$ 0.000 0.00%

Credit (CREDIT) Rank 5305

| Mkt.Cap | $ 59,002.00 | Volume 24H | 0.00000000CREDIT |

| Market share | 0% | Total Supply | 0.00000000CREDIT |

| Proof type | PoW/PoS | Open | $ 0.000002 |

| Low | $ 0.000002 | High | $ 0.000002 |

Balance Credit

Conversely, credit refers to money received as a loan by the bank to the customer, which should be repaid, with interest on a later date. Credit history, paying capacity, income and debts are the parameters which determine the amount of credit. When one makes use of a credit card, he is actually taking a loan from the issuing bank, which requires repayment along with interest. The difference between debit card and credit card is same as debit differs from credit.

You will then see all the postings done to that account. If we have a $300 loan, the value of the loan account in the accounting system is really negative $300, but we just say our loan account balance is $300. When we discuss our company's account balances, we ignore whether the actual balance in the underlying accounting system is positive or negative.

A Bank Guarantee vs. a Letter of Credit: What's the Difference?

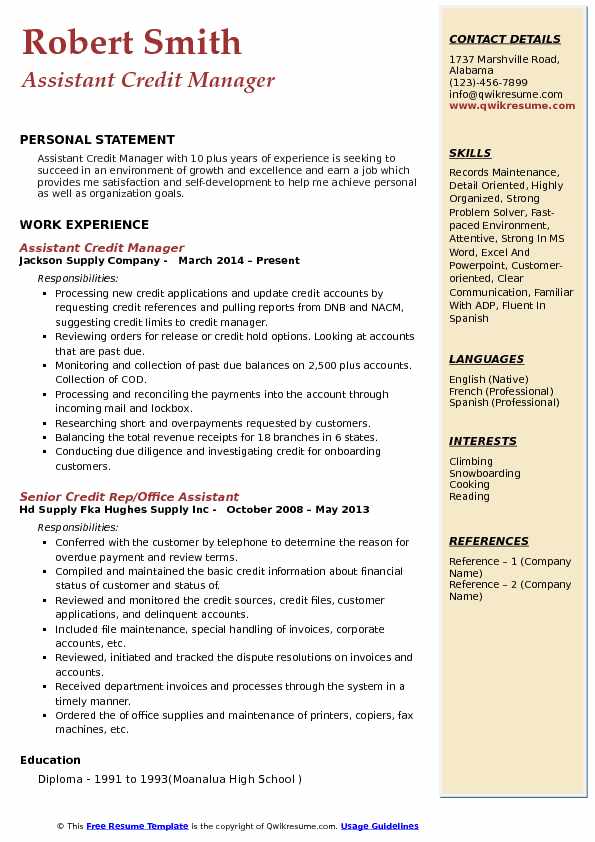

To understand debits and credits, know that debits are expenses and losses and that credits are incomes and gains. You should also remember that they have to balance, meaning that if a debit is added to an account, then a credit is added to another account. To keep debits and credits in balance, keep a ledger with credits on one side and debits on the other. Then, use the ledger to calculate the ending balance and update your balance sheet. Asset accounts, which are debit accounts, include cash, accounts receivable (money owed by others for goods sold on credit), inventory, prepaid expenses, plants and equipment, office supplies, and investments.

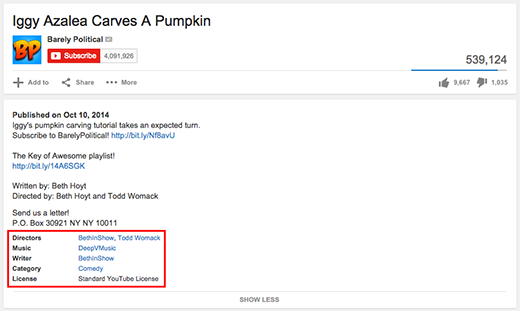

These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. The major difference between Credit Card and Debit Card is that, in Debit card the amount is withdrawn from the bank account linked to it, while in the Credit card the amount is not withdrawn from the account.

Because different lending uses (mortgage, automobile, credit card) have different parameters, FICO algorithms are adjusted according to the predictability of that use. For this reason, a person might have a higher credit score for a revolving credit card debt when compared to a mortgage credit score taken at the same point in time.

You didn’t see “it” coming, and now “it” is knocking on your door. Balance Credit is a company that’s here to help. Your student loan payments, on time or missed, are reported every 30 days.

Visual Synonyms of credit

Accounting debits and credits explained in an easy-to-understand way! We use simple math concepts to take the confusion out of debits and credits.

Defaulting on a loan lowers your FICO score, and makes it harder to be approved for new lines of credit. If this happens, contact your servicer to learn about options for rehabilitating your loan to get your account back into good standing, which will get you back on track to improve your score. Your FICO score considers which types of credit accounts you have experience using. It's usually best to have both revolving (like credit cards) and installment (like student or auto loans) lines of credit, as long as you are able to manage them.

The cardinal rule of bookkeeping is that DEBITS must equal CREDITS. This is the basic formula on which double-entry bookkeeping is based. Even if you have not had any training, I believe you can understand these principles.

Images & Illustrations of credit

What do you mean by credit?

Credit is generally defined as an agreement between a lender and a borrower, who promises to repay the lender at a later date—generally with interest. In accounting, a credit may either decreases assets or increases liabilities and equity on a company's balance sheet.

It might be a good strategy to charge only small items and pay your card balance off in full each month. To decrease an account you do the opposite of what was done to increase the account. For example, an asset account is increased with a debit.

If the borrower makes a $40 payment and incurs a finance charge of $6, her balance falls to $566, and she now has $434 in available credit. A credit limit is one of the factors that affect consumers' credit scores and can impact their ability to get credit in the future.

What is credit and debit?

In the dual entry accounting system, a contra entry is an entry which is recorded to reverse or offset an entry on the other side of an account. If a debit entry is recorded in an account, it will be recorded on the credit side and vice-versa.

Having good credit means that you are making regular payments on time, on each of your accounts, until your balance is paid in full. Alternately, bad credit means you have had a hard time holding up your end of the bargain; you may not have paid the full minimum payments or not made payments on time. Opening a lot of new accounts in a short period of time can lower your credit score, at least temporarily.

- The five C’s, or characteristics, of credit — character, capacity, capital, conditions and collateral — are a framework used by many traditional lenders to evaluate potential small-business borrowers.

- For this reason, it can be beneficial to keep credit card accounts open even if you don't use it regularly and don't have a balance.

- But if you start with a negative number and add a positive number to it (debit), you get a smaller negative number because you move to the right on the number line.

- Consumers who did not pay bills end up on the blacklists that are held by different credit bureaus.[4] Having an entry on the black list may result in the denial of contracts.

- A credit to one account is a debit to another.

A sheet which lists the debits in the left column and credits in the right column. It balances the total debits and credit costs incurred to a company. Debits and credits are not used in a single entry system.

Master the 5 C’s of Credit

Beside these lists several agencies and credit bureaus provide credit scoring of consumers. In Australia, credit scoring is widely accepted as the primary method of assessing creditworthiness.

Credit reports are used to generate a credit score. One of the most commonly used credit scoring formulas is Fair Isaac's FICO score, which ranges from 300 (low) to 850 (high). The higher your score, the more likely you are to be approved for new credit, or offered a lower interest rate. Many factors from your credit history are used to calculate your FICO score. The nationwide consumer credit agencies don't disclose how scores are calculated, so no one knows exactly how they are determined.

What is the best definition of credit?

Credit is an agreement whereby a financial institution agrees to lend a borrower a maximum amount of money over a given time period. Interest is typically charged on the outstanding balance. In the accounting world, a credit is also a journal entry reflecting an increase in assets.

You write a check for $300, which results in a credit of $300. You give your Dad $100, which results in a debit of $100. From a math perspective, think of a debit as adding to an account, while a credit is subtracting from an account.

Establish banking relationships - open checking and savings accounts. This will not directly establish your credit history, but lenders typically ask for bank account numbers on credit applications. If the account remains in good standing, this can help the lender know that you can responsibly manage money.

What are the 4 types of credit?

Credit is an agreement whereby a financial institution agrees to lend a borrower a maximum amount of money over a given time period. Interest is typically charged on the outstanding balance. In the accounting world, a credit is also a journal entry reflecting an increase in assets.

Bank credit is the total amount of funds a person or business can borrow from a financial institution. A credit rating is an assessment of the creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation. In accounting, accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.

It is not easy for us to carry a huge amount of cash or a chequebook every time with us, so credit card and debit card are good facilities that helps to overcome such a problem. If you have enough cash balance in your bank account, then you can choose the debit card, but if you don’t have a bank account and your credit ratings are quite good, then you can choose the credit card. Which card suits you more, according to your requirements. Asset accounts normally have DEBIT balances. When you deposit money in your bank account you are increasing or debiting your Checking Account.

FICO is a publicly traded corporation (under the ticker symbol FICO) that created the best-known and most widely used credit score model in the United States. FICO controls the vast majority of the credit score market in the United States and Canada although there are several other competing players that collectively share a very small percentage of the market. A loan commitment is an agreement from a commercial bank or other financial institution to lend a borrower a specified sum of money as either a lump sum or a line of credit.