$ 1.000 0.12%

True USD (TUSD) Rank 314

| Mkt.Cap | $ 494.51 M | Volume 24H | 3.21 MTUSD |

| Market share | 0% | Total Supply | 0.00000000TUSD |

| Proof type | N/A | Open | $ 1.00 |

| Low | $ 1.00 | High | $ 1.00 |

CoinCheckup

TUSD is a price-stable cryptocurrency which is backed 1-for-1 by US Dollars. The token uses multiple escrow accounts to reduce counterparty risk, and to provide token-holders with legal protections against misappropriation. TUSD is the first asset token built on TrustToken, a platform to create asset-backed tokens. TrueUSD is a price-stable cryptocurrency backed by US Dollars. Spoofy is the nickname for a mysterious cryptocurrency trader who allegedly manipulates bitcoin and crypto prices.

If you already have a Binance account and Bitcoin or another altcoin to support conversion, go ahead and skip to step 3. TrueUSD, part of the TrustToken asset tokenization platform, is a blockchain-based stablecoin pegged to the value of USD.

It’s also faster to convert to cryptocurrencies than regular fiat. Tether also holds the ace when it comes to buying cheap cryptocurrencies when the market dips. Tether brings a comparative advantage which its predecessors have failed to bring to the table – value for value conversion of fiat currencies into crypto-coins thereby making it possible to facilitate trade with them.

Just because a stock is trading at a good price right now doesn't mean its safe and will continue to do so in the future. You should read up on tether and the accusations made against it. I feel dirty exchanging my bitcoins to Tether when I do hedging or preserve my portfolio's worth. I might run into bad news and be left holding a bag of worthless USD wannabe.

How much is Usdt worth?

Security Concerns Tethering via wired connection is undoubtedly more secure as both the devices are connected through short cables. Connections via hotspot can be intercepted using software such as Wifi sniffers. Connecting to public Wifi hotspots is not secure.

If you are interested in using Tether, I’d advise never storing significant sums in it. USDT should only be used for short-term trading and transfers. If converting to and transferring large amounts as USDT, do so in batches, which will reduce your overall exposure. As a result, many crypto enthusiasts are naturally skeptical of Tether. However, without solid evidence of misconduct, the allegations made against Tether and Bitfinex are just elements in another FUD (fear, uncertainty, doubt) campaign.

Sequel to deposits made into Tether’s Limited bank accounts using fiat currencies, the company credits the user’s wallet with its equivalent in tether, thereby enabling the user to use tether as they please. However, since April 18, 2017, Tether had stopped receiving deposits in exchange for the token citing problems with its Taiwanese banks as the reason.

TrueUSD News

Binance doesn’t just list any old cryptocurrency though, it has to really prove itself as a solid cryptocurrency for Binance to list it. Deposits are always free, but withdrawals do cost money. Withdrawal fees are different for each cryptocurrency, and change depending on their value.

This also makes the stablecoin less risky than typical cryptocurrencies. Its relevance as an alternative to fiat is a big advantage that cannot be overemphasized cherished by traders and investors. For many investors, Tether provides an avenue to park their investments when the market is bearish, especially in countries where converting from cryptocurrencies to fiat is a hassle. In the same vein, an approved client who wires USD to Kraken’s bank account would receive USDT at the rate of 1$ per Tether.

Hence, Ledger has an institutional custody partnership brewing with the Japanese bank Nomura. Despite USDT’s recent loss of parity with the dollar amid renewed questions about its issuer’s reserves, Benjamin Soong, Ledger’s new head of operations for the Asia-Pacific region, said the token remains popular there. TrustToken was founded by a team from Stanford, UC Berkeley, Palantir, and Google, and is backed by Stanford-StartX, Founders Fund Angel, FJ Labs, and BlockTower Capital.

Stablecoins allow exchanges to create fiat currency pairs without actually accepting fiat. For example, you can have a BTC/USDT trading pair which simulates the BTC/USD market without the need for regulation.

4. Receive TrueUSD tokens

What is the difference between USD and Usdt?

What is the difference between USD and USDT in trading bitcoin? USD are dollars that are held directly in a bank account. USDT are coins that issued by Tether which some exchanges will accept, but the money doesn't go into the exchange's bank account and to the exchange, it's just another coin.

At the initiation of any transaction a TrueUSD smart contract is created, into which the respective transferred amount is minted and delivered to the User’s wallet. This TrueUSD token can be redeemed for equivalent fiat currency. During redemption of the tokens, another smart contract is activated which burns the number of tokens required.

- The Model S and Model X both offer USDT support, the main difference being that the Model X can be controlled from your mobile phone as well.

- On Tuesday, October 16, 2018, Tether withdrew 250 million USDT out of circulation after an initial 50 million USDT and 200 million USDT were sent to Tether’s treasury address by Bitfinex.

- His solace had initially been on PayPal, but things went awry after Turkey banned PayPal in 2017.

- Defining an equation for the net amount of bitcoins and tether transferred between the exchanges in each sample period.

Exchanges

Even with such a system, exchanges can be lured by the available incentive for fraud. Among the well-orchestrated face-saving attempts was the hard fork implemented to blacklist stolen funds amounting to 30 million tethers. There are still a good number of exchanges using the token to enable traders to take a cash position before embarking on a trade. The over-reliance on this token portends excellent threats to the entire crypto industry with the burgeoning market cap.

What is the USDC?

I'd give Tether between 48 hours and 72 hours to transfer the funds. If everything is there as they claim it is, this should be very quick and painless.

However, if the value of Litecoin increased, so would the withdrawal fee. This is because the fee is fixed to the price of Litecoin, and not top the price of USD (or your local currency). Binance have had a very successful start since they were created in 2017.

Tether is one of the most popular stablecoins around today. In this post, I’ll explain what a stablecoin is, what is Tether and how it works.

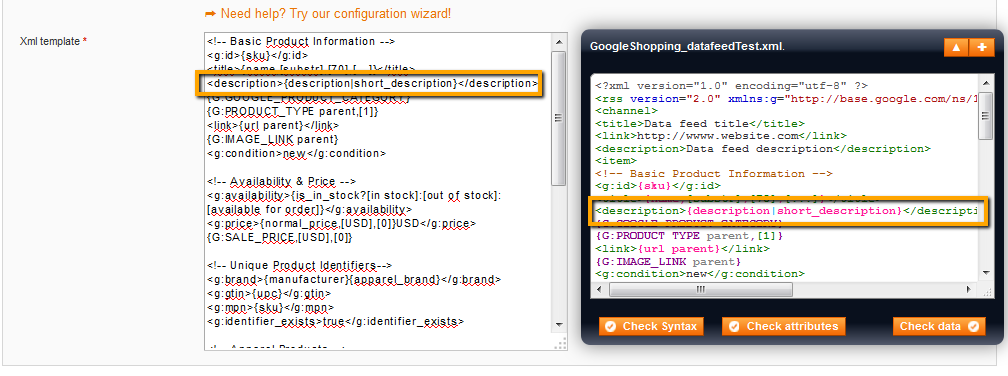

TrueUSD is made possible by tokenizing US Dollars through TrustToken’s legal and technical platform. TrustToken is a platform to tokenize real-world currencies (such as USD and Yen) and assets (such as real estate, art, and IP). A cryptocurrency is a digital or virtual currency that uses cryptography and is difficult to counterfeit because of this security feature.

Is Usdt the same as USD?

Crypto enthusiasts will tell you that holding USDT (“Tethers”) is the same as holding dollars. But now, Tether, the issuer of USDT, has now admitted that Tethers are not 100% backed by actual dollars. So Tether does not have 100% traditional currency backing for its reserves.

The Tether peg is maintained through collateral, meaning for every 1 USDT in existence there’s a US Dollar sitting in deposit. This platform is used for various digital assets, which are anchored to the Bitcoin blockchain. Following Bitcoin, Ethereum based Tether coins were launched as well. As a result, Bitfinex now refuses US customers and it no longer provides markets denominated in USD. 1 USDT is intended to remain exactly equal to $1—not a cent more or less.

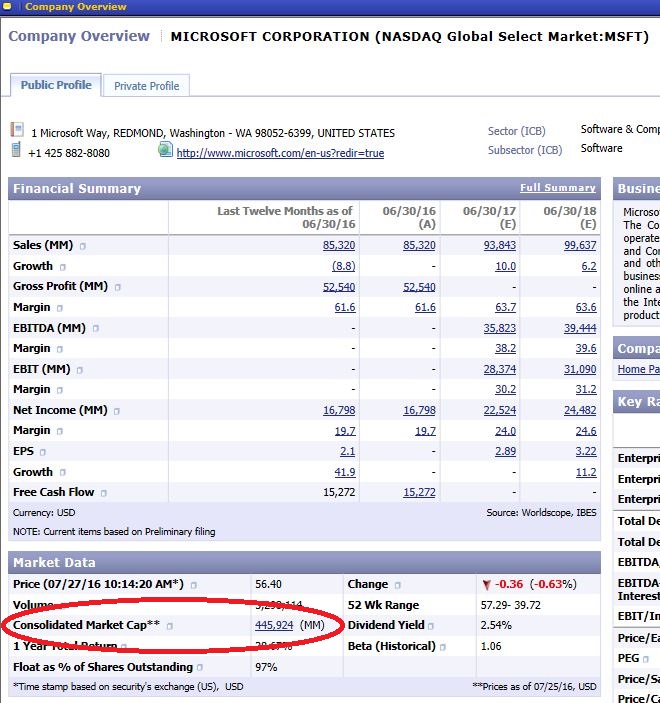

What is the value of Coinbase?

Tether is the most widely integrated digital-to- fiat currency today. Buy, sell, and use tethers at Bitfinex, Shapeshift, GoCoin, and other exchanges.

TUSD is Crypto.com's 10th token, joining bitcoin (BTC), ether (ETH), Litecoin (LTC), Binance Coin (BNB), XRP, Enjin Coin (ENJ), Basic Attention Token (BAT), and its own MCO and CRO tokens. Ledger, the hardware cryptocurrency wallet maker, plans to add support soon for more stablecoins, including expanding tether (USDT)’s usability across all its products and services, executives said. Starting today, traders can easily and quickly trade into a stablecoin that is 100% legally backed by US Dollars. TrueUSD offers token-holders full USD collateral, regular attestations (starting with this one), and legal protections against misappropriation of the underlying USD.

What Are the Advantages of Paying With Bitcoin?

Unlike Bitcoin, Tether is backed by a reserve, providing fewer price fluctuations than competing cryptos. Tory Reiss, co-founder of TrustToken, told Bitcoin Magazine that Binance chose TrueUSD as a quote pair due to the liquidity and trust that it is able to bring to the market. “TrueUSD is currently the largest regulated stablecoin, which will allow traders to actually have enough supply to securely trade with a price stable cryptocurrency," he said. In January 2015, the cryptocurrency exchange Bitfinex enabled trading of Tether on their platform. Bitfinex is one of the largest Bitcoin exchanges by volume in the world.

How can I buy Usdt to USD?

The Ledger Nano S is small and compact. The way the Ledger Nano S works is pretty similar to any hardware wallet. When you first plug it into your computer and set it up you will choose a PIN to protect the device from unwanted access. Later, you will receive a 24-word seed phrase that acts as your private key.

Who Owns Tether?

Now you need to enter the currency code for the cryptocurrency you want to buy. As I am demonstrating how to buy Litecoin (LTC), I will enter LTC. Click on the Select Deposits Coin and type in If you want to deposit using a different cryptocurrency, simply enter its code.

Tether is uncomfortably close to the fiat banking system, and not just because of its obvious fiat linkage. Comparing to Bitcoin, Tether is centralized, permissioned, and trust-dependent. The Ethereum-based Tether allows for tokenized USD and EUR to be transferred over the Ethereum network. This enables interoperability with Ethereum-based protocols and Decentralised Applications (DApps) whilst allowing users to transact and exchange fiat pegged currencies across the Ethereum Network. Tether is backed by currencies and assets that are equivalent to the number of USDT in circulation.

However, today there are also Ethereum-based Tether for US Dollars and Euros, compatible with the ERC-20 standard. Cryptocurrencies are notorious for being volatile, and trading one volatile currency for another creates a great deal of complication and extra risk. By contrast, Tether transaction times are completed in minutes. This benefit is significant because cryptocurrency traders often need to rapidly shift funds, and take advantage of arbitrage opportunities. Since the majority of mainstream interest in cryptocurrencies is due to their fluctuation in price, one might question the purpose of a cryptocurrency, which is predicated on maintaining a fixed price.

It is very important that you send the coins to the correct Binance deposit address. Make sure you double check the address after copy and pasting it. Our Binance review explained earlier that the exchange does not allow customers to deposit using popular payment methods, such as a debit or credit card. This means that you will need to deposit with a cryptocurrency. The easiest way to do this is with Bitcoin (BTC) or Ethereum (ETH), as there are other exchanges that allow you to buy them easily with fiat money.

Bitcoin is a digital or virtual currency created in 2009 that uses peer-to-peer technology to facilitate instant payments. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified.

The researchers argued that Bitfinex supplies the market with Tether regardless of the demand. They faulted this move, which they believe creates artificial demand for Bitcoin and other cryptocurrencies—pushing prices up, which is similar to the inflationary effect of printing more money. When prices fall, they can convert tether into bitcoin, in a way that pushes bitcoin up, sell some and replenish the Tether reserves.