$ 2,344.800 0.00%

Digital Gold (DGLD) Rank 2748

| Mkt.Cap | $ 3.76 M | Volume 24H | 0.00000000DGLD |

| Market share | 0% | Total Supply | 0.00000000DGLD |

| Proof type | N/A | Open | $ 2,344.80 |

| Low | $ 2,344.80 | High | $ 2,344.80 |

The Relationship Between Gold and the U.S. Dollar

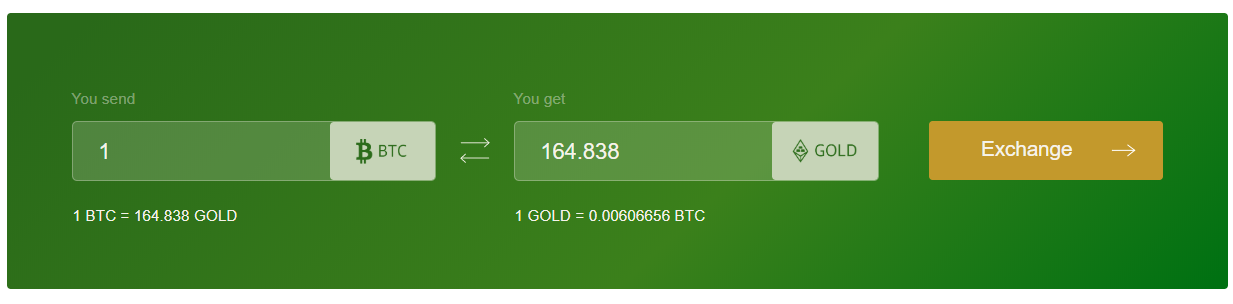

While the U.S. dollar can be divided into cents, or 1/100 of 1 USD, one "Satoshi" is just 1/100,000,000 of 1 BTC. It is this extreme divisibility which makes bitcoin's scarcity possible; if bitcoin continues to gain in price over time, users with tiny fractions of a single bitcoin can still take part in everyday transactions. Without any divisibility, a price of, say, $1,000,000 for 1 BTC would prevent the currency being used for most transactions.

1 from the comfort of your home, without worrying about its purity, safety and storage. These are some of the advantages that are being marketed to investors of digital gold.

With all 21 million bitcoin in circulation, that would put the price of 1 Bitcoin at $514,000. M3 (which includes all the other buckets) minus M1 is worth about 45 trillion U.S. dollars. We will include this as a store of value that is comparable to bitcoin. To this, we will also add an estimate for the worldwide value of gold held as a store of value. While some may use jewelry as a store of value, for our model we will only consider gold bullion.

However, gold was used during the period of Grecian history before and during the time of Homer's life. During the thirteenth and fourteenth centuries, European nations starting minting gold coins rather than their earlier preference of using silver for coinage.

Zengold, like other digital currencies, is a crypto-tech secured token. This means that it is capable of being used to make payments any time. It also means that it generates lower transaction fees. Each token, representing a gram of gold is divisible into 0.001 grams.

Of course, thefts also occur in the fiat currency world as well. In those cases, however, regulation is much more settled, providing somewhat more straightforward means of redress. Bitcoin and cryptocurrencies more broadly are still viewed as more of a "Wild West" setting when it comes to regulation. Different governments view Bitcoin in dramatically different ways, and the repercussions for Bitcoin's adoption as a global currency are significant.

Also, the Royal Canadian Mint produces packs of 1 gram gold Maple Leaf coins. Over time, gold’s value in terms of purchasing power stays relatively constant. Of course, there are major cycles wherein gold can gain or lose value dramatically due to supply and demand issues, speculation, or manipulation. But as long as the dollar keeps losing value, gold – the ultimate money – can be expected to ultimately reflect that depreciation by carrying a steadily higher price tag. Gold coins & gold ornaments are very popular among the people of the world.

Is Bitcoin gold backed by gold?

“The yen is the most 'safe-haven' of 'safe-haven' currencies, with the Swiss franc and U.S. dollar vying for second place,” the Goldman analysis found.

The amount of gold you purchase will be backed by certified 24k (995 fine) physical gold. The gold bought will be insured and kept safely with a reputed Custodian on a consolidated basis.

M3 is M2 plus large time deposits and money market funds. Since M0 and M1 are readily accessible for use in commerce, we will consider these two buckets as medium of exchange, whereas M2 and M3 will be considered as money being used as a store of value.

Philippines: 197.9 tonnes

Gold is thought to have been discovered in Turkey as early as 9000 BC, but it is only quite recently that it has become of international commercial interest. There is another big leap between 22nd and 23rd place with Austria recorded as holding 280 tonnes of gold, more than 50 tonnes more than Belgium. Much of its stock was held in the Bank of England, but the Austrian National Bank is said to be working on repatriating much of this back to Vienna so that at least half of Austrian gold is held at home.

Digital Gold vs Traditional Gold

How do you get gold from mercury?

Currently, the world's largest source of gold is located in the Witwatersrand basin. This area in South Africa has provided a large amount of the world's gold. It is also believed that there is still about 40% of the basin that has yet to be mined and still holds much more gold.

For example, during periods of extreme stress in markets it may be impossible to obtain physical metal anywhere near the quoted spot price. Premiums on retail bullion products may surge as a consequence.

- Perhaps the biggest question it hinges on is exactly how much adoption will Bitcoin achieve?

- Yet in real terms gold prices today aren’t much different from what they were when they were last quoted at $20 an ounce.

- Spot (paper) prices can sometimes diverge from real-world pricing in the markets for physical precious metals.

- A mineral-rich country, Uzbekistan has a wealth of resources including petroleum, natural gas, gold, silver and uranium.

- The advantage of purchasing bars of the size is that small quantities can be easily liquidated.

The names of some famous jewelers situated in Kerala state, India are also mentioned in this article. But the important point regarding gold is that its price is increasing daily. Individual can take physical delivery of his or her E-gold units at any time if he wants. As mentioned above 1 unit of E-gold equivalent to 1 gm of gold.

The main uses of money are as a medium of exchange, a unit of account, and a store of value. For example, the negative correlation between the dollar and oil prices was weaker in the 2012 to 2016 period compared with the first, the economists said.

You can buy E-gold as low as 1unit, which is the minimum amount you should buy when you purchase E-gold. The maximum amount of units you can buy in a single order is units. That is you can't buy the E-gold as 1.5 unit, 2.5 units, etc. You can buy E-gold during the time interval 10 am to 11.30 pm, in India.

Why selling price of gold is less than buying price?

1 Gram Gold Bar One gram gold bars are typically the smallest sized bars (.032 troy oz) that an investor can purchase.

The lower figure is suggested by organizations such as GATA with the higher figure typically cited by mainstream gold analysts. The world is lurching through a serious monetary disorder. The proximate cause is the collapse of the housing bubble and the subprime-credit crisis, but the ultimate cause is the inherently unstable monetary system foisted upon us by a banking cartel. Governments cannot force people to use their money beyond a point.

Exchanging national currency

In addition, since gold bars are typically priced lower per ounce than gold coins or some numismatics, it makes them an even more attractive investment. Specialty products such as jewelry and collector’s items are generally not considered to be bullion. Bullion investors should avoid collectible (numismatic) coins that carry high premiums over spot prices. Better bullion dealers sell gold bullion products by the gram. For example, Pamp Suisse and other well-regarded mints produce 1 gram gold bars.

How can I buy e gold?

In grams, you can buy a minimum of 0.0005 grams and a maximum of 50 grams. b) Selling of gold starts from 0.0005 grams or Rs 1. e) According to the FAQs section, on any given day, the selling price is lower than buying price because there are certain costs which include taxes, bank charges and others.

The original gold metal is in the form of physical where as the E-gold is in the form of electronic. You can buy the E-gold in small quantities like 1gm. This electronic form gold can be converted into physical form at any time. So that individual can invest in E-gold for a period to achieve the target amount, and then he can sell it or buy in a physical form. There is no need of worry about the purity of gold in E-gold investment plan.

And also which is free from insurance cost and storing cost. This will help to store the gold without the fear of the thief. Despite being a small island off the coast of China, Taiwan is sitting on 423.6 tonnes of gold and has held this amount of the precious metal for several years. Gold is always seen as a strong investment in uncertain times and with Brexit, the unpredictable Trump Presidency and threats from North Korea, the world is certainly going through a period of instability. This has pushed the price of gold up, making Taiwan's gold assets a sound investment for the near term.

Saudi Arabia: 323.1 tonnes

Buying 2.5 gram gold bars made of .9999 fine gold offers investors a hedge against inflation like larger bars, but at a price point that is more manageable. While slightly more than the 1 gram gold bar, 2.5 gram bars are still very affordable and can usually be bought for between $100 and $150, depending on spot price. One factor to consider when purchasing gold bars is the premium added to the price of spot gold. Bars that are smaller in size, such as 1 to 5 gram bars, will usually include a higher premium than a 5 or 10 troy ounce bar. There are many types of gold bars available, all in various sizes that fit the needs of individuals with different budgets.

Will the US dollar crash?

Three types of gold In the modern jewelry market, there are three kinds of gold: yellow gold, white gold, and rose gold.What gives gold these different colors depends on the metals used in the alloy mixture.