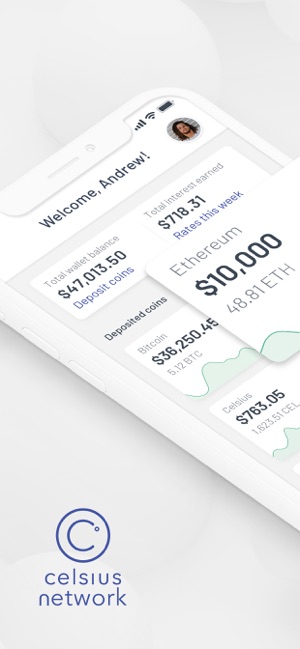

$ 0.021 -0.19%

Celsius Network (CEL) Rank 3905

| Mkt.Cap | $ 755,047.00 | Volume 24H | 3.37 MCEL |

| Market share | 0% | Total Supply | 0.00000000CEL |

| Proof type | N/A | Open | $ 0.02 |

| Low | $ 0.02 | High | $ 0.02 |

3 Best Bitcoin Loan Programs

There are no minimum or maximum deposits for the BlockFi Interest Account. Despite this, only deposits over 0.5 BTC or 25 ETH actually accrue interest. Balances of up to and including 25 BTC or 250 ETH (equivalent to around $130,000 and $40,000 respectively) will earn the 6.2% APY interest rate. Any balances over this limit earn a tiered rate of 2% interest.

Introducing: Bitcoin Lending Platforms

There are various ways for you to get a few Bitcoins of your own. You can either buy them from an exchange service which you think is good enough to cite a reasonable exchange rate, or you could buy a cryptocurrency mining rig for yourself.

Is Celsius crypto safe?

The Celsius Model Assets held under BitGo's management are insured for up to $100 million, and it is widely known as the single most secure and trusted crypto storage and custody provider. Not only do we keep assets secure, but we also give our community total access to their assets at all times.

BlockFi claims that applicants can get the money into their accounts in just 90 minutes from the start of the application. That’s what makes the company one of the fastest crypto-backed lenders in the U.S., where it currently operates in 46 states. In fact, the process of applying for a Bitcoin loan on BlockFi is not a very complicated one.

Top 5 Best Bitcoin Lending Sites 2020

BlockFi provides an Individual Account, which is owned by one person or entity who can deposit, transfer or withdraw the cryptocurrency held in the account. They also offer a Business Account which is owned by a corporation, or other commercial entity holding an account in any capacity other than an individual capacity. The application process can be completed in a few minutes, and users can specify their desired loan terms and submit their application with a response generally being given a few hours after it is received.

Earn Interest on Bitcoin: How to Earn Compound Interest on Your Crypto

Why is my APR so high?

APR stands for Annual Percentage Rate. The annual percentage rate on a loan is the amount the lender would charge if you borrowed the money for a year, as a percentage of the original loan. For instance at 40% APR, to borrow for a year you'd be charged 40% of the original loan, on top of paying it back.

Additionally, BlockFi charges a loan origination fee that averages around 1% to 2% of the loan amount, which is determined by the loan amount requested by the applicant, their location, and the credit history. Unchained Capital also gives the borrower an option of renewing the loan at the end of the tenure with “potentially” new terms so as to defer the principal repayment. Additionally, the company doesn’t charge any prepayment penalties, allowing the borrower to close the loan at anytime without any additional charges. Unchained Capital’s website shows that it charges interest rates between 8% and 14% for loan durations ranging between 3 months and 60 months. The borrower will then make monthly interest payments for the duration of the loan, while the last payment will also include the principal amount.

As they choose to sometimes sell and lend cryptos in order to generate additional fiat, the volatility of cryptocurrency prices can lead to adverse results as borrowers on their platform only repay the USD value of their loan. Due to the eligibility requirements attached to taking out a crypto backed loan, the platform appears to be suited to more savvy individuals with some experience of business and investing.

Why Are Credit Card Interest Rates So High?

We’re taking the exact same 80% profit margin that banks have kept for themselves for centuries and returning it to our community of depositors.

- Gemini also has digital asset insurance coverage and is SOC 2 Type 1 security compliant across both its exchange and custodian platform.

- The process of acquiring a Bitcoin in itself has become a major industry.

- If the applicant is satisfied with the loan offer, they accept the same and send the collateral Bitcoin, Litecoin, or Ether to BlockFi’s custodian – Gemini – and get the loan amount wired into their account.

- This is also the key that appears on the blockchain ledger as a user’s digital signature, not unlike a username on a social media newsfeed.

- All financial products, shopping products and services are presented without warranty.

Unchained Capital is another crypto-finance company that potential borrowers can look at to get a loan on their crypto holdings. The company closed a $3 million seed funding round in June 2018. Bitbond is a global marketplace lending platform for small business loans.

The Celsius business model is structured to do the exact opposite of what banks do — by giving 80% of total revenue back to our community each week in the form of earned interest. We earn profits by lending coins to hedge funds, exchanges, and institutional traders, and by issuing asset-backed loans at an average of 9% interest.

Take loans

What is Bitbond?

Bitbond is a global marketplace lending platform for small business loans. On our platform small business owners can get financing from both retail and institutional investors. We don't use traditional credit scoring, but rather use alternative data provided during the borrower application in order to rate borrowers.

At the end of 12 months, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate. Another notable feature of the BlockFi is that it doesn’t charge any prepayment penalty, so a borrower can repay the loan at any time during those 12 months and get back the collateral to their specified address.

While the company has been around for a few years now, the amount of success it has managed to gain in that time is simply amazing. The brand has been developed to perfection and the amount of trust the customers place in their service is higher than ever before. Apart from being a borrower, you also get to be a lender on the platform if you have the right resources. So irrespective of whether you are looking forward to helping people or are interested in making some quick money, you can sign up as a lender on the website.

How do I buy Bitcoins with an IRA?

Bitbond is basically a lending platform that offers opportunity for small business owners to secure loans to grow their online businesses. They get the loans in form of bitcoins and pay an interest rate depending on the amount they have borrowed.

There are other companies, which are offering comparable solutions like Cobo[1] (China), Custody Coinbase[2] (USA) and Tangany[3] (EU). All these services are offering custodian blockchain wallets for enterprise customers but also for personal usage. We only issue asset-backed loans, which means every dollar-borrower gives us more than 100% of the value of the loan they take in another asset, such as cryptocurrency. If they don’t return the loan amount or don’t pay the interest on that loan, we will use the collateral to pay down the loan, meaning the coin holders always have more collateral than the total loans out.

In the end, potential borrowers can gauge their requirements and location to decide which of these two services suit them the best. However, in case the value of the collateral drops by 25%, Unchained Capital will make a call to the borrower and request for additional collateral or a principal repayment. In case the borrower doesn’t act and the value of the collateral goes down by 45%, Unchained Capital can take over the collateral and sell the same to recover the principal and any outstanding interest amount. In case the value of the cryptocurrency increases and the loan to value ratio hits 40%, borrowers can request partial return of the collateral under certain terms and conditions.

BlockFi will use $50 million of the fresh capital infusion to provide loans to its customers. New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans.

Most companies that want to be trustworthy in the crypto sphere will provide a detailed explanation as to what will happen to deposited assets in the event that the company goes under. For many, this means making use of a device such as a hardware wallet, or even a low-tech solution like a paper wallet. Some companies have even released innovative metal wallets that are designed to withstand potential disasters such as fires and floods, but they come with their own costs.

How do you lend a Bitcoin?

So, how to lend at Bitfinex? Again, it's easy. Move BTC or USD to your Funding Wallet. Then go to the Funding Tab and make your Loan Offers, setting an Amount, a Period and a Rate.

On May 1, your new account balance will be 1.010 BTC, having earned 30 days of interest totaling 0.005 BTC. This process repeats month over month until you decide to withdraw your funds.

How To Transfer CEL from Liquid to your Celsius Network wallet

However, the company may have more leeway to operate given that most loans last for 12 month periods, and they can expect the minority of their users to demand sudden access to their crypto deposits. In the event that your crypto portfolio drops in value, you may be required to deposit additional funds and post more collateral. For example, anyone taking out a loan against $100,000 worth of Bitcoin is eligible for a loan amount of $50,000 due to BlockFi’s loan-to-value ratio of 50%. This works in a similar way to a bank giving a client a mortgage and using the property as collateral, in the event that the borrower stops paying off the loan, the bank can repossess the property. With BlockFi, once an individual has been approved for a loan, their assets are transferred to a wallet controlled by Gemini, and remain there until the loan is paid off.