$ 0.003 3.74%

TrustPlus (TRUST) Rank 3450

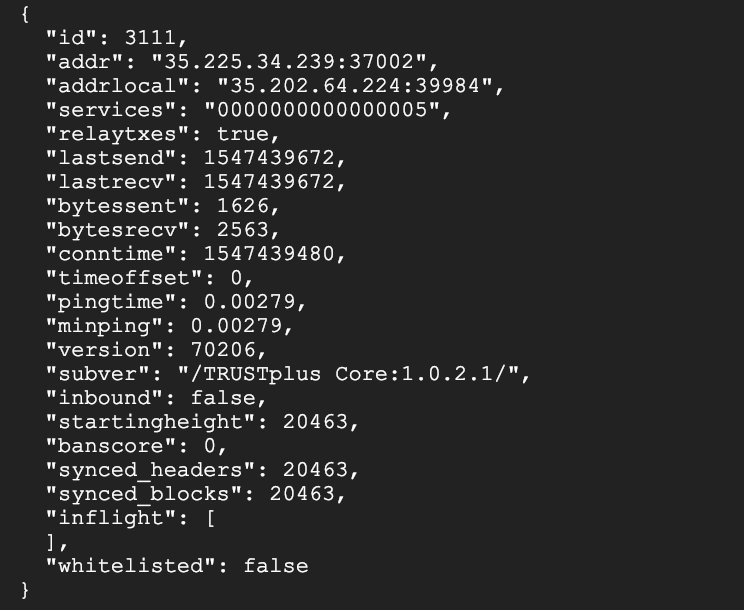

TrustPlus (TRUST) is an X11 algorithm based crypto currency that has a short PoW phase of just under seven days. The PoS rate is 18% per annum and there was a premine for roughly 10% of the PoW mined coins.

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000TRUST |

| Market share | 0% | Total Supply | 0.00000000TRUST |

| Proof type | PoW/PoS | Open | $ 0.0030 |

| Low | $ 0.0029 | High | $ 0.0031 |

Trustplus Mini Wanachi Vibrating Massager Cordless Massage Wand Full Body Waterproof-Black: Amazon.com.au: Health & Personal Care

Why You Should Avoid Trading Binary Options on Bitcoins

Some or all data provided by Nomics.com Cryptocurrency Market Data API. Forex Trading.Company was established to provide global traders a deep and insightful source of information on forex trading strategies and indicators.

But when it comes to Bitcoin, the trading remains constant and active 24 hours, seven days a week and 365 days a year. The clock from a volume standpoint is mainly distributed across American, Europe, and Asian sessions. To avoid problems that are associated with multicollinearity, traders would be smart to select indicators that work well or complement each other. They want this to happen without causing redundant results that could be seen as confusing. Traders of all types and sorts could use one momentum as well as trend indicator.

It will allow you to get into Bitcoin without worrying about losing a bunch of money. With 21 million Bitcoins on the market, the platform offers near infinite possibilities for what can be traded.

For the most part, the fluctuations that happen throughout the day rarely bother them. Many don’t even mind the extreme changes that occur and those with a lot of experience know the volatile nature of Bitcoin because of its’ history. They also tend to think of price crashes as major opportunities in which they can purchase more Bitcoin and make a lot of money in the long run. They may pull profits if the price hits a peak they don’t think will maintain but rarely will they liquidate all of their Bitcoin assets at one time. As of now, this method of trading is highly realistic with Bitcoin.

One may be used to confirm the others and make it a much safer investment. The results will, in turn, create signals that can be determined as misleading. With experience, the indicators can confirm price moves that are expected. In reality, however, the multicollinearity will sometimes make variables seem less impactful than they are and make it hard to predict market conditions accurately. But they do not give exact signals as to when to buy or sell.

But in this guide, you’ll learn the ropes of cryptocurrency markets and how to trade on them. If you’re already a crypto veteran, then you can show this to your newbie investors and have them read it to save you some time. You can read through it, to make sure it’s congruent with what you think a newbie should learn. There is never really a way to predict the market with precise accuracy.

But as far as Bitcoin has come and seems to be going, it’s unlikely that the currency will go anywhere at all. The concern with investors is primarily based around investing, something that is a bit of a global phenomenon when it comes to Bitcoin. The politics behind the entire project are one that is designed to support all of the people involved and protect the general user as well as larger entities. It's the newest digital currency, and unlike gold and fiat (regular money), it's not regulated or trackable by any bank, government or other financial institution. They’re relatively unmoved by daily changes in Bitcoin prices.

Log in to Twitter

Even this guide isn't enough to help you achieve fail-safe trading. And you'll need to do it with your own trades and continually learn everything you can, before you get the success you’re looking for. Other currencies tend to have problems that we can talk about later in this guide. And just to clear it up, many organizations consider cryptocurrencies money. They are their own currency types, unlike PayPal, FedWire or Western Union – where you just send actual fiat from one place to another.

- They were initially created for the primary purpose of getting your hands on Bitcoin without ever having to own it.

- You'll need to learn continuously; education is one of the most critical factors of trading.

- Also, there is another major plus to trading, low cost for exchanges.

- CFDs are not usually sustainable for holding for an extended period because of the price it costs to maintain them.

- They may alter between swing trading and day trading, or nurse specific accounts until it's time to bear them out or liquidate them.

- Leveraging on a CFD happens through a type of loan that is made between the exchange and the trader.

There's no other store of value that is like it and it's one of the world's first widely traded digital currencies. It's also a programmable currency that has a predictable level of inflation. It's because of this that Bitcoin prices typically move entirely independent of any other currencies or trading exchanges like Forex, stocks or bonds. It's a complete global network and is almost entirely safe from the risks that different currencies face.

One positive note, however, is that Bitcoin is known to be incredibly profitable. At first glance, it may seem hard and volatile, which is true, but there are always two sides to every coin. Just this year Bitcoin has gone up in price more than ten-fold. It started off as a mostly free currency in 2009, and in the last eight years has created millionaires all over the world. Most of the people were risk takers, ready to get in on the cash crop.

There are also scalpers, people who are looking to profit on the minute to minute exchanges. They typically use different imbalances in the market to order and book a multitude of minor profits.

They were initially created for the primary purpose of getting your hands on Bitcoin without ever having to own it. And for many people, CFDs are a great place to start trading. When mixed with the extreme volatility of Bitcoin, the amount of leverage can be powerful enough to open doors for individual traders. There is usually a very distinct form of professional traders who understand how to capitalize on trading like this.

They could be specific indicators like MACD, Bollinger Bands, RSI or others. There are many that you should master at a fundamental level at minimum, before moving on. They could include things such as money management and other discipline effecting aspects as well.

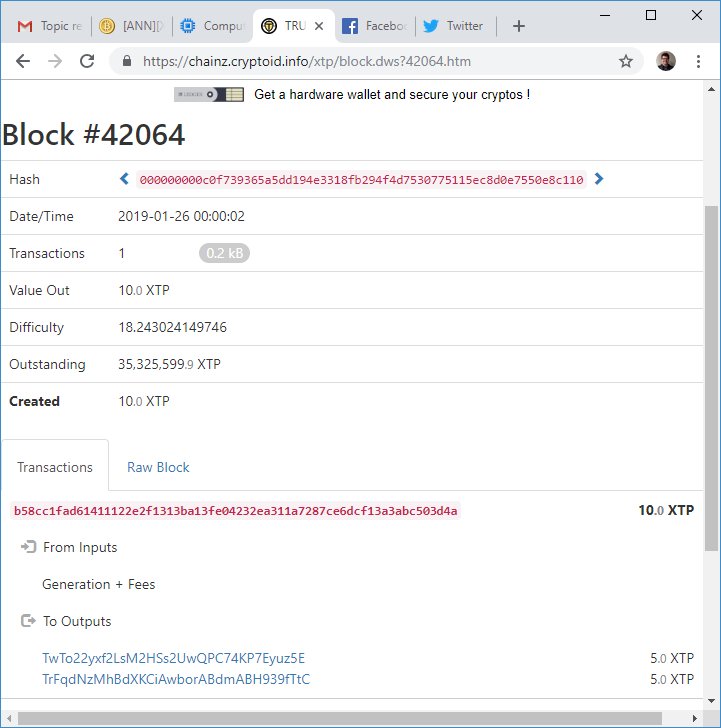

TrustPlus (XTP) Trading Ideas

Having a simple guide that starts from the beginning is the most comfortable and most helpful way to understand how cryptocurrency operates. Helping the XTP project is rewarding, and each person can help in their way. The Bitcoin project had a core value of making everything open source.

TrustPlus Blockchain Data

When it comes to using different platforms and exchanges, spreads can differ slightly then the current price of Bitcoin. There is a difference between the buy and sell amount of any asset on a security standpoint. Bitcoin will spot price for a trader to buy a contract that is slightly under the current value being sold. When it comes to trading Bitcoins, they are nothing like stock and commodities. Regular stocks only trade during specified business hours.

Bitcoin is far superior to nearly every other currency in the market as of now. There is a limited amount of only about 21 million coins, with inherent advantages over traditional fiat currencies. Anyone trading in buy & hold methods of trading usually base their actions on many different fundamental analyses than that of other technical analysis based decisions.

But they are not considered to be stable or ideal for long-term holders of cryptocurrency. The reason is when you use a CFD; you have to pay the price for your coin to be held. It's not a lucrative or sustainable way for traders or investors to make money. The cost is considered a premium and takes about 1% of your daily position. Traders of this nature are commonly called "holders" within the Bitcoin community.