$ 1.120 -0.01%

STASIS EURS (EURS) Rank 667

| Mkt.Cap | $ 139.04 M | Volume 24H | 0.00000000EURS |

| Market share | 0% | Total Supply | 0.00000000EURS |

| Proof type | N/A | Open | $ 1.12 |

| Low | $ 1.11 | High | $ 1.12 |

STASIS EURS

Not only does the token mirror the Euro currency, but in doing so, it also enhances liquidity assurance. STASIS EURS brings the reliability of fiat currencies into the volatile world of cryptocurrencies. Its token, the EURS, mirrors the Euro if the value is tied to collateral.

STASIS EURS is a project on the marketplace and known for its fiat-collateralized cryptocurrency pegged to Euro. The engagement aims to dispel any doubts that EURS stablecoins are backed one-to-one by euros.

STASIS EURS (EURS) Review

CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Disclosure Read More The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Stasis’ promised audits – the first is expected in Q – are all the more notable since some issuers, and not just Tether,have claimed that audits are currently unobtainable in the stablecoin market.

A cryptocurrency is only viable if it is in demand. That is why it is important to check any and all potential use cases of a certain token before diving into its benefits. View STASIS EURS (EURS) price history chart, statistics and other information. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

New to Twitter?

Malta-based tokenization platform STASIS has launched EURS, a stablecoin backed by the Euro. EURS, aiming to be the biggest "fully verified and collateralized stablecoin" in the world, launched with a $100 million pre-launch order book which is expected to hit $500 million by year’s end. The goal of the Foundation is to provide oversight of the STASIS companies through a board of multiple directors, ensuring that no one person ever has control of the company’s assets, including the reserve accounts for EURS and other tokenized assets. The Foundation owns 100% of the share capital of STSS (Malta) Limited, the token issuer. STASIS is a revolutionary step towards combining the vast potential of the cryptocurrency market with the stability and reliability of traditional currencies.

The project has had a lot of positive press recently. And we don’t just mean the crypto-centric publications like the Bitcoin Magazine. STASIS was talked about on Forbes, CNN, Wall Street Italy, and Yahoo. The project is based on the STASIS ecosystem of frameworks that implemented to deliver the benefits of both worlds – digital as well as physical – to the user.

Each stablecoin unit is backed by a corresponding unit of Euro. Bid price is the best price at which a market maker is willing to buy a currency. Binance, the world’s leading crypto currency exchange. Trade the largest range of crypto pairs, from anywhere.

Coinopsy

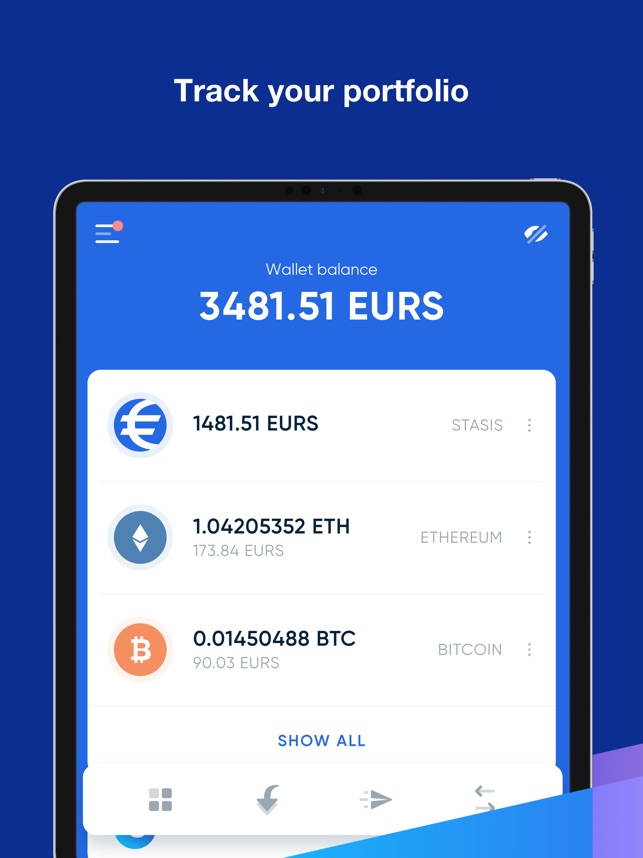

Several trading options are present, including spot and OTC markets. The platform's interface is very intuitive and easy to navigate. STASIS EURO is a type of digital crypto currency, utilizing peer-to-peer transactions, mining and other technological feats into a modern day asset. Use this page to follow news and updates regarding STASIS EURO, create alerts, follow analysis and opinion and get real time market data. STASIS merges the benefits of digital assets with the reliability of traditional ones via the EUROS token.

Past performance is not necessarily indicative of future results. STASIS EURS reached its highest price on 30 June, 2019, when it was trading at its all-time high of $ 1.67. EURS is currently being traded on London-based crypto exchange DSX, but there are plans to expand to other cryptocurrency exchanges in the future. One major concern with stablecoins is whether the issuer can hold enough fiat to backup the digital coins in circulation. Representatives from STASIS told Bitcoin Magazine that the name of the institution would be revealed at a later date.

- STASIS was talked about on Forbes, CNN, Wall Street Italy, and Yahoo.

- Trading and investing in digital assets is highly speculative and comes with many risks.

- And we don’t just mean the crypto-centric publications like the Bitcoin Magazine.

- CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

HitBTC has been listed STASIS EURS(EURS) , according to its announcements. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Market Overview Watch updated crypto prices, market caps, volumes. Global Market Chart Historical market cap and volume for the entire market.Recently Added Discover the latest coins listed on CoinCheckup.Top Gainers Best performing coins over the last 24h.Top Losers Worst performing coins over the last 24h. Help us make a description by answering 5 simple questions. EURS token is a collateralized stable coin that is designed to become the bacbone of the crypto-economy. Similar to Tether, EURS is fiat-collateralized.

@stasisnet

Trading and investing in digital assets is highly speculative and comes with many risks. The analysis / stats on CoinCheckup.com are for informational purposes and should not be considered investment advice. Statements and financial information on CoinCheckup.com should not be construed as an endorsement or recommendation to buy, sell or hold. Please do your own research on all of your investments carefully. Scores are based on common sense Formulas that we personally use to analyse crypto coins & tokens.

STASIS EURS (EURS) - Fiat Crypto

With a market capitalization of nearly $1.9 billion, USDT is the seventh-most valuable cryptocurrency overall. Stasis’ EURS, by contrast, ranks 82nd, with a market cap of just $35 million, according to CoinMarketCap. Stablecoin issuance is an increasingly crowded and competitive corner of the cryptocurrency sector, and a number of providers are aiming to reassure a skeptical market by publicizing their relationships with prominent accounting firms. Most cryptocurrency holders are subject to significant volatility and counterparty risk.

Blockchain is a digital ledger in which transactions made in Bitcoin or another cryptocurrency are recorded chronologically and publicly. STASIS EURS is proud with quite the team at the wheel. Nearly every member of the project comes from a finance and/or fintech background and the advisors have proven track records in asset management, accounting, and business development.

STASIS provides a full-service tokenization platform, including smart contract creation, third-party audits, custodial services, and deep expertise in current regulatory environment. Tokenization is the process of representing real-world assets on the blockchain. By combining the immutable record, transaction speed, and accessibility of blockchain technology with traditional assets, we can deepen liquidity and remove intermediaries across a range of asset classes.

The first such report was published Thursday. It makes clear that the document does not constitute an audit. The EURS stablecoin combines the benefits of blockchain technology with the reputation and relative stability of the euro. EURS token is a virtual financial asset that is designed to digitally mirror the EURO on the condition that its value is tied to the value of its collateral.

STASIS EURUS is not a solution for newbie investors or scalpers who still lack the experience. The ecosystem seems to be designed for seasoned professionals from the traditional financial system to operate in the cryptocurrency market.

EURS mitigates these risks by letting users hold a stable digital asset, transparently backed by euro reserves. The project founders have vast industry experience and long-term track in IT and finance, helping facilitate direct communication with European crypto-market regulators.

Many cryptocurrency investors and traders will be wary of any such claim by a stablecoin issuer, due to nagging questions around the dominant issuer, Tether. Stasis, a Malta-based issuer of stablecoins, has hired accounting firm BDO Malta to conduct quarterly and annual audits of its financials, including the euro reserves backing the startup’s EURS token. HitBTC is a platform for digital asset and currency exchange where you can quickly and securely trade Bitcoin, Ethereum, EOS, Tether and many other cryptocurrencies.

STASIS seems like a stable, reliable, transparent blockchain project that is developed by an experienced team and backed by actual market demand. We can’t see anything going wrong with the project if they’ll be keeping up the good work. Press coverage like that will continue bringing attention to the project. That attention, as we all know, is the same thing as actual money on the world of cryptocurrencies and digital assets.