$ 9.281 -4.42%

Numerai (NMR) Rank 842

Numerai is a network of data scientists that are incentivised to forecast models to improve hedge fund returns. Numaire is the token that facilitates the reward structure that correct predictions receive. Founders described it as a social network or software company whose business model happens to be a hedge fund. USV partner Andy Weissman says, “Network effects get more valuable with every participant that uses them. What’s an example of that in a financial institution? We’ve never seen one before except for this.”

Numerai has already raised $7.5 million in traditional venture capital from Union Square Ventures, Joey Krug (Augur), Juan Benet (FileCoin), Fred Ehrsam (Coinbase), and Olaf Carlson-Wee (Polychain). So the Numeraire token will not be sold in a “crowdsale” or “ICO”.

In Febuary 2017 1,000,000 NMR tokens were issued to 12,000 data scientists.

| Mkt.Cap | $ 98.83 M | Volume 24H | 208,589.00NMR |

| Market share | 0% | Total Supply | 2.00NMR |

| Proof type | Open | $ 9.71 | |

| Low | $ 9.12 | High | $ 9.81 |

Numerai and Polychain

Where to buy NMR?

Each week, one hundred scientists earn bitcoin, with the company paying out over $150,000 in the digital currency so far. If the fund reaches a billion dollars under management, Craib says, it would pay out over $1 million each month to its data scientists. Though he declines to say just how successful it has been, due to government regulations around the release of such information, he does say it's making money.

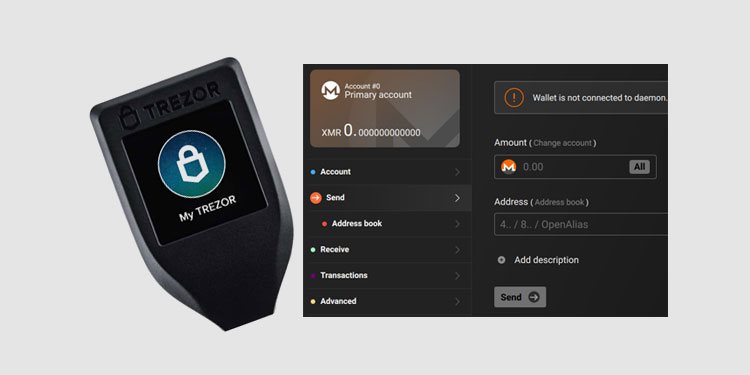

The proven and user-friendly MyEtherWallet will be a much better choice, and the use of which is completely free. The best solution, however, is to buy wallet hardware like Ledger Nano S or Trezor. The purchase of such a portfolio is an expenditure of several hundred dollars, but for people handling large amounts of different tokens, it is definitely useful. Numerai significantly improves this system by introducing many modifications that bypass limitations and restrictions.

Three months ago, about 4,500 data scientists had built about 250,000 machine learning models that drove about 7 billion predictions for the fund. Now, about 7,500 data scientists are involved, building a total of 500,000 models that drive about 28 billion predictions. As with the crowdsourced data science marketplace Kaggle, these data scientists compete to build the best models, and they can earn money in the process. For Numerai, part of the trick is that this is done at high volume. Through a statistics and machine learning technique called stacking or ensembling, Numerai can combine the best of myriad algorithms to create a more powerful whole.

The purpose of Numeraire

At one point, he wanted to share the company's data with a friend who was doing more advanced machine learning work with neural networks, and the company forbade him. "That's when I started looking into these new ways of encrypting data—looking for a way of sharing the data with him without him being able to steal it and start his own hedge fund," he says. Under the banner of a startup called Numerai, Craib and his team have built technology that masks the fund's trading data before sharing it with a vast community of anonymous data scientists. Numerai is a hedge fund managed by an anonymous community of data scientists.

The entire purpose of cryptocurrency ledgers is to be without central system owners. As such, these coins can to varying extent slip through the cracks and into the hands of people who can use them without the blessing of their government. Because cryptocurrency ledgers do not typically embed the notion of people’s real-world identities in them, stablecoins can often be held by completely unknown users.

The auction mechanism leads to equilibrium bidding behavior that reveals rational data scientists’ confi- dence in their models’ ability to perform well on new data. The auction mechanism also yields natural arguments for the economic value of a Numeraire token. For an activity so heavily dependent on the efficient transmission and interpretation of information, the business of allocating capital has been slow to adopt the network model. Meanwhile, the pace at which the field of machine learning is advancing is rapidly accelerating. Between breakthroughs in our understanding of the science, platforms such as Kaggle, the Netflix Prize and a wealth of free online learning tools, there is an increasing supply of talent tackling all aspects of computing and data analysis.

Not on Twitter? Sign up, tune into the things you care about, and get updates as they happen.

Its trades are governed by artificial intelligence created by an open community of data scientists. In addition, there is no guarantee that the hedge fund will continue to work with Numerai. Suppose such a fund has gone bankrupt or found a better way to anticipate the market.

Numerai is thus not a search for the best model; it is a platform to synthesize many different models, an invisible collaboration to build the meta model. At scale, Numerai’s fund is exposed to every model and a diversified portfolio without the risk of relying on a single and imperfect model.

Powerful companies on Wall Street like Renaissance and Bridgewater Associates, have already done research on this before. What distinguishes Numerai from the above companies is that they focus on crowdsourcing, creating machine learning algorithms.

The solution offered by them is tokenization, issuing one million tokens (Numerai) for specialists who will analyze data for them and make forecasts. Such tokens enable them to manage and coordinate many different activities, as a result, they accumulate huge amounts of uncorrelated models of dispersed intelligence (Swarm Intelligence), which allows them to make investment decisions. Hedge funds are extremely competitive and do not share information among others.

- The other key team members, advisers, and investors are Geoffrey Bradway, Xander Dunn, Joey Krug, Peter Diamandis, Dr. Norman H. Packard, Dr. Vitaly Shmatikov and Dr. Arvind Narayanan.

- Culliton says it's more difficult to work with the encrypted data and draw his own conclusions from it, and another Numerai regular, Jim Fleming, who helps run a data science consultancy called the Fomoro Group, says much the same thing.

- In our Framework for Securities Regulation of Cryptocurrencies we explained why this exact type of outcome strikes an ideal policy balance.

Where to hold NMR?

We transform and regularize financial data into machine learning problems for our global network of data scientists. Numerai is not a search for the ‘best’ model; it is a platform to synthesize many different, uncorrelated models with many different characteristics.

You’re viewing a free company profile from the PitchBook Platform. To explore Numerai’s full profile, request a free trial.

Such employees are recruited anonymously and are paid using virtual tokens. Hedge funds have been exploring the use of machine learning algorithms for a while now, including established Wall Street names like Renaissance and Bridgewater Associates as well as tech startups like Sentient Technologies and Aidyia. But Craib's venture represents new efforts to crowdsource the creation of these algorithms. Others are working on similar projects, including Two Sigma, a second data-centric New York hedge fund. But Numerai is attempting something far more extreme.

On the secondary market, it's value for a holder that is not a data scientist is just speculative. He studied mathematics at Cornell University in New York and then worked for a resource management company in South Africa. The other key team members, advisers, and investors are Geoffrey Bradway, Xander Dunn, Joey Krug, Peter Diamandis, Dr. Norman H. Packard, Dr. Vitaly Shmatikov and Dr. Arvind Narayanan.

Numerai Board Members (

Operator of a hedge fund platform intended to offer global equity strategies built by a network of data scientists. Founded in 2015, Numerai is an employee owned hedge fund sponsor based in San Francisco, California. The firm invests in the public equity markets across the globe. The firm employs long/short strategy to make its investments.

numerai-cli

Our data scientists compete on the leaderboard, but models are ranked and rewarded based on their contribution to the meta model. A trustless relationship exists between Numerai and our data scientists, facilitated by encryption and anonymity. Data scientists do not need to tell us who they are, and receive payments in Bitcoin.

The data they use to power these models is encrypted and so are their models. It is the “blind leading the blind” according to this piece in Wired. I like that description as the focus moves away from things like fundamental and technical stock analysis to true pattern recognition done by machines.