$ 0.000 %

Compound Ethereum (CETH) Rank 15186

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000CETH |

| Market share | 0% | Total Supply | 0.00000000CETH |

| Proof type | N/A | Open | $ 0.00000000 |

| Low | $ 0.00000000 | High | $ 0.00000000 |

Ripple

Beyond those, you will see your offer APR, which is a simple way to show the total price over the course of a year. Click here for more information on interest rates & APR, and the difference between them. Click here to learn more aboutcollateralized loans using your crypto assets. BitGo investors include Goldman Sachs and the platform is SOC 2 Type 2 certified.

The Compound protocol currently has $ – of assets earning interest across – markets

Why is my APR so high?

APR stands for Annual Percentage Rate. The annual percentage rate on a loan is the amount the lender would charge if you borrowed the money for a year, as a percentage of the original loan. For instance at 40% APR, to borrow for a year you'd be charged 40% of the original loan, on top of paying it back.

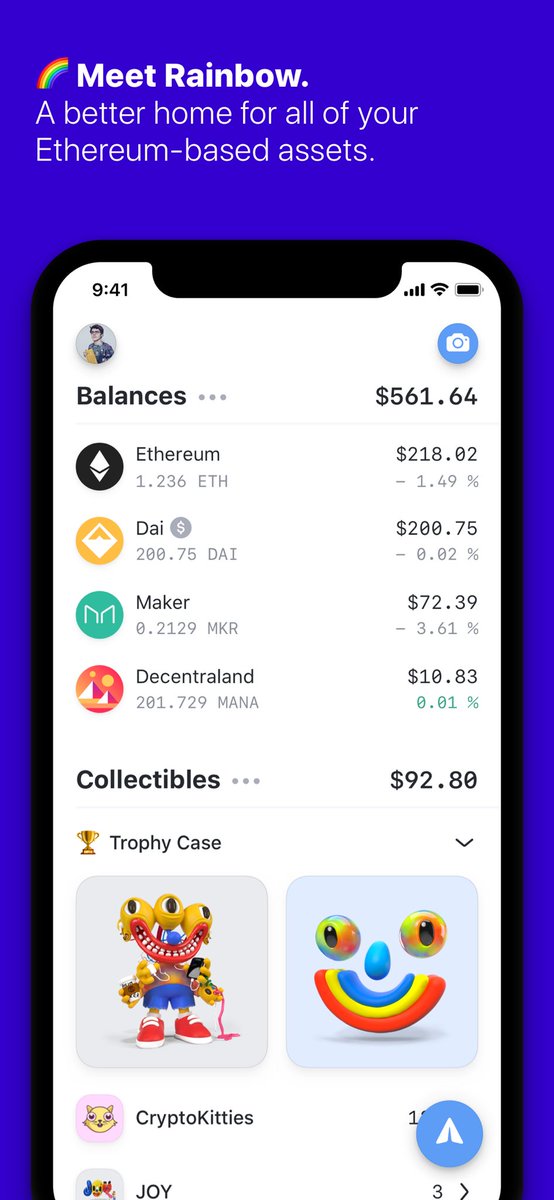

Also, it enables every lender to withdraw their assets anytime without waiting for the maturity of any loans issued against the pool. Compound is a protocol built on ethereum ecosystem that gave birth to different ethereum-asset-based money markets on its decentralized nodes. These markets are actually a pool of assets that algorithmically derive interest-rates based on the supply and demand for that particular asset category. There are lots of issues disturbing the world and finance is at the foundation of it. Interest rates charged by finance houses are getting too much and sometimes discourages people from going to them for help.

Will banks use XRP?

Compound.Finance — The most decentralised platform managed by Smart Contracts deployed on the Ethereum network. Which makes it the most secure and trustworthy platform to store your cryptos. It loses points however because unfortunately you can only lend out the DAI stable coin on Compound.

What is compound interest?

There are numerous trading strategies and every trader has their preferred way to increase their crypto holdings through trading. However, an increasingly popular way to trade is by leverage trading. In this scenario, traders will borrow funds to bolster their trading. In crypto, these leveraged loans are calledcrypto-backed loans.

Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications.

This gives Nexo quick and easy access to cash anywhere around the world. It’s all handled through an automated platform that uses 256-bit encryption, there are no credit checks required and clients retain ownership of their digital assets.

When calculating compound interest, the number of compounding periods makes a significant difference. This model is often done to in different ways, including interest-earning accounts. Some people also refer to this simply as lending out your Bitcoin. In the end, the result is the same — by transferring your Bitcoin or other cryptocurrencies to the financial service provider, you will earn interest on your Bitcoin over time. When I first engaged with Compound, Robert Leshner explained his vision for the community to eventually drive new features and the overall shape of the Compound protocol over time.

A core objective of the Compound Finance protocol is to provide individuals with the ability to ‘trade the time value’ of a digital asset. This derives from the financial concept, ‘the time value of money’, which stipulates that money in the present is worth more than the identical sum of money that is received in the future. This is due to the earning capacity of money received in the present; money received in the present can be invested, thus, enabling that money to earn a return and generate a larger sum of money in the future. One way to generate such a return is by lending a given amount of money, upon which the lender can then earn a return in the form of an interest rate that is attached to the loan. Since the conventional and decentralized peer-to-peer money markets need to match user’s asset-requirements with the available lenders in order to initiate a trade.

How to earn compound interest on your Bitcoin balance

This sparked my interest as the once walled garden of working inside Coinbase and Uber was no longer a constraint. What does a product roadmap look like when the same community who uses your product today, helps create tomorrow’s version of it with you?

- In simple terms compounds can be described as substances that have two or more Atoms bonded together.

- In this case, you may wish to try this version of the formula, originally suggested by Darinth Douglas, and then expanded upon by Jean-Baptiste Delaroche.

- Ledger Nano also provides backup and recovery by using a passphrase.

- When stored on the platform, trueusd (TUSD), gemini dollar (GUSD), paxos standard (PAX), Circle’s usdcoin (USDC), and Maker’s dai (DAI) will generate a 8 percent interest rate for those holding the currencies.

- It may be that you want to manipulate the compound interest formula to work out the interest rate or principal investment/loan figure.

How do I invest in Nexo?

Quick guide to buying Nexo (NEXO) Find the currency you want to use, such as BTC or ETH, and click “Deposit.” Copy the wallet address or scan the QR code. Transfer funds into your wallet. Click “Exchange.”

How does a crypto loan work?

How does crypto lending work? Cryptocurrency lending services connect borrowers to lenders on their platforms. Lenders receive their cryptocurrencies back once the borrower pays back the loan. Loans on most platforms are backed by tangible assets, such as real-estate.

The incentivization process is done by converting cTokens into an increasing amount of its holder’s underlying asset. Peer to Peer decentralized protocols were introduced to facilitate collateralized and uncollateralized loans between market participants like lenders and borrowers. Seamlessly borrow assets from the Compound protocol right to your wallet. Trezor is also a hardware wallet which is known to support most of the popular cryptocurrencies at affordable rates.

This can be achieved by either supplying more assets to the protocol or paying back any outstanding borrowed assets. A negative account liquidity also means that the user’s account is subject to liquidation. The borrow function transfers an asset from the money market to the user, which has the effect of commencing the accumulation of interest based on the current borrow rate for the borrowed asset. The withdraw function transfers a user’s asset from the money market back to the user, which has the effect of reducing the user’s supply balance in the protocol. The supply function allows a supplier to transfer an asset into the money market.

How do I get a Bitcoin loan?

The easiest way to get a bitcoin loan is through a peer-to-peer platform that connects investors with borrowers, usually for a fee. To borrow through a bitcoin loan platform, you first need to set up an account and wait for verification.

Launched in April 2018, the Nexo platform offers instant crypto-backed loans to customers. This allows users to retain full ownership of their digital assets while at the same time being able to access cash. Compound interest, or 'interest on interest', is calculated with the compound interest formula. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest. Subtract the principal if you want just the compound interest.

The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. Suppose a principal amount of $1,500 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly.

Telling if Interest is Compounded

The compound protocol then aggregates the supply of lent funds, resulting in a high level of liquidity for that money market. This lending mechanism also means that users that do decide to supply funds to the protocol are able to withdraw their tokens at any time. They do not have to wait for a specific loan to mature in order to recover their lent funds. Assets that are supplied to the protocol will accrue interest based on the supply interest rate that is unique to that particular asset.

A big positive is that the compounding interest is calculated daily. Compound is a nice platform that gives us a taste of what a DeFi applications can be.

BlockFi’s biggest let down is that interest is paid out monthly and that there are minimum deposit amounts. Still the interest rate for Ether is the highest at 6.2% so it still might present to be the best option for you. Celsius- The guy that invented VOIP has built a nice Mobile App that manages your crypto lending. It accepts a nice variety of stable coins and cryptocurrencies with pretty good rates.

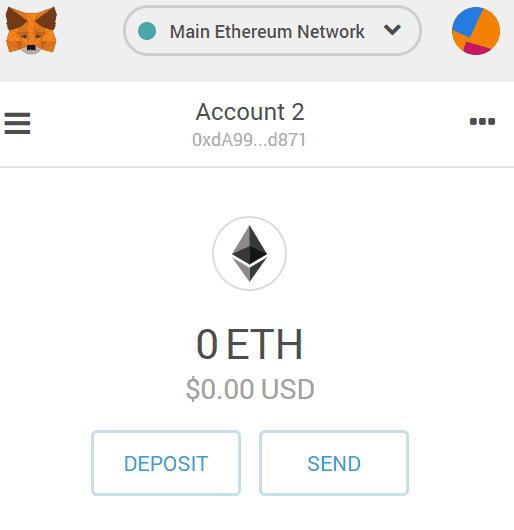

Enter the quantity of the asset you’d like to Supply, and then submit the transaction. Assets are supplied directly from your Ethereum account into Compound, and once supplied, immediately begin earning the prevailing interest rate. Unfortunately there is one platform that I would stay away from in its current format.