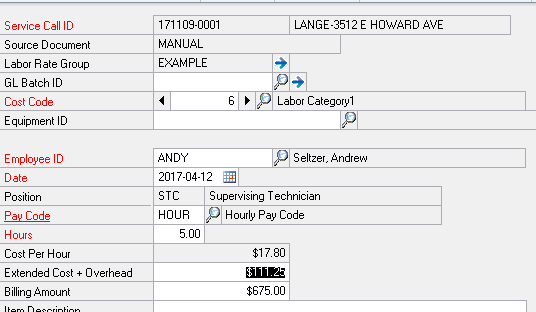

The APR also includes any other charges, such as broker fees and closing costs. Banks charge borrowers a little higher interest rate than they pay depositors so they can profit. At the same time, banks compete with each other for both depositors and borrowers.

How does the foreign exchange work?

Increase real value of debt. Deflation increases the real value of money and the real value of debt. Deflation makes it more difficult for debtors to pay off their debts. Therefore, consumers and firms have to spend a bigger percentage of disposable income on meeting debt repayments.

How Much Are Pips Worth and How Do They Work in Currency Pairs?

Adjusting the nominal interest rate to compensate for the effects of inflation helps to identify the shift in purchasing power of a given level of capital over time. Because inflation rates are not constant, prospective real interest rates must rely on estimates of expected future inflation over the time to maturity of a loan or investment. If you know what the rate is, the best places to exchange your money is at a bank or an ATM. Because banks run on standard hours around the world as well, it may not always be convenient to take your cash to a bank. ATMs offer a good backup plan because you can usually get local currency at the current exchange rate.

A cross-currency swap is an agreement between two parties to exchange interest payments and principal denominated in two different currencies. These types of swaps are often utilized by large companies with international operations. "U.S. / Euro Foreign Exchange Rate." Accessed Dec. 13, 2019. Most exchange rates are free-floating and will rise or fall based on supply and demand in the market.

So, a simple 10% interest means that if one borrows $100, one pays back $110. In the example above, the monthly savings is $39 a month. If you knew you wouldn't stay in the house for 8.5 years, you'd take the higher interest rate. The only disadvantage of the APR is that very few people will stay in their house for the entire life of the loan.

5 Reasons You Won't Retire on Time (and How to Change That)

Flexible exchange rates can change day to day but are often in very small increments of less than one cent. But major economic factors, like government shifts or business decisions, can have impacts on international exchange rates. For an example of a flexible exchange rate, look at the shifts between the United States and Canada.

Political philosophers in the 1700s and 1800s elucidated the economic theory behind charging interest rates for lent money, authors included Adam Smith, Frédéric Bastiat and Carl Menger. Some of those titles included the Theory of Fructification by Anne-Robert-Jacques Turgo, and Interest and Prices by Knut Wicksell. Find the best rates or the right bank for your checking and savings needs with our guides and tools.

- The higher your score, the lower the interest rate you will have to pay.

- Some countries have restricted currencies, limiting their exchange to within the countries' borders.

- Department stores often offer major appliances on a simple-interest basis for periods of up to one year.

- Most countries have their own kind of money, such as the United States dollar or the British pound.

- JPMorgan Chase CEO Jamie Dimon this week said bank executives have discussed imposing certain fees on consumers if rates fall to zero.

As more money is saved, less money is spent, further decreasing aggregate demand. At this point, people's expectations regarding future inflation are also lowered and they begin to hoard money. Consumers have less incentive to spend money today when they can reasonably expect that their money will have more purchasing power tomorrow. Falling prices can also happen naturally when the output of the economy grows faster than the supply of circulating money and credit.

What are the 3 types of variables?

There are three main types of variables in a scientific experiment: independent variables, which can be controlled or manipulated; dependent variables, which (we hope) are affected by our changes to the independent variables; and control variables, which must be held constant to ensure that we know that it's our

APR vs APY: Why Your Bank Hopes You Can't Tell the Difference

Is 4.25 a good interest rate?

A variable interest rate (sometimes called an “adjustable” or a “floating” rate) is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically. Conversely, if the underlying index rises, interest payments increase.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. To find the best mortgage rate, shop around with at least three different lenders to compare products and rates.

In general, variable rate loans tend to have lower interest rates than fixed versions, in part because they are a riskier choice for consumers. Rising interest rates can greatly increase the cost of borrowing, and consumers who choose variable rate loans should be aware of the potential for elevated loan costs. However, for consumers who can afford to take risk, or who plan to pay their loan off quickly, variable rate loans are a good option.

How to Calculate Student Loan Interest

The Federal Reserve’s interest rate decisions don’t directly impact mortgage rates. Long-term rates, such as 30-year fixed-rate mortgages, are more closely tied to the 10-year Treasury yield. On February 4, 2020, according to Bankrate’s latest survey of the nation’s largest mortgage lenders, the benchmark 30-year fixed mortgage rate is 3.640 percent with an APR of 3.890 percent. The average 15-year fixed mortgage rate is 3.150 percent with an APR of 3.400 percent. The 5/1 adjustable-rate mortgage (ARM) rate is 3.360 percent with an APR of 4.120 percent.

In contrast to credit cards, which use compound interest, loans only calculate interest on the initial principal. Tom could get competitive car loan interest rates by looking into companies like LendingTree which compare interest rates realtime. Your credit score has the most impact on the interest rate you are offered when it comes to various loans and lines of credit. For example, for personal loan APRs, in 2018, someone with an excellent score of 850 to 720 would pay approximately 10.3% to 12.5%. At the other end, if you have a poor credit score of 300 to 639, the APR will increase to 28.5% to 32.0%.

They must still have a known value, and could be carried around. This idea soon spread to Greece, the rest of the Mediterranean, and the rest of the world. In some parts of the world, different things have been used as money, like clam shells or blocks of salt. Money can be defined as anything that people use to buy goods and services.

The price of a variable rate loan will either increase or decrease over time, so borrowers who believe interest rates will decline tend to choose variable rate loans. In general, variable rate loans have lower interest rates and can be used for affordable short term financing.

What does variable interest mean?

The real interest rate adjusts the observed market interest rate for the effects of inflation. The real interest rate reflects the purchasing power value of the interest paid on an investment or loan and represents the rate of time-preference of the borrower and lender.

The moral dubiousness of charging interest on loans fell away during the Renaissance. People began borrowing money to grow businesses in an attempt to improve their own station. Growing markets and relative economic mobility made loans more common, and made charging interest more acceptable.

Variable interest rates can also be found in credit cards, corporate bond issues, swap contracts, and other securities. Variable interest rates for mortgages, automobiles, and credit cards may be based on a benchmark rate, such as the prime rate in a country. Banks and financial institutions charge consumers a spread over this benchmark rate, with the spread depending on a number of factors, such as the type of asset and the consumer’s credit rating.

The APR tells you the total cost over the life of the loan. The bank applies the interest rate to the total unpaid portion of your loan or credit card balance. Interested in earning cash for doing what you already do online?

These funds can come from their own depositors, since the banks pay 2% interest on five year GICs and charge 4% interest on a five-year mortgage. By borrowing from their depositors and lending to their mortgage borrowers, a bank makes a 2% “Net Interest Margin” (NIM) and a profit. Fixed-income derivatives also can carry variable rates. An interest rate swap, for example, is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. Variable interest rates can be found in mortgages, credit cards, corporate bonds, derivatives, and other securities or loans.

The rate reflects how much one currency costs in terms of the other. Currency pairs are two currencies with exchange rates coupled for trading in the foreign exchange (FX) market. Let's say someone traveling to Japan wants to convert $100 into yen, and the exchange rate is 110. To convert yen back into dollars one needs to divide the amount of the currency by the exchange rate.