$ 0.034 -3.79%

SalPay (SAL) Rank 3534

| Mkt.Cap | $ 1.35 M | Volume 24H | 355,300.00SAL |

| Market share | 0% | Total Supply | 0.00000000SAL |

| Proof type | N/A | Open | $ 0.04 |

| Low | $ 0.03 | High | $ 0.04 |

SALPay Mobile – Applications sur Google Play

Our Electronic Bundy Clock allows your employees to clock-in and out of work using their PCs or tablets. It comes with location restrictions that give you full control over where they can update their time records.

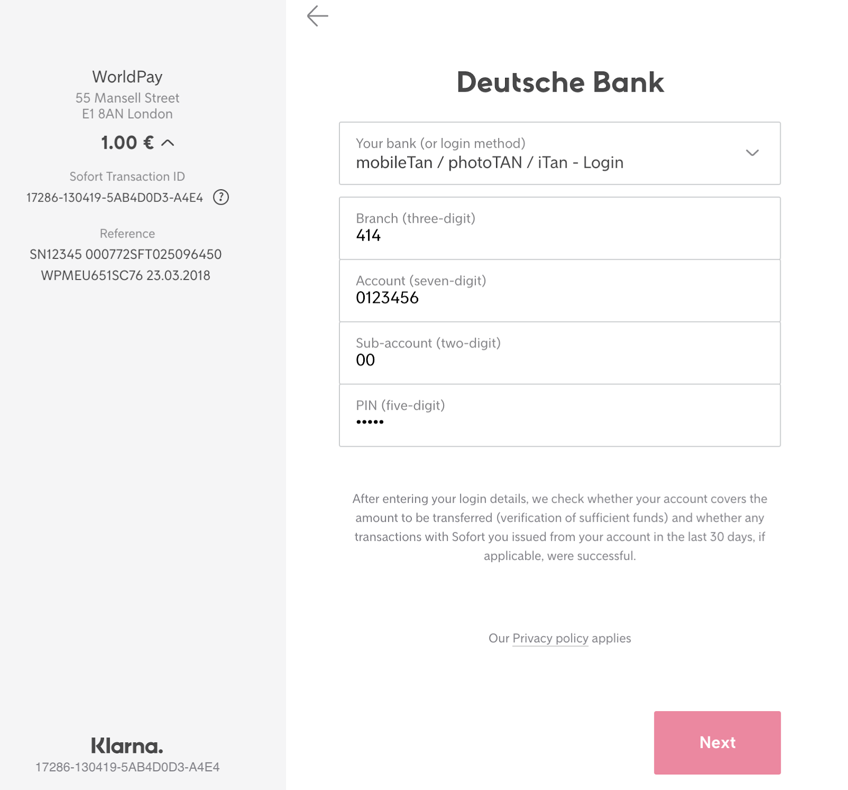

Just by sending an SMS, loan proceeds will be credited to their account within 10 minutes. Once it’s in the payroll account, the customer can withdraw the funds through any ATM.

Though it is not reflected on the client’s pay slip since the payment method is via Automatic Debit Arrangement (ADA) from payroll credits. Your loan proceeds will be credited automatically to your payroll account and you will receive an SMS alert from 2346. The hold out will be lifted once the amount due is debited from your payroll and applied as payment for your amortization. Posting of payment would be the following banking day after your payroll is credited on your account. Your payment due date is based on your payroll cut-off dates, amortization will be automatically debited from your payroll account 2 banking days before your actual payout.

SBC shall have the right to keep all evidences of my Salary Advance. I acknowledge that the above evidences and the corresponding Statements of Account are valid and conclusive proof of all my transactions. SALAD deductions can be seen in the payroll account.

YOUR PAYROLL SOFTWARE SHOULD BE AFFORDABLE

Prepare your employees for the unexpected. Give them access to the fastest and most convenient salary advance program. Pick a username Email Address Password Sign up for GitHub By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails. A pay card (or payroll card) is a prepaid card that employers can use to pay employees.

After loan maturity, a fixed fee of P250 will apply per month. You may call our Customer Service Hotline at or email for further assistance. After sending an SMS availment request, you will receive a reply from 2346 indicating approval of your request. DO NOT reply to the welcome SMS from Security Bank.

Salarium enables you to produce pay records for thousands of your employees within 5 minutes.

You are now enrolled in Security Bank’s Salary Advance Program. Avail up to [Credit Limit] for at most 3 months. This amount is valid until [End of Month]. Just text SBCSALAD [space] AMOUNT [space] # OF DEDUCTIONS to 2346. Insufficient payment – If the balance of or credits to the payroll account is not sufficient to cover for the payment due, SBC shall debit the remaining available balance in my payroll account.

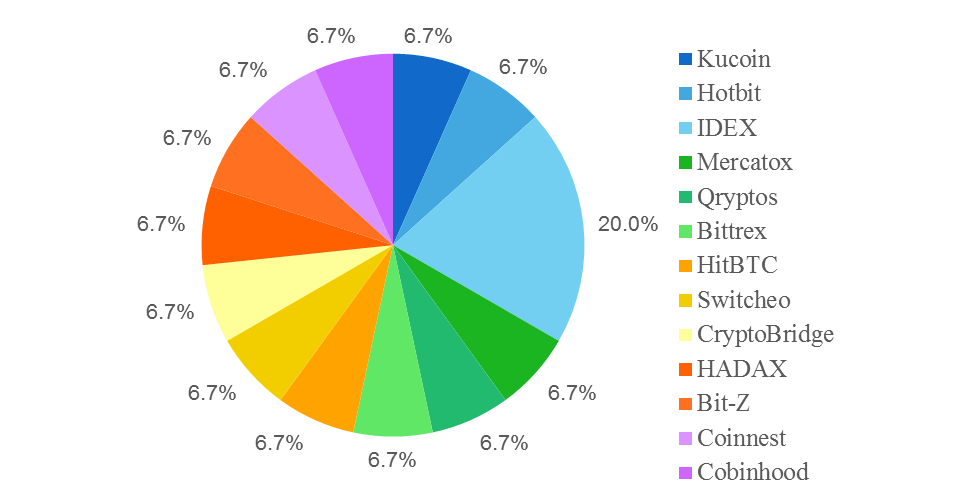

SalPay's 3.0 will be an ERC20-based algorithm wallet to hold SalPay and other Ethereum-based tokens. Salarium also offers SALPay, a cash card paired with a cutting-edge electronic wallet, so you can provide your employees access to more benefits and features than what a regular bank offers. SALPay saves you the hassle of setting up your employees’ bank accounts and submitting their requirements. With all of the processing done online, you can get your employees set up in minutes.

Fill-out the Letter of Intent to Deactivate SALAD Enrolment. Click here to download the letter, fill out the details, and send to Processing time is 1 working day. If your salary is insufficient for the amortization amount, the payment will be considered “Missed” amortization. This will be deducted on the next payroll date on top of the amount due for the current cut-off PLUS an additional “late payment charge” amounting to P125 per missed payment in the duration of the loan.

SalPay SAL Coin Values SAL

If the proposed amendment is not acceptable to me, I shall be obliged to prepay the entire obligation under this program upon demand by SBC. Saturday, Sunday and Holiday – Whenever any payment to be made hereunder falls due on a Saturday, Sunday, or public holiday under the law of the Republic of the Philippines, such payment may be made on the next succeeding banking day. Verification process – My SMS requests are still subject to SBC’s evaluation and validation. Should my request be disapproved, SBC will notify me of the disapproval via SMS. SBCSALAD [space] AMOUNT [space] # OF DEDUCTIONS to 2346 and follow the succeeding SMS instructions.

- Prepare your employees for the unexpected.

- Whether you are an employee, consultant, agent, or contractor—you will get instant access to your salary, allowances, bonuses, commissions and loans—without ever having to line up at a bank.

- For every availment, a processing fee will be automatically deducted from the loan proceeds that would be credited to your account.

- The assigned credit limit is equivalent to the individual’s average net salary credited to payroll account for the last 6 months or P30, 000.00 whichever is lower.

- “Date of Salary Advance” – the date on which my SMS confirmation is received by SBC.

- A pay card (or payroll card) is a prepaid card that employers can use to pay employees.

Upon my default as herein defined, my account shall be considered a “delinquent account” for purposes of the late payment charges under Section 8 hereof and SBC is hereby authorized, at its option, to suspend or cancel my subscription to the program, and to disallow any further Salary Advance requests. The amount certified by SBC as the amount outstanding shall be prima facie evidence of the amount due from me as at the date thereof. Request for change of mobile number enrolled in SALAD, please call Customer Service Hotline at .

Your assigned credit limit varies depending on the average net salary credited to your payroll account for the last 6 months. The assigned credit limit is equivalent to the individual’s average net salary credited to payroll account for the last 6 months or P30, 000.00 whichever is lower. SALPay is being used by a growing number of companies to pay and provide financial services in a faster and more convenient way to people just like you.

However, if you avail five (5) days before from your payroll date, your first due date will be the succeeding payroll date. Employers may get in touch with the Security Bank team for accreditation, and submit the required documents for accreditation. If your company doesn’t offer Salary Advance, ask them to get accredited. Fill out the form and we’ll take it from there.

It is a loan program designed and offered by Security Bank that allows employees to advance on their next salary in the fastest and most convenient way possible. Multiple requests – SBC shall allow only one outstanding Salary Advance per subscription. Further requests will be allowed only when all obligations related to the outstanding Salary Advance are fully satisfied. “Date of Salary Advance” – the date on which my SMS confirmation is received by SBC.

Whether you are an employee, consultant, agent, or contractor—you will get instant access to your salary, allowances, bonuses, commissions and loans—without ever having to line up at a bank. This is because SALPay is integrated to Salarium, a cloud-based human resource management and payroll solution. Credit shall be provided by SBC under the Salary Advance Program until SBC cancels, closes or freezes operation of the said Program in accordance with these terms and conditions.

Typical banks still rely on uploaded disbursement instructions in plain text files, which are incredibly prone to human error. With SALPay, you'll never have to worry about making mistakes in paying your employees.

Failure to do so shall not prevent SBC from applying payments via salary deduction with corresponding penalty charges. Disbursement – SBC shall credit the loan proceeds to my payroll account and send an SMS notification to me upon crediting. “Salary Crediting Day” – means the day/s of the month that my employer declared to credit salary to its employees’ payroll accounts, which will also serve as the basis of my payment dates and maturity date of my Salary Advance. Even without the ATM Card, your approved SALAD availment will still be credited to your payroll account. However, we urgently encourage you to visit the SBC Branch nearest you and request for an ATM Card Replacement to allow you immediate access to the funds.

Each payday, the card is loaded with the employee’s wages for that pay period. Employees can use the pay card like a debit card, or they can withdraw wages through an ATM, bank cashier, or purchase where they receive cash back.

Customers should text to 2346 as indicated in the welcome SMS. You must accurately indicate your personal “Active” mobile phone number on the Credit Agreement Form (CAF). For every availment, a processing fee will be automatically deducted from the loan proceeds that would be credited to your account. You may specify the number of instalments you want to repay the loan within a maximum of three (3) months. Your account will be debited for the amortization every payday, which would be twice (2x) in a month.

Allow 3 banking days to process your request. I hereby agree to still authorize SBC to continue debiting my payroll account such amount as may be necessary from time to time as payment for all outstanding obligations arising from this program in case SBC terminates or cancels the Program. Evidence of Salary Advance. – Salary Advance shall be evidenced by my request and confirmation made via SMS.