$ 0.000 %

Hshare (HSR) Rank 22996

Hshare is a dual network blockchain comprised both of a blockchain-based network and a DAG-based network. It allows for anonymous transactions through the use of zero proof technology. The blockchain-based side of Hshare features a PoW/PoS cryptocurrency.

| Mkt.Cap | $ 0.00000000 | Volume 24H | 0.00000000HSR |

| Market share | 0% | Total Supply | 84 MHSR |

| Proof type | PoW/PoS | Open | $ 0.00000000 |

| Low | $ 0.00000000 | High | $ 0.00000000 |

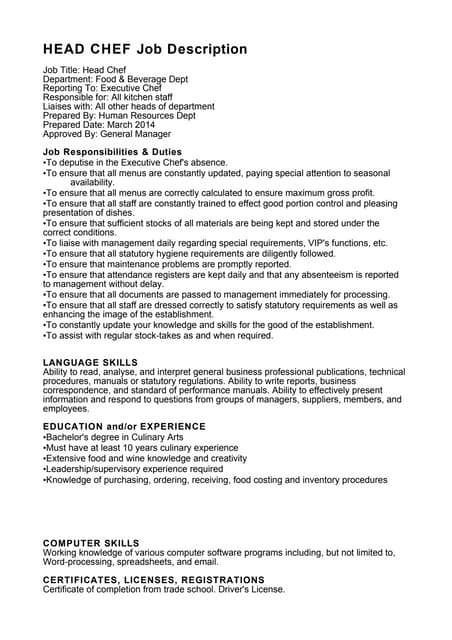

Share Class Definition

HC Exchanges

Reporting corporations (those that are required to publish financial reports) can list their shares on an exchange. But in order to do so, they must undergo a higher level of regulatory compliance and issue a prospectus to potential purchasers. Other similar product were CSI 300 Index (and the sub-index CSI 100) by China Securities Index Company and "Dow Jones China 88 Index" by S&P Dow Jones Indices.

What to watch in the markets: Wednesday, February 5th

Various permutations of share classes and voting rights are possible, for example Facebook has Class A shares which trade publicly and Class B shares which do not. Class B shares have 10 votes per share vs 1 vote per share for the Class A shares. Because Mark Zuckerberg owns 28% of the Class B shares he controls the voting rights. When one member of a married couple sets up a corporation, it is quite common for shares to be split between them so the other member can receive company dividends. Keep in mind, a non-reporting corporation cannot be listed on a stock exchange.

Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. Apple Inc. (AAPL) has 4,715,280,000 ordinary shares on issue that pay a 1.62% annual dividend yield, according to Nasdaq.com. Let’s assume an institutional investor owns 300 million ordinary shares in the tech giant. While ordinary shareholders face greater financial risk than creditors and preferred shareholders of a corporation, they can also reap greater rewards.

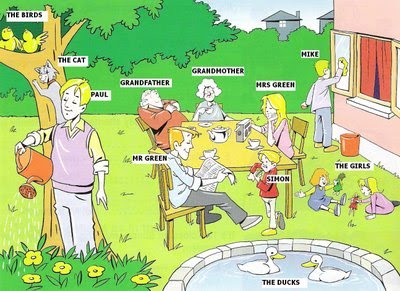

But a shareholder isn't limited to an actual individual. In fact, shareholders can also be an institution such as a mutual fund company. These companies can buy shares in a company and package them into funds and sell them to their clients. Before we delve into the different kinds of share classes you can set up, it's important to understand shares and shareholders.

The Basics of Mutual Fund Share Classes

They can be voting or non-voting, but the preferences are specified when the share class is created. This is why it can be an advantage to set up at least one other share class when you're setting up a new corporation — non-voting common shares.

Hong Kong law forbids trading suspensions by Hong Kong’s stock exchange in the absence of orders given by the Securities and Futures Commission in consultation with Hong Kong's Financial Secretary. In Hong Kong, screens displaying quotations for stocks whose prices are rising are in green while those for stocks with falling prices are in red. The reverse applies on the Mainland, rising prices are shown in red and falling prices in green.

Investor shares demand $1,000 to $3,000 initial deposits and carry an average expense ratio of .18%. Admiral shares have $3,000, $50,000 or $100,000 minimums, but the expense ratio averages .11%. Finally, the Institutional shares begin at $5 million, and their average expense ratio is .05%. Different classes of mutual fund shares incur differing fees and expenses.

A famous example of this is Berkshire Hathaway Inc. (BRK.A), whose Class A Common Shares have a par value of $5 but trade above $300,000 on the New York Stock Exchange (NYSE) as of May 2019. Any number of preferred share classes can be set up — each with distinct rights attached. This is why preferred shares are often used to try and entice people to invest and raise money for the corporation. In return for investing in a business, most angel investors and venture capitalists receive preferred shares which give them specific rights and privileges over those of the common shareholders.

- If you have 1 share out of one million, then you own 0.0001% of Company X. Issuing shares helps corporations in many ways, including access to capital for future investments or projects.

- On Mainland, the settlement cycle for securities settlement is usually T+1.

- All additional shares of a company's stock are, by definition, preferred shares.

A share class is a specific kind of security held by the owner. It determines what rights the shareholder has in the company.

This article explains three share series that may be used when setting up a new corporation - common voting shares, common non-voting shares and preferred shares - and explains when and why you might want to use each share class. Ordinary shareholders have the right to a corporation's residual profits. In other words, they are entitled to receive dividends if any are available after the company pays dividends on preferred shares. They are also entitled to their share of the residual economic value of the company should the business unwind; however, they are last in line after bondholders and preferred shareholders for receiving business proceeds.

Chip (stock market)

When stockholders have the right to vote on matters of corporate policy making, they are said to own voting shares. Both B and C shares tend to pay higher expense ratios, the annual management and maintenance fee charged by the fund, than A shares do.

The most common share class is the A share, which carries a front-end load, payable upon purchase, or upfront. These funds may seem costly in the beginning but may be less expensive if held over the long-term. These upfront sales charges range from 2% to 5.75%, depending on the type of fund and the volume purchased. Google instituted a dual share class structure during its corporate transformation into Alphabet Inc. in 2015. The company issued an A-class share with the ticker symbol GOOG and a C-class share with the ticker symbol GOOGL.

Ordinary shares include those traded privately as well as shares that trade on the various public stock exchanges. In many jurisdictions, ordinary shares have a stated "par value," but this value is more of a technicality, and is rarely more than a few cents per share. Market forces, the value of the underlying business and investor sentiment toward the company determine the market value that investors pay for ordinary shares.

A share class is a designation applied to a specified type of security such as common stock or mutual fund unit. Companies that have more than one class of common stock usually identify a given class with alphabetic markers, such as "Class A" shares and "Class B" shares; these carry different rights and privileges. Mutual funds also have share classes, which carry different sales charges, expense ratios, and minimum initial investment requirements. When you create a new corporation in the United States or Canada and prepare your Articles of Incorporation, you'll have to set up shares and share classes.

SHARE - Survey of Health, Ageing and Retirement in Europe

If a company makes large profits, the creditors and preferred shareholders do not receive more than the fixed amounts to which they are entitled, while the ordinary shareholders divide the large profits among themselves. The same occurs when companies, such as start-ups, are sold to larger corporations. Ordinary shares provide investors with voting rights (one vote per share) and represent proportionate ownership of a company. Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. For example, investment company Vanguard offers three share classes.

H-share companies are companies incorporated in Mainland China and whose listings in Hong Kong are approved by the China Securities Regulatory Commission (CSRC). Shares in these companies are listed in Hong Kong, subscribed for and traded in Hong Kong dollars or other currencies, and referred to as H shares.